Record Number of Venture Capital Investments Last Year

Focus on Late-Stage Companies, Early-Stage Investment Share Falls Below 20%

Last year, venture capital (VC) investment reached an all-time high. However, the market does not seem to feel this impact. This is because investments were concentrated only in profitable areas amid domestic and international economic uncertainties.

According to the Korea Venture Capital Association and related industries on the 4th, the scale of VC grew significantly last year. The number of domestic VCs has increased every year, reaching 249 last year, the highest number ever. The number of investments in portfolio companies last year was 2,494, the highest since related statistics began to be compiled. This is a significant increase compared to 2,281 in the previous year.

The investment amount also increased. Last year, the new investment amount by VCs was 6.6 trillion won, a significant rise from 5.4 trillion won the previous year. VC new investment amounts had peaked at 7.7 trillion won in 2021 and then showed a declining trend. However, last year saw a rebound, switching to an upward trend.

Although both the number of VCs and investment cases reached record highs last year, there are complaints in the market. Investment in early-stage companies has significantly decreased, and investments have been concentrated only in areas where profitability is immediately guaranteed.

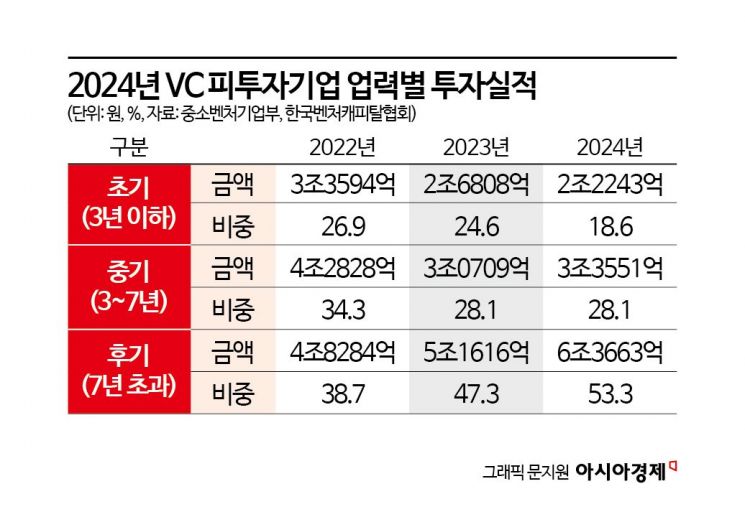

Based on the business age of portfolio companies last year, the proportion of investment in early-stage companies within three years was only 18.6% of the total investment amount. This is a significant decrease compared to 26.9% in 2022 and 24.6% in 2023. On the other hand, 53.3% of the total investment amount was concentrated in late-stage companies with a business age of seven years or more. This is the first time in the past 10 years that the investment proportion in companies over seven years has exceeded 50%.

A, the CEO of an IT solution development company established three years ago this year, said, "I knocked on the doors of dozens of VCs to receive investment last year, but ultimately failed to secure any investment," adding, "The investment funds previously received are now running out, and the company's operation is currently at a standstill."

This is a consequence of limited venture investments by limited partners (LPs) due to increased domestic and international economic uncertainties.

Last year, 120 VCs formed and registered new venture funds, accounting for only 48.2% of the total (249). This is the first time since 2020 that the new venture fund formation rate has fallen below 50%. The annual new venture fund formation rate peaked at 59.9% in 2021, rising from 52.7% in 2020, then declined to 56.7% in 2022 and 50.8% in 2023.

Looking into the LP status of newly formed venture funds last year, private LP contributions in 2024 amounted to 8.1324 trillion won, a sharp 25.1% decrease from the previous year. Financial institutions' contributions to new venture funds were 2.8721 trillion won, down 31.9% year-on-year. Contributions from general corporations also decreased by 15% to 2.3152 trillion won.

A VC industry insider explained, "Due to various domestic and international uncertainties, including the inauguration of Donald Trump's second term as U.S. president, LPs are hesitant to invest in venture funds," adding, "To attract investments, profitability must be guaranteed, so investments inevitably focus on late-stage companies that have reached a certain growth trajectory."

The contraction of investment in early-stage companies is expected to continue this year as well. Another VC industry insider said, "Investment managers no longer select companies solely based on their technological capabilities and growth potential," adding, "They must present more concrete profitability, and investment managers are raising their standards in this regard."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.