Jamsil, Samsung, Daechi, and Cheongdam Apartment Transactions Increase from 41 to 47 After Lifting of Restriction

Average Apartment Price Drops 5% After Lifting

"Weekly Trends from the Korea Real Estate Board Are Sample Prices, Not Actual Transaction Prices"

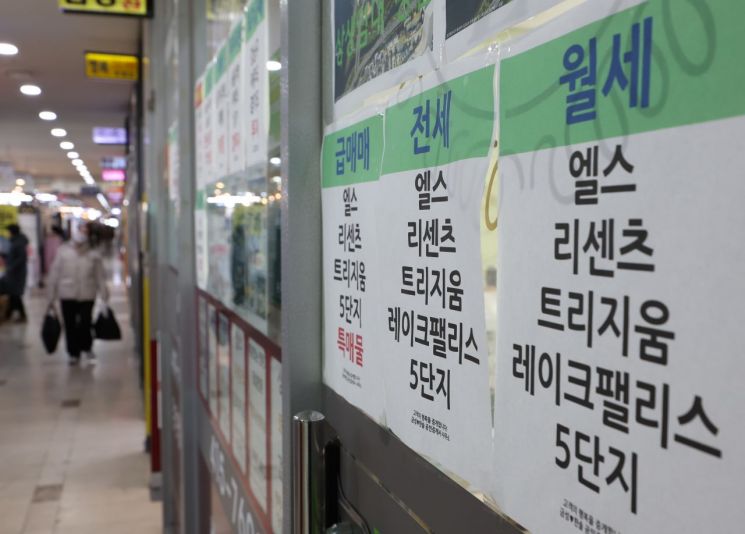

Seoul City announced on the 28th that "although the transaction volume in the Jamsil, Samsung, Daechi, and Cheongdam areas increased after the land transaction permission zone was lifted, there was no overall price surge observed."

Based on actual transaction data analyzed on the same day, Seoul City stated that apartment transactions in the Jamsil, Samsung, Daechi, and Cheongdam areas increased by 6 cases, from 41 transactions before the permission zone was lifted (January 30 to February 12) to 47 transactions after the lifting (February 13 to 26).

Earlier, on the 12th, Seoul City announced adjustments to the land transaction permission zones. The main point was lifting the land transaction permission zones in areas excluding the reconstruction apartments in Jamsil, Samsung, Daechi, and Cheongdam. The land transaction permission zone system requires prior approval from the district office chief when trading housing, commercial buildings, or land above a certain scale in areas where development is planned or speculative trading is a concern, to prevent speculative transactions.

Seoul City Reveals Cases of Price Decline After Lifting, Saying "No Transactions Occurred"

Although there are cases where some apartment prices increased after the lifting, Seoul City explained that there are also cases of price decline and that this has not led to a real increase in buying demand.

The city explained that the average apartment price per square meter during the same period decreased by about 5%, from around 31 million KRW before the lifting to 29.55 million KRW after the lifting.

According to the Ministry of Land, Infrastructure and Transport's actual transaction disclosure system, an 84㎡ unit in Jamsil Els was traded on the 19th for 2.69 billion KRW, which is 150 million KRW lower than the actual transaction price on the 11th (2.84 billion KRW). An 84㎡ unit in Jamsil Licenz was sold on the 14th for 2.75 billion KRW, 80 million KRW lower than the transaction price on the 4th (2.83 billion KRW).

A 135㎡ unit in Jamsil Lake Palace was traded on the 13th for 3.34 billion KRW, 35 million KRW lower than the transaction on January 10 (3.375 billion KRW). A 97㎡ unit in Daechi Samsung was traded for 3.1 billion KRW on the 24th of last month, but on the 14th it was traded for 3.01 billion KRW.

Currently, the asking prices based on the national average are 3.3 billion KRW for Jamsil Els, 3.35 billion KRW for Jamsil Licenz, and 3.8 billion KRW for a 135㎡ unit in Jamsil Lake Palace. As asking prices have risen by more than 300 million KRW in recent weeks, showing signs of overheating, the city disclosed actual transaction details to calm the market.

The city explained, "Although sellers' asking prices have risen after the lifting of the land transaction permission zone, the gap between the prices buyers want is large, so actual transactions are not taking place."

Seoul City Points Out "Weekly Trends Differ from Actual Transaction Prices," Also Shares Real Estate Agents' Opinions

Seoul City pointed out that weekly apartment price trends are not actual transaction prices and differ from the city's data analysis results. According to the 'Weekly Apartment Price Trends' announced by the Korea Real Estate Board on the 24th, the price change rate for apartment sales in Seoul was 0.10%, and 0.36% in the southeastern region. Seocho-gu rose by 0.26%, Gangnam-gu by 0.38%, and Songpa-gu by 0.58%.

The city explained, "The weekly apartment price trend survey is a sample price that comprehensively references not only actual transaction prices but also real estate agents' opinions, listings, and market price information," adding, "It calculates the 'sample price and price index' for a sample of 33,500 households nationwide and announces the price index change rate."

The city stated, "Although concerns about market overheating have been raised due to high-priced transaction cases highlighted by some media, there has been no overall price surge."

On the 25th, the city held a meeting with district offices and the Real Estate Agents Association to discuss market trends with real estate agencies in the areas where the permission zones were lifted.

Real estate agents reported that although asking prices in some complexes have risen by about 300 million to 500 million KRW, actual transactions have not followed. They evaluated that for real estate prices to rise, a flow of 'asking price increase - transaction increase - follow-up buying' must appear, but since the transaction increase is not clear, speculative concerns are low, according to Seoul City.

The city stated, "We will strictly block the inflow of speculative forces due to the lifting of the land transaction permission zones while continuously managing to stabilize the real estate market and protect actual demanders."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)