Expectations Rise for Shift Toward Fiscal Expansion

DAX Rally Continues as Euro Strengthens

With the victory of the center-right conservative party in the German federal parliamentary election, there are expectations that increased liquidity and pro-business policies will positively impact the German stock market.

According to exit polls released at 6 p.m. local time on the 23rd by German public broadcaster ARD, the center-right Christian Democratic Union (CDU) and Christian Social Union (CSU) alliance is projected to receive 29.0% of the vote, significantly ahead of the far-right Alternative for Germany (AfD) at 19.5% and the Social Democratic Party (SPD) at 16.0%. Subsequently, CDU leader Friedrich Merz declared victory in the election.

Market participants expect Merz to implement traditional right-wing policies such as pro-business measures and tax cuts to address the economic recession in Germany, Europe’s largest economy. Matt Gertken, a geopolitical strategist at BCA Research, stated, "This election result will be positive for the market. A centrist government will shift policies toward being pro-business and expanding investment," adding, "Moreover, Germany is now more likely to avoid confrontation with U.S. President Donald Trump over issues related to Russia, China, and trade frictions."

Neil Burrell, Chief Investment Officer (CIO) at Premier Milton Investors, also observed, "There is little room for disappointment in the stock market at this point. At least in the short term, this election result could have a positive effect on the stock market."

If Merz forms a coalition government with other mainstream parties, fiscal policy reforms are expected to gain momentum. Krishna Guha, Vice Chairman at Evercore ISI, said that if the CDU/CSU alliance and SPD form a coalition and push for debt limit reforms with support from other parties, "it would be the most desirable outcome for European financial markets, including Ukraine."

Recent asset market movements have already begun to reflect the possibility of additional borrowing by Germany. Long-term bond prices have fallen more sharply than short-term bonds, causing the yield curve to steepen at its fastest pace since 2022. Bloomberg reported, "The election result in Germany signals the end of the era of fiscal tightening. Germany, which has emphasized fiscal soundness, is facing a major change," adding, "Germany has the lowest borrowing costs and the least debt burden in Europe, so it has the capacity for additional borrowing."

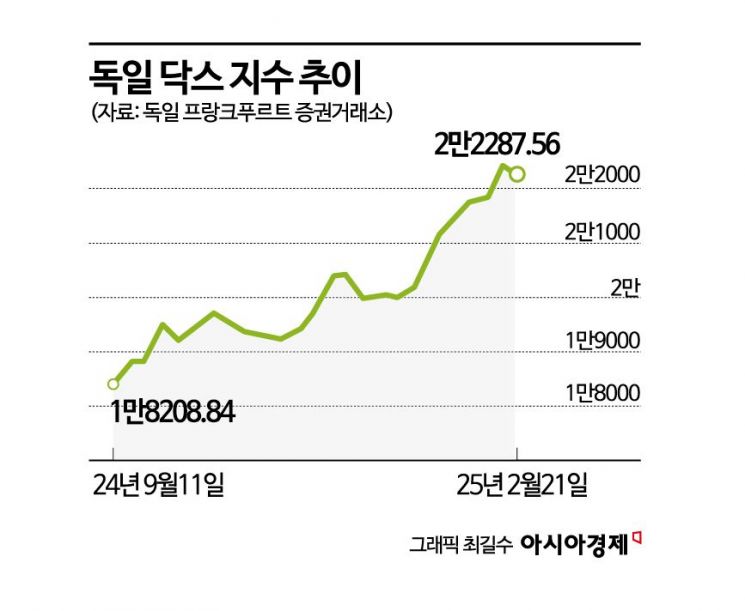

Amid these expectations, Germany’s benchmark stock index, the DAX, has risen nearly 12% year-to-date as of the close on the 21st, contrasting with the recent sluggish performance of the U.S. stock market. In particular, German defense company Rheinmetall AG surged 45% since the beginning of the year on forecasts that it will be the biggest beneficiary of increased defense spending following fiscal reforms.

The euro has also strengthened, showing its strongest performance since August last year, thanks to global capital inflows into the German stock market. Dane Sekoff, foreign exchange strategist at SpareBank 1 Markets, analyzed, "The euro has been weak due to structural weaknesses in the German economy, but if the new government pursues reforms and increases investment in infrastructure and defense, the situation could improve." However, he added, "This election result will not bring a decisive change to the euro. President Trump’s tariff policies will negatively impact the euro."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)