Power Demand Soars, but All Nuclear Plants to Halt by May

Persistent Anxiety Over Intermittent Blackouts and Water Rationing

<Table of Contents>

<1> TSMC as a God... Visiting the '2㎚' Holy Ground

<2> The ‘6 Deficiencies’ and Technology Security Holding Back TSMC

<3> The Opening of Obscure Taiwan

<4> Korea-Taiwan: Between Deterrence and Cooperation

"No power, water, land, labor force, skilled talent, or waste disposal facilities."

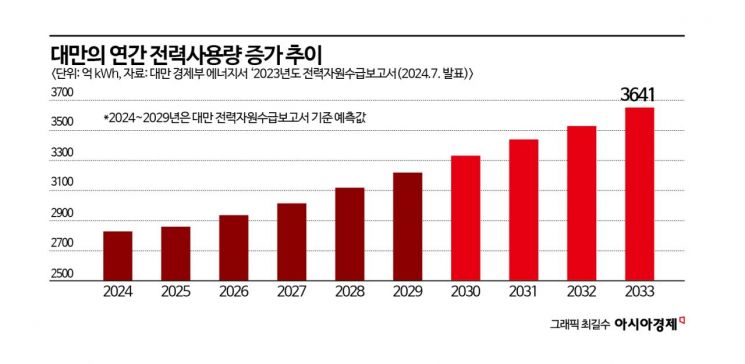

The biggest risk facing Taiwan's TSMC in preparing for the global trade war is the so-called '6 Deficiencies' problem, referring to shortages in six critical areas. Most of these are geopolitical limitations that are difficult to overcome, such as shortages of power, industrial water, and land. Recently, the Taiwanese government cut large subsidies for power infrastructure projects in the budget citing fiscal soundness, raising the possibility of hindering semiconductor companies' strategies to expand advanced facilities. Amid intensifying U.S.-China competition and the race among nations to secure future core technologies, the status of the 'number one foundry' is at risk due to chronic resource shortages.

According to the 'TSMC Sustainability Report' released last year, TSMC's power consumption at its bases in Taiwan and overseas in 2023 was 23.22 billion kWh, a sharp increase of 86.7% compared to 2018. During the same period, Taiwan's total power consumption increased by only 3.7%. The proportion of power required for TSMC's facility operations relative to Taiwan's total consumption has also risen steeply each year. The share, which was about 4.7% in 2018, increased to 5.1% in 2019, 5.9% in 2020, 6.4% in 2021, and reached 7.5% and 8.5% in 2022 and 2023 respectively, continuously setting new records annually. There are forecasts that this share could rise to 25% by 2030.

The overall semiconductor demand is also on the rise. In Taiwan's annual power sales for power supply, which was about 155.1 billion kWh in 2019, semiconductor manufacturing accounted for 26.8 billion kWh or 17.3%, but this share jumped to 23.2% in 2023.

Power shortage worsens... Nuclear reactor operation license expiration imminent

Taiwan has yet to devise a breakthrough solution to the power shortage issue. Due to the renewable energy expansion and nuclear phase-out policies under former President Tsai Ing-wen and the Democratic Progressive Party, only one of the four nuclear power plants installed in Taiwan is currently operational (the No. 2 reactor of the Third Nuclear Power Plant). The license for the last reactor, No. 2, is set to expire in May. Although the opposition party is pushing for legal amendments to extend the nuclear plant's lifespan, discussions have only been prolonged. Compared to 2014, when all three nuclear plants were operational and nuclear power generation peaked at 16.3%, the average nuclear power generation share from January to November 2024 stands at 4.4%, a decrease of 11.9 percentage points.

While renewable energy capacity is increasing, mainly through solar and offshore wind power, the growth rate of power generation remains slow. As of the end of November last year, Taiwan's renewable energy capacity reached 20,687 MW, accounting for 30.7% of total capacity, but the share of power generation was only 11.1%.

Meanwhile, Taiwan's daily power supply capacity has fallen below the legally mandated adequate standard for four consecutive years amid policy stagnation. Power supply capacity can be assessed through equipment reserve rate and supply reserve rate; the equipment reserve rate has been below the legal standard of 15% since 2021. The daily supply reserve rate fell below 10% on 102 days out of 1,095 days over the past three years (2022?2024), with two days dropping below 6%. A supply reserve rate below 6% corresponds to the 'caution' stage, where warning lights are triggered for power supply conditions.

According to statistics from Taiwan's Ministry of Economic Affairs Energy Department, Taiwan's energy import dependency reached 96.2% in 2023. Examining the trend over the past five years (2019?2023), the dependency slightly decreased from 97.3% in 2019 to 96.2% in 2023 but remains at a high level.

Meanwhile, Taiwan Power Company announced in 2022 that it would invest 564.5 billion TWD over the next ten years to upgrade the power grid to enhance accident response and stable operation capabilities. However, on January 21, the Taiwan Legislative Yuan cut subsidies worth 100 billion TWD from the government budget citing fiscal soundness deterioration. If subsidy cuts disrupt power facility replacement projects, the power supply safety of semiconductor companies including TSMC could be seriously threatened.

No water, land, or people... Government scrambling to find solutions

On the 'Silicon Island' of Taiwan, with a population of about 23 million, there is a shortage of water, land, and people. Due to climate change reducing rainfall, Taiwan's total water supply has decreased by 7% over the past decade. Water rationing was imposed in 2015, 2019, and 2021 due to insufficient rainfall, with a two-month water rationing order issued mainly in central Taiwan in 2021.

Water shortage is a serious risk factor in Taiwan's semiconductor-focused industry. The semiconductor manufacturing process requires 'Purified Water' for wafer cleaning, which directly affects wafer quality.

The government is considering alternatives such as improving leakage rates, installing interregional pipelines, and building desalination plants. Companies have also taken individual measures. During the 2021 drought, TSMC and UMC supplied water to factories using water trucks. Subsequently, TSMC invested in water-saving and drainage facilities and built a recycled water plant at its Tainan factory.

Other chronic major shortages in Taiwan include industrial land scarcity due to continuous industrial park development, labor force decline due to low birth rates and aging, shortage of skilled talent due to slow training relative to demand, and lack of waste disposal facilities. Particularly, the population issue is escalating into a structural social problem beyond the semiconductor sector. Taiwan's population peaked at 23.6 million in 2019, but since 2020, deaths have exceeded births, causing natural population decline every year. Taiwan's National Development Council projects that Taiwan will enter a super-aged society with over 20% of the population aged 65 or older this year, and by 2070, the working-age population (16?64 years) will be only 7.83 million, less than half of the total population (15.81 million).

Nomura Research Institute, in its report titled 'Impact and Countermeasures of Taiwan's "6 Deficiencies" on the Industrial Sector,' stated, "The social demographic composition poses a significant threat to Taiwan's economy and industrial competitiveness," forecasting that Taiwan's labor supply will be 3.4 million less than demand by 2025.

Lee Young-ki, head of KOTRA Taipei Trade Center, explained, "Amid intensifying U.S.-China competition and the race among nations to secure future core technologies, Taiwan's semiconductor industry's position in the global supply chain has grown more important than ever," adding, "Given Taiwan's power supply issues escalating into a global supply chain concern, it is crucial to watch how Taiwan will address power supply stabilization challenges going forward."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.