Hotel Shilla to Add Senior Housing Operations at Next Month's Shareholders' Meeting

Prolonged Slump in Core Duty-Free Business... Seeking Alternatives

Weighing Entry into High Value-Added Senior Residence Market

Industry Peers Like Lotte Hotel and Mayfield Strengthen Related Businesses

Hotel Shilla has chosen the senior housing service sector as a new business venture. As its core duty-free business faces difficulties due to a decline in Chinese tourists and a sluggish domestic market, the company is seeking new revenue generation methods. With the advent of an aging society, the premium residential welfare business targeting the silver generation with purchasing power is attracting attention from industry peers, and the competitive landscape of the related market is expected to expand in the future.

According to industry sources on the 25th, Hotel Shilla will address the appointment of internal and external directors along with some amendments to its articles of incorporation at the regular shareholders' meeting scheduled for the 20th of next month. The company plans to add comprehensive resort business, condominium sales and operation, and senior housing and leisure welfare installation and operation business to its business objectives. The key focus in this agenda is the 'senior housing and leisure welfare installation and operation business.' This is interpreted as a plan for a senior residence business that integrates hotel-level premium services such as meals, housing, and activities targeted at middle-aged and older adults. A Hotel Shilla official stated, "We are not immediately pursuing this business, but we have proactively expanded our business objectives in the articles of incorporation to secure various business opportunities in the future."

For Hotel Shilla, which is struggling in its main business, discovering new future growth engines is urgent. On a consolidated basis, the company's sales last year increased by 10.6% year-on-year to 3.95 trillion won, but it recorded an operating loss of 5.2 billion won, turning to a deficit. While the annual sales of the duty-free business (TR), which accounts for more than 80% of total sales, increased by 11.9% to 3.2819 trillion won compared to the previous year, it posted an operating loss of 69.7 billion won. This was due to added burdens such as commissions for Chinese daigou (personal shoppers) and rental fees at Incheon International Airport.

As the duty-free sector's slump has prolonged since the COVID-19 pandemic, Hotel Shilla is seeking new paths by diversifying its portfolio in the hotel and leisure sectors instead of the duty-free segment. Among these, the senior residence business is an area where Hotel Shilla has not yet entered, but industry peers have judged it to have growth potential and have already ventured into this field.

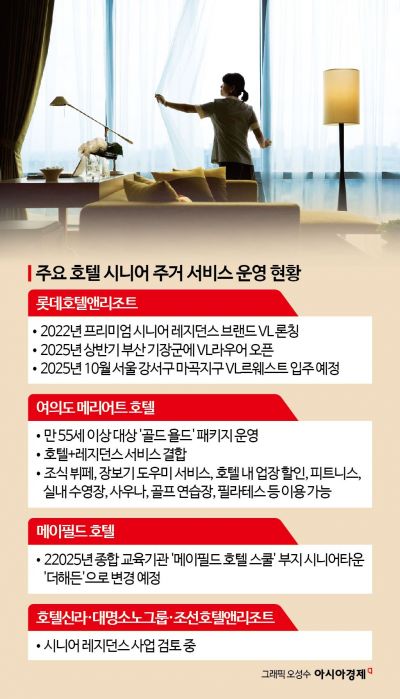

For example, Lotte Hotel & Resort launched the premium senior residence brand 'VL (Vitality & Liberty)' and entered the silver housing market. In the first half of this year, the first senior complex under the VL brand, 'VL Lower,' is scheduled to be established in the Gijang-gun area of Busan. It will have a total floor area of 198,670 square meters (about 60,100 pyeong), with four basement floors and 18 above-ground floors, housing a total of 574 units. Based on 50 years of accumulated hotel services, Lotte Hotel plans to provide healthcare, hotel-style meals, housekeeping services, and more. 'VL Le West,' opening in October in the Magok district of Gangseo-gu, Seoul, is also scheduled for occupancy.

Marriott Executive Apartments (Yeouido Marriott Hotel) also introduced the 'Gold Yold' package last year targeting the 'Yold (Young Old ? people who maintain a youthful sense and enjoy an active old age)' demographic, for customers aged 55 and over. The package offers benefits such as breakfast buffet at the hotel restaurant, shopping assistant services, and discounts at hotel outlets, with all rooms equipped with kitchens and laundry facilities. Guests can use facilities such as fitness centers, indoor swimming pools, saunas, golf practice ranges, and Pilates without usage limits, and can also enjoy spa massages, valet parking, and laundry services through monthly free vouchers.

Additionally, Mayfield Hotel near Gimpo Airport plans to establish the senior residence 'The Hidden,' and affiliates of Shinsegae Group, such as Chosun Hotel & Resort and Daemyung Sono Group, are also considering entering the senior housing business. An industry insider said, "The silver generation with economic power prefers a residential culture with well-equipped health management and infrastructure without concern for costs, so interest in senior residences is high," adding, "From the hotel industry's perspective, which has aimed for premium services, this is also attracting attention as a high value-added industry."

Meanwhile, according to the Korea Health Industry Development Institute, the domestic silver industry market size is expected to grow from 72 trillion won in 2020 to 168 trillion won by 2030.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.