10th Anniversary Press Conference for Toss App

On Questions About the FSS 'Leniency Controversy'

"Not in a Position to Comment... Will Follow Decisions"

On Card Companies Expanding Pay Partnerships and Fee Controversy

"Fees Should Be Lowered Through Openness and Competition Like Open Banking"

Lee Seung-geon, CEO of Viva Republica, which operates Toss, said on the 26th regarding the recent Financial Supervisory Service (FSS) 'leniency controversy' that "it is difficult to respond" and that "we will comply well with the financial authorities' decision." Regarding the controversy over fee rates and consumer welfare following the expansion of Apple Pay adoption by card companies and the introduction of Samsung Pay's paid policy, he said, "We need to lower the fee rates through competition."

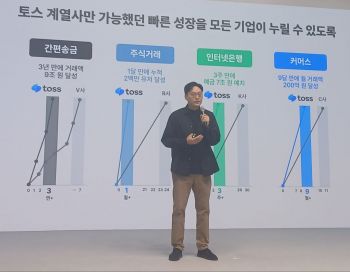

Lee Seung-geon, CEO of Toss, is speaking at the 10th anniversary press conference of the Toss app held on the 26th at Anderson C's 'Square of Toss' in Seongsu-dong, Seongdong-gu, Seoul. Photo by Moon Chae-seok

Lee Seung-geon, CEO of Toss, is speaking at the 10th anniversary press conference of the Toss app held on the 26th at Anderson C's 'Square of Toss' in Seongsu-dong, Seongdong-gu, Seoul. Photo by Moon Chae-seok

CEO Lee made these remarks at a press conference commemorating the 10th anniversary of the Toss app, held on the morning of the same day at 'Square of Toss' in Seongsu-dong, Seongdong-gu, Seoul.

When asked, "What do you think about the FSS leniency controversy?" he said, "We (Toss) are a supervised institution, and the supervisory authorities will make judgments regarding sanctions, so we have never thought that we are in a position to comment," adding, "We will comply well with the decisions made by the authorities."

In 2022, Toss used 29.28 million electronic receipt transaction records combined with Toss member card transaction details without customer consent. Under the Credit Information Protection Act, personal credit information must only be used for purposes agreed upon by the customer. The FSS had requested a severe disciplinary action of a three-month suspension for CEO Lee and then-Chief Information Security Officer Shin Yong-seok. Subsequently, CEO Lee's disciplinary action was lowered by two levels to a mild warning after going through the Sanctions Review Committee.

Regarding the consumer burden risk caused by the expansion of Apple Pay adoption by card companies and the introduction of Samsung Pay's fee charging, recently pointed out by Financial Services Commission Chairman Kim Byung-hwan, CEO Lee expressed agreement. In response to related questions, he said, "There are concerns about transaction fees taking up too large a portion, but it will be difficult to lower transaction fees with the current method," adding, "It is necessary to introduce a market-economic structure where transaction fees decrease through openness and competition among all payment companies, like open banking."

Lee Seung-geon, CEO of Toss, is speaking at the Toss app 10th anniversary press conference held on the 26th at Anderson C's 'Square of Toss' in Seongsu-dong, Seongdong-gu, Seoul. Photo by Moon Chae-seok

Lee Seung-geon, CEO of Toss, is speaking at the Toss app 10th anniversary press conference held on the 26th at Anderson C's 'Square of Toss' in Seongsu-dong, Seongdong-gu, Seoul. Photo by Moon Chae-seok

CEO Lee stated that he will accelerate innovation to dominate the offline payment market beyond online to create an era of 'payment without a wallet.' Toss Face Pay, known as 'face payment,' recently entered the offline market through partnerships with the three convenience store chains (CU, GS25, and 7-Eleven). As of this month, the number of merchants equipped with Toss Place payment terminals has surpassed 100,000. CEO Lee said, "There are about 1.8 million offline stores in South Korea, and currently, Toss terminals have about a 6% nationwide penetration rate," adding, "We will increase Face Pay payments through partnerships with convenience stores, where user payment frequency is high."

Regarding the strategy to catch up with competitors like Naver Pay and Kakao Pay, which have millions of merchants, he said he would compete on 'quality over quantity.' In response to related questions, CEO Lee said, "Rather than focusing on increasing the number of merchants using (Toss terminals), we will make merchants feel real changes," adding, "We want merchants and small business owners to say, 'Since using Toss Face Pay, I have been making more money.'"

CEO Lee emphasized strengthening consumer protection functions. At the same time, he announced for the first time that the 'Toss Safety Compensation System' will be expanded to Face Pay (offline). This service compensates consumers first before asking for liability if they suffer damages such as fraud during transactions like remittance, payment, or loans.

He said, "We will expand the Safety Compensation System to Face Pay," adding, "Whether it is identity theft or anything else, before clarifying the cause of the wrongful transaction, we will compensate consumers regardless of whether Toss is at fault or not."

He also presented a vision for global expansion. The plan is to rapidly spread the unprecedented financial super app innovation worldwide. The goal is to grow Toss into a global service with half of its users being foreigners within five years.

CEO Lee said, "Toss has changed the market landscape through innovation over the past 10 years and will become the financial super app for people worldwide."

Meanwhile, Square of Toss is an exhibition space set up by Toss at Anderson-si Seongsu to commemorate the 10th anniversary of the app launch, running from today until the 2nd of next month. From the 28th to the 2nd of next month, a three-day talk session featuring various speakers to help plan financial life and life changes will be held. The 'Toss Winning Session,' which shares Toss's success strategies, will feature Toss executives including CEO Lee as speakers. The 'Next Talk Session,' designed to help plan daily life, will include lectures by writer Song Gil-young, Professor Jung Hee-won of Seoul Asan Hospital's Geriatrics Department, and money trainer Kim Kyung-pil.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.