Deposit Interest Rates Drop to the 2% Range After About 2 Years and 7 Months

KB Kookmin Bank Lowers Deposit Rates by 0.05% Starting on the 24th

Meanwhile, Loan Interest Rates Continue to Rise

Although deposit interest rates at commercial banks are rapidly declining, loan interest rates including additional margins are falling more slowly than the drop in market interest rates due to the authorities' household loan management policy. As a result, concerns are emerging that the widening interest rate spread (loan interest rate minus deposit interest rate) is only increasing banks' profits.

According to the banking sector on the 25th, KB Kookmin Bank lowered the highest interest rate of its 'KB Star Time Deposit' (1-year maturity, including preferential rates) by 0.05 percentage points from 3.00% to 2.95% starting the day before. According to KB Kookmin Bank, the last time this product's highest interest rate was in the 2% range was in July 2022, meaning it has returned to the 2% range after about 2 years and 7 months.

Earlier, Shinhan Bank also lowered the highest interest rate of its 'Solpyeonhan Time Deposit' (1-year maturity, including preferential rates) by 0.05 percentage points from 3.00% to 2.95% on the 20th. For Shinhan Bank as well, the last time this product's highest interest rate was in the 2% range was June 2022, marking about 2 years and 8 months since deposit rates fell to the 2% range.

Other banks are also lowering deposit interest rates one after another, citing 'reflection of market interest rates.' SC First Bank reduced the interest rates of four types of installment deposits (time deposits) by up to 0.50 percentage points starting from the 17th. Hana Bank simultaneously lowered the base interest rates by 0.20 percentage points for three products?'Hana Time Deposit,' 'High Unit Plus Time Deposit,' and 'Time Deposit'?with maturities ranging from 12 to 60 months starting from the 14th.

According to the consumer portal of the Korea Federation of Banks, as of the 24th, the representative time deposit products (1-year maturity, including preferential rates) of the five major banks (Kookmin, Shinhan, Hana, Woori, NH Nonghyup) showed interest rates ranging from 2.95% to 3.30% per annum.

It is expected that if the Bank of Korea's Monetary Policy Committee lowers the base rate by 0.25 percentage points from 3.00% to 2.75% on that day, other commercial banks are also likely to reduce their time deposit interest rates to the 2% range.

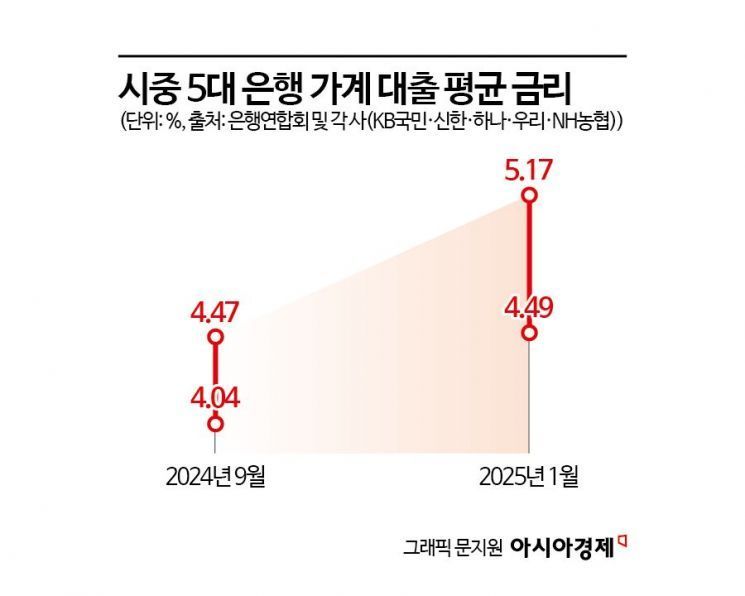

On the other hand, loan interest rates have actually risen even after the base rate cut. According to disclosures by the Korea Federation of Banks, the average household loan interest rates for the five major commercial banks (Kookmin, Shinhan, Hana, Woori, Nonghyup) based on new loan amounts in January ranged from 4.49% to 5.17%, up 0.45 to 0.7 percentage points compared to September before the rate cut (4.04% to 4.47%). In particular, Woori Bank's loan interest rate rose by as much as 1.13 percentage points during this period.

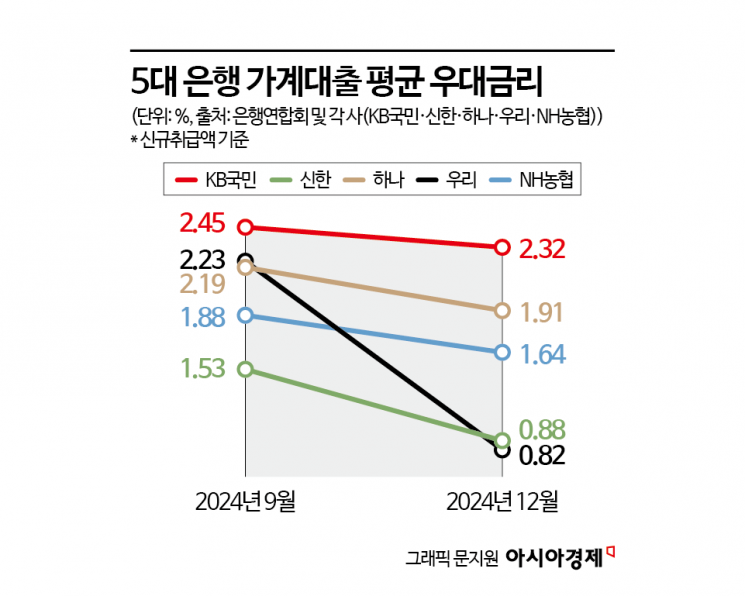

The reason loan interest rates remain unchanged despite the base rate cut is due to banks' self-adjusted additional and preferential interest rates. Loan interest rates are finally determined by adding the additional margin to the funding cost and then subtracting the adjustment rate (preferential rate). Banks raised loan interest rates by increasing additional margins or lowering preferential rates. Woori Bank's average preferential rate was 2.23% in September last year before the base rate cut but dropped to 0.82% in December, a decrease of 1.41 percentage points. Consequently, loan interest rates surged by more than 1 percentage point. Shinhan Bank lowered its preferential rate by 0.65 percentage points (from 1.53% to 0.88%) during the same period and raised the additional margin by 0.19 percentage points (from 2.47% to 2.66%), maintaining high loan interest rates.

In response, the Financial Supervisory Service has announced plans to conduct a thorough inspection of 20 banks regarding the reduction of loan interest rates. Earlier, Financial Services Commission Chairman Kim Byung-hwan also stated, "Although the base rate was cut twice last year, the pace and extent of additional margin reductions were not sufficiently reflected," adding, "I believe it is time for banks to reflect the base rate cuts in the new year."

The banking sector appears to be in a state of confusion. They argue that the increase in loan interest rates is due to the financial authorities' household debt management orders. A representative from a commercial bank said, "The only methods banks can use to manage household loans are to raise interest rates or reduce loan limits," explaining, "This is simply a response to manage household loans in accordance with the authorities' directives."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.