Green Finance Must Continue Despite Trump Administration Concerns

Experts Emphasize the Importance of Green Finance Activation and Government Support

Calls Grow for Mandatory ESG Disclosures and Digital Innovation in Green Finance

Amid concerns that climate change response policies might regress following the administration of U.S. President Donald Trump, experts in academia have expressed the view that green finance must continue.

Professor Hyun Seok of Yonsei University Graduate School of Environmental Finance stated this on the 27th at the ‘Future Changes and Growth Strategies in Finance’ seminar held at the International Conference Room of the Bankers’ Hall in Jung-gu, Seoul. He emphasized, “Even if the Trump administration is passive in responding to climate change, the direction we must take is already set,” adding, “Temperatures are rising, and climate change negatively impacts the macroeconomy, so the role of finance to mitigate these effects is inevitably emphasized.”

In his presentation on ‘Strategies to Revitalize Green Finance,’ Professor Hyun stressed the necessity of green finance activation strategies to respond to climate change. He also stated that to innovate green finance, mandatory sustainable disclosures (such as ESG disclosures) and climate risk assessments must be implemented to ensure information transparency. Activating green finance through digital technology is essential. He pointed out the economic benefits of issuing digital green bonds, such as improving efficiency and liquidity, and said, “Looking at cases in Japan and Hong Kong, instances of greenwashing are also decreasing.” He mentioned that active roles from the government and financial institutions are necessary for transition finance that helps shift from high-carbon industries to low-carbon industries.

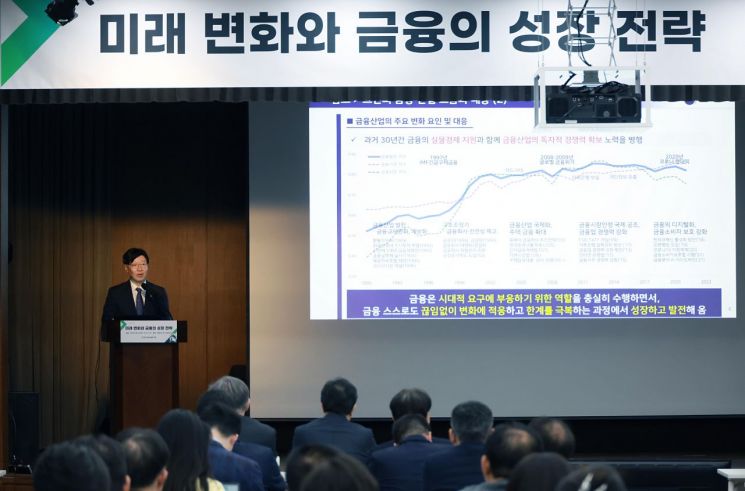

Kim So-young, Vice Chairman of the Financial Services Commission, is delivering the keynote speech at the Future Finance Seminar hosted by the Korea Institute of Finance on the 27th at the Bankers' Hall in Jung-gu, Seoul. Photo by Financial Services Commission

Kim So-young, Vice Chairman of the Financial Services Commission, is delivering the keynote speech at the Future Finance Seminar hosted by the Korea Institute of Finance on the 27th at the Bankers' Hall in Jung-gu, Seoul. Photo by Financial Services Commission

Similar opinions were expressed by the banking sector handling green and transition finance. Yoo In-sik, head of the ESG Management Department at Industrial Bank of Korea, acknowledged, “It is true that the momentum for climate finance has weakened due to external environmental changes such as Trump’s administration,” but argued, “Since Korea already has a widening gap compared to the U.S. and others, it is important to continue (developing climate finance).” Hwang Jae-hak, senior investigator at the Financial Supervisory Service, noted that the U.S. Securities and Exchange Commission (SEC) has not taken an active stance regarding climate disclosures, and suggested, “Rather, Korea should prepare in advance for the difficulties in practically implementing climate disclosures by utilizing this situation.”

Voices calling for government support to revitalize green finance also emerged. Lee In-gyun, director at the Korea Federation of Banks, stated that support for certification costs, especially for small and medium-sized enterprises, is necessary to activate certification systems for green companies. He further emphasized that corporate disclosure systems should be activated to resolve information asymmetry between investors and investees, and incentives such as low-interest loans and tax benefits are also needed for this purpose.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)