TSMC Expands Investment in the U.S.

Immediate Response to Trump's Tariff Pressure

Will It Acquire Intel?... Local Experts Remain Cautious

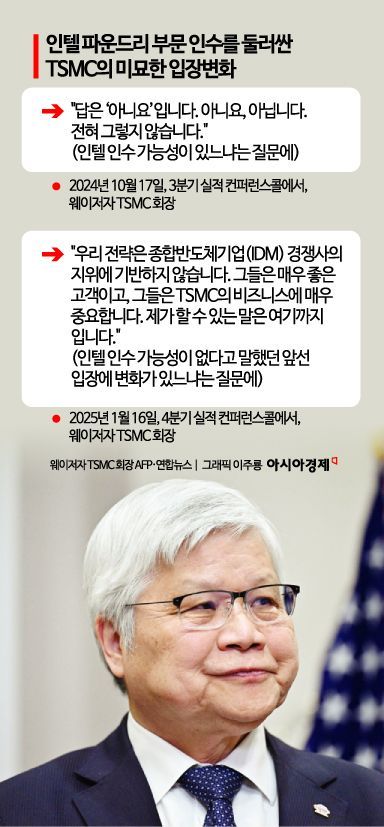

There has been growing attention to the subtle shift in Taiwan's TSMC's stance regarding the acquisition of Intel's foundry division by the U.S. semiconductor company Intel. Contrary to its previous clear denial when publicly asked about the possibility of acquiring Intel, TSMC recently left room for interpretation with more ambiguous remarks.

At the Q4 earnings conference call held last January, TSMC Chairman Wei Zhejia responded to a question about considering the acquisition of Intel's foundry fab by saying, "Our strategy is not based on the position of integrated device manufacturer (IDM) competitors," adding, "They are very good customers, and they are very important to TSMC's business." He then hinted that "this is all I can say," implying it was difficult to comment further in detail.

This was a significant departure from his remarks during the Q3 earnings announcement in October last year. At that time, Chairman Wei responded to a similar question with a firm "No. Absolutely not," repeatedly denying the possibility. In just three months, his position shifted to somewhat leaving the door open.

Chairman Wei's recent comments appear to reflect the firm U.S. tariff stance that materialized immediately after President Donald Trump's re-election. Earlier, Taiwanese local media such as Liberty Times cited sources reporting that U.S. authorities recently proposed to TSMC measures including "building advanced packaging plants in the U.S., investing in Intel's foundry with the U.S. government and various partners, and directly taking over packaging orders related to Intel's TSMC U.S. customers." President Trump, who aims to bring all industries to the U.S. backyard, openly expressed dissatisfaction during the election period, noting that most global semiconductors are produced in Taiwan.

Some speculate that TSMC will support Intel's management difficulties through one of several methods such as equity investment, joint venture (JV) establishment, or fab acquisition. This outlook gained momentum when Chairman Wei appeared alongside President Trump on the 3rd (U.S. local time) and announced a decision to invest $100 billion (approximately 145.9 trillion KRW) in the U.S., signaling cooperation with the U.S. administration's tariff policies.

However, local experts remain cautious and avoid making predictions about whether TSMC will acquire Intel. In an interview with Asia Economy, Liu Mengjun, Director of the First Economic Research Institute at Taiwan's Chung-Hua Institution for Economic Research, said regarding the possibility, "If TSMC needed it, they would have acquired it long ago," adding, "(At least) it was not part of TSMC's plans." Nevertheless, he elaborated, "TSMC will certainly find the best way to achieve its goals with the lowest risk and cost."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.