"Computation Needs Are 100 Times Greater" ... Expectations for Inference Demand

"We Will Comply with U.S. Government Export Controls and Tariffs"

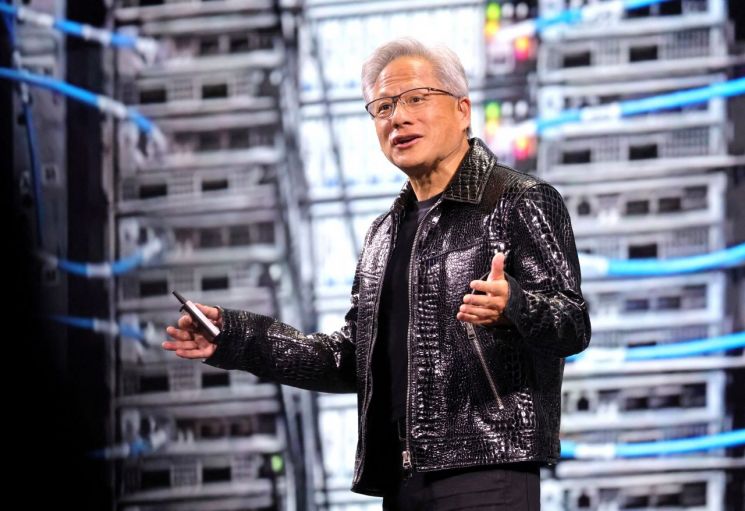

Nvidia, the leading company in artificial intelligence (AI), dispelled concerns and raised expectations for growth in the AI sector by presenting a positive outlook despite the shock caused by China's AI 'DeepSeek.' Since inference-type AI models like DeepSeek require significantly more computational processing than before, the demand for AI chips could actually increase. Nvidia plans to accelerate growth by launching the 'Blackwell Ultra' chip in the second half of the year and diversifying its business into automobiles, robots, and more.

On the 26th (local time), Nvidia announced that its revenue for the last quarter (November 2024 to January 2025) reached $39.33 billion, with earnings per share of $0.89. These figures represent increases of 78% and 82%, respectively, compared to the same period last year.

Recently, unlike the U.S. big tech companies that invested astronomical amounts in AI development, China's DeepSeek used chips with reduced performance due to low development costs and export controls, yet demonstrated comparable performance, shocking the AI industry and market. This raised doubts about the demand for Nvidia, which has virtually monopolized the AI chip market with its high-priced, high-performance graphics processing units (GPUs), causing its stock price to plunge temporarily.

However, Jensen Huang, Nvidia's CEO, said, "Demand for Blackwell is tremendous," focusing on the potential demand created by inference-type AI and interpreting it as an 'opportunity.' He emphasized, "Inference AI can require 100 times more computations per task," and highlighted that Nvidia chips handle all processes from training to inference and reasoning. He added, "The significance of DeepSeek R1 is that it open-sourced the inference AI model. Almost all AI developers are using R1 or reinforcement learning techniques like R1 to scale model performance," and said, "We designed Blackwell for this moment." He also stated, "This is just the beginning of the AI era. We will grow strongly in 2025." According to the company, more than 40% of last year's data center revenue came from inference. Huang said AI software will become an essential element of data centers, adding, "Data centers will increasingly become AI factories."

Another concern about Nvidia is that major clients like OpenAI and Meta are designing customized chips, moving away from Nvidia. Huang dismissed this concern, saying, "Just because a chip is designed doesn't mean it will necessarily be deployed." He added, "Nvidia chips are much more common, end-to-end (E2E), and useful at every stage of AI software development and execution," and noted, "Our product performance is up to eight times better."

Addressing criticism about overreliance on a few big tech clients, Huang cited AI adoption cases in automobile factories and said that over time, the enterprise market will expand more than the hyperscale market. Nvidia's revenue from chips for automobiles and robots was recorded at $570 million.

He also announced new product launches for the second half of the year. Huang said, "We plan to release Blackwell Ultra, the next version after Blackwell, in the second half." He stated that all production delays for Blackwell have been resolved, and unlike the transition from Hopper to Blackwell, Blackwell and Blackwell Ultra use basically the same system, so the new product launch is expected to proceed smoothly. A new chipset called 'Rubin' is scheduled for release next year.

With the U.S. administration under Donald Trump having initiated a trade war by announcing high tariffs, Nvidia is inevitably affected. Semiconductor export regulations to China are also expected to tighten further. Bloomberg reported last month that the U.S. is reviewing a three-stage export control plan that would impose a total volume cap on AI chip exports. Nvidia CFO Colette Kress said, "It is uncertain what the U.S. government's (tariff) plans are, including timing, countries, and amounts," adding, "We will comply with export controls and tariffs."

However, she explained that global demand for Nvidia chips remains strong. Kress mentioned, "Many countries worldwide are building AI ecosystems, and demand for computing infrastructure is surging," citing AI investment cases in France and the European Union (EU). She added that sales to data centers in China are much lower than when export controls began and predicted that if regulations remain unchanged, shipments to China will maintain current levels. Huang said that fourth-quarter sales in China are similar to the same period last year but about half compared to before export controls were implemented.

Regarding the U.S. Stargate project, in which Nvidia participates as a technology partner, Huang said, "The first Stargate data center will use Spectrum-X."

Nvidia's revenue for the last quarter exceeded the Wall Street average estimate of $38.05 billion compiled by market research firm LSEG by 3.3%. The company forecasted about $43 billion in revenue for the current quarter, which is 3% higher than LSEG's estimate of $41.78 billion.

CFO Kress stated that Nvidia's gross margin has decreased as it launched more complex products. Currently, it is in the low 70% range, down 3 percentage points from a year ago. She predicted that once the Blackwell production line is fully operational, the margin will recover to the mid-70% range by the end of the year.

On the day, Nvidia's stock price closed up 3.67% in regular trading on the New York Stock Exchange but fell 1.18% in after-hours trading.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.