Loan Loss Provisions for Loan Receivables Surge 1.8 Times in One Year

"Responsible Completion Projects Drive Up Loan Loss Provisions"

The scale of loan loss provisions for loan receivables managed by real estate trust companies has increased 1.8 times in one year. The aftermath of an increasing number of construction companies failing to pay on construction sites is spreading to trust companies. While the funds lent by trust companies, which bear the obligation of responsible completion, to construction companies have grown, it has become more difficult to recover this money, causing the scale of loan loss provisions to compensate for losses to grow exponentially. Within the industry, there is even a perspective that halting projects is more beneficial than continuing them. There are forecasts that 'ghost buildings'?unfinished buildings?could emerge across the country.

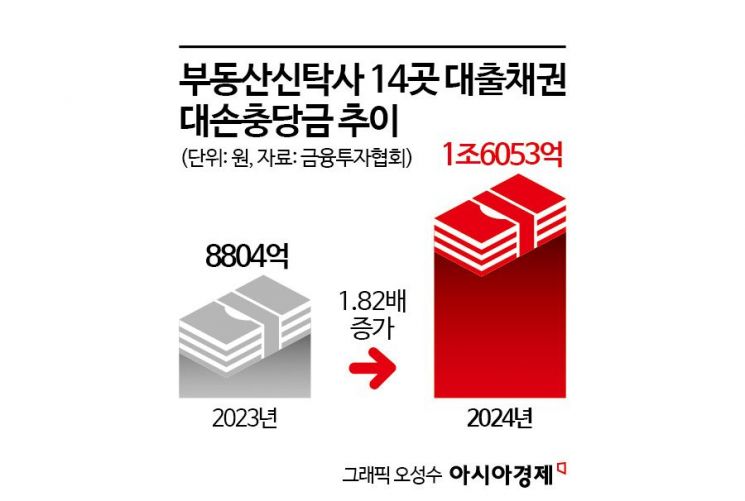

According to the Korea Financial Investment Association and others on the 25th, as of the end of last year, the total loan loss provisions for loan receivables set by 14 domestic real estate trust companies amounted to 1.6053 trillion won. This is a 1.82-fold increase compared to 880.4 billion won at the end of the previous year.

Sharp Increase in Trust Companies' Loan Loss Provisions

Looking at the loan loss provision balances for loan receivables by trust company, Korea Investment Real Estate Trust saw a sharp increase from 3.6 billion won at the end of 2023 to 36.9 billion won in one year, about a tenfold rise. Daishin Asset Trust also rose from 6 billion won to 30.8 billion won during the same period, and Mugunghwa Trust, which received a management improvement order from financial authorities, increased from 22.3 billion won to 90 billion won.

The trust company with the largest loan loss provision balance is Kyobo Asset Trust, which increased from 102.9 billion won to 347.6 billion won. KB Real Estate Trust also expanded its scale from 159 billion won to 344.1 billion won. However, Coramco Asset Trust was the only domestic real estate trust company to see a decrease in loan loss provision balance, dropping from 210.3 billion won to 147.7 billion won.

This is the result of many trust companies lending money with their own capital as construction companies face liquidity shortages. Recently, trust account loans (trust account advances) lent by trust companies to marginal construction companies using their own capital have increased sharply. The total trust account loans of all trust companies were 4.8551 trillion won until 2023 but surged to 7.7 trillion won last year, reaching 131.7% of their own capital. Among these, the amount that may not be recovered is recognized as loan loss provisions, and since trust companies lent funds to projects with concerns about insolvency, the scale of loan loss provisions has grown even larger than before.

The recent increase in responsible completion-type managed land trust projects, where trust companies promise responsible completion or credit enhancement, has also influenced the expansion of loan loss provisions. Trust companies competitively secured orders for this business model despite high risks to enjoy high returns. However, problems began as the completion deadlines approached for responsible completion-type managed land trust projects that started construction during the active real estate market from 2020 to 2022. When crises hit construction companies due to high interest rates and rising prices, trust companies responsible for completion had to inject funds using their own money. For example, Kyobo Asset Trust’s loan loss provisions for trust account loans surged from 102.9 billion won in 2023 to 347.5 billion won last year. KB Real Estate Trust also jumped from 159 billion won to 344 billion won during the same period.

Massive Loan Loss Provisions Lead to Snowballing Losses

As loan loss provisions increased, the operating profits of real estate trust companies plummeted. Since amounts expected to be difficult to recover in the future were recognized as expenses and accumulated as loan loss provisions, losses grew. Kyobo Asset Trust recorded operating losses of 312 billion won despite sales of 121.9 billion won last year. KB Real Estate Trust also posted sales of 133.7 billion won but an operating loss of 106.9 billion won. The workforce is also shrinking. The total number of employees at the 14 companies last year was 2,775, about a 6% decrease compared to 2,961 the previous year.

An industry insider said, "Loan loss provisions increased as losses began to occur in responsible completion-type projects," adding, "The lending syndicates are even trying to impose legal liability on trust companies for their losses, increasing the risk burden." He continued, "In the past, trust companies tried to fulfill responsible completion even if they incurred some losses, but now the situation has changed as lending syndicates apply pressure. They have started to consider whether it is more beneficial to stop the project and file lawsuits or pay penalties rather than continue investing funds and recovering them later."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.