Strong Performance from Sungwoo, Megatouch, and Seah Mechanics

Expectations Rise for Joining the Tesla Ecosystem via LG Energy Solution

Domestic secondary battery-related stocks all surged simultaneously. The expectation of joining the 'Tesla ecosystem' seems to dispel concerns about Tesla's sluggish stock price and business outlook.

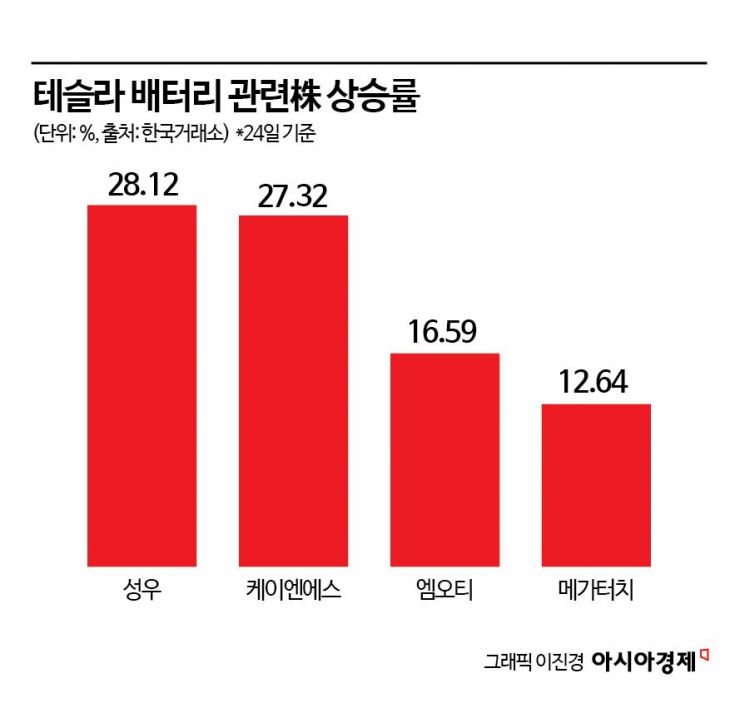

According to the Korea Exchange on the 25th, the stock price of electric vehicle parts manufacturer Sungwoo closed at 22,600 KRW, up 28.12% from the previous day. During the session, it soared to 22,900 KRW, hitting the upper limit. The stock price rise was driven by the positive news of joining the 'Tesla value chain.' Sungwoo received attention for the news that it will exclusively supply its main part, the 'top cap assembly,' to LG Energy Solution, Tesla's battery outsourcing partner. The top cap assembly is a component that prevents fire and explosion in cylindrical batteries and is expected to be installed not only in Tesla's Cybertruck and Model Y but also in the humanoid robot 'Optimus.'

On the same day, Megatouch's stock price jumped 12.64% on expectations of joining the Tesla value chain through LG Energy Solution (1.85%). Megatouch exclusively supplies 100% of the test pins applicable to all types of batteries produced by the three domestic battery companies. MOT (16.59%), which exclusively supplies Samsung SDI (6.7%), also saw its stock price reflect expectations of sales growth due to the adoption expansion of the '4680 cylindrical battery' by automakers including Tesla.

The 4680 battery is a next-generation cylindrical battery standard that increases energy and output by at least five times compared to the existing 2170 battery, attracting industry attention. One Cybertruck contains 1,360 4680 battery cells. LG Energy Solution, one of the leaders in this field, plans to publicly showcase the 46-series cell lineup (4680, 4695, 46120), known as next-generation cylindrical batteries, for the first time at 'InterBattery 2024,' starting from the 5th of next month.

While Tesla is gaining market attention in humanoid and autonomous driving businesses and providing momentum for stock price increases in the domestic stock market, the future business outlook is somewhat clouded. Ross Gerber, known as an early Tesla investor, recently warned in an interview with Business Insider that the stock price could be halved this year, citing a slowdown in electric vehicle demand and Tesla's owner risk. Tesla's stock price has fallen about 16% this year as of the 21st (local time).

Yeonju Park, a researcher at Mirae Asset Securities, evaluated, "The technological capabilities of Chinese autonomous driving and electric vehicle companies such as Xiaomi, BYD, and Huawei are rapidly advancing," adding, "In the case of humanoids, the technology gap is still large, so Tesla has a high competitive advantage, but to contribute significantly to corporate value, more tangible achievements such as securing mass production capacity are necessary." She also lowered Tesla's target price from the previous $394 to $390.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.