Insurance Planners Involved in Sophisticated Insurance Fraud Are on the Rise

FSS to Conduct On-Site Training to Raise Compliance Awareness Before Sentencing Guidelines Take Effect

Mr. A, a member of an organized crime group, established a corporate-style broker organization and planned crimes as the mastermind behind insurance fraud. The head of this organization, Mr. B, acted as a director of a hospital involved in the insurance fraud conspiracy and recruited fake patients with actual expense insurance. Mr. C, an insurance planner affiliated with a large-scale corporate insurance agency (GA), analyzed the insurance product coverage for the fake patients recruited by the organization, encouraged them to purchase additional insurance, and handled false insurance claims on their behalf. This group claimed insurance payments totaling 2.1 billion KRW but was caught by regulatory authorities.

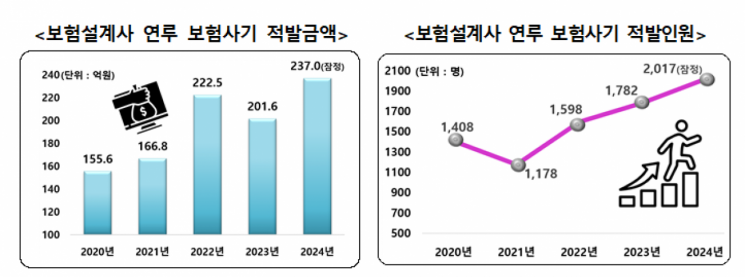

As insurance fraud becomes increasingly sophisticated, cases involving insurance planners have also risen. According to statistics from the Financial Supervisory Service (FSS) on the 5th, the amount detected in insurance fraud cases involving insurance planners increased from 15.56 billion KRW in 2020 to 23.7 billion KRW last year. During the same period, the number of individuals caught in insurance fraud also rose from 1,408 to 2,017.

The FSS plans to conduct on-site training targeting employees and insurance planners affiliated with GAs, where compliance education has been somewhat insufficient, as the number of insurance planners involved in organized insurance fraud has recently increased. The FSS will inform them about trends in insurance fraud and the revised sentencing guidelines to raise awareness of insurance fraud and promote compliance consciousness.

The FSS is working in cooperation with related agencies such as the National Police Agency, National Health Insurance Service, Life Insurance Association, and General Insurance Association to detect insurance fraud. They are also conducting preventive activities, including joint nationwide public awareness campaigns. However, cases of organized insurance fraud involving insurance planners, hospitals, clinics, and brokers continue to occur, and the number of insurance planners involved in insurance fraud has not decreased.

Amount Detected in Insurance Fraud Involving Insurance Agents. Provided by the Financial Supervisory Service

Amount Detected in Insurance Fraud Involving Insurance Agents. Provided by the Financial Supervisory Service

The Supreme Court Sentencing Commission is expected to finalize the sentencing guidelines, including strengthened measures against insurance fraud, later this month. The guidelines will include provisions to impose aggravated punishment for crimes committed by professionals in the insurance industry who abuse their professional opportunities, especially when the methods of the crime are particularly egregious. Legal penalties for insurance fraud are expected to become significantly stricter going forward.

In response, the FSS, together with the Life Insurance Association, General Insurance Association, and Insurance GA Association, plans to conduct on-site training sessions in seven cities nationwide from the 13th to the 21st, starting in Seoul, to prevent employees and insurance planners affiliated with GAs from becoming involved in insurance fraud and to enhance their compliance awareness before the sentencing guidelines take effect.

Through this training, insurance planners on the front lines of recruitment activities will be clearly made aware that insurance fraud is not merely a simple dishonest act but a serious crime. The training will also cultivate their ability to recognize and report suspicious cases from the stage of insurance contract conclusion. An FSS official stated, "This will enhance the preventive effect of blocking insurance fraud in advance and contribute to creating a healthy insurance ecosystem."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.