Tempus AI: The Star of US Health Tech

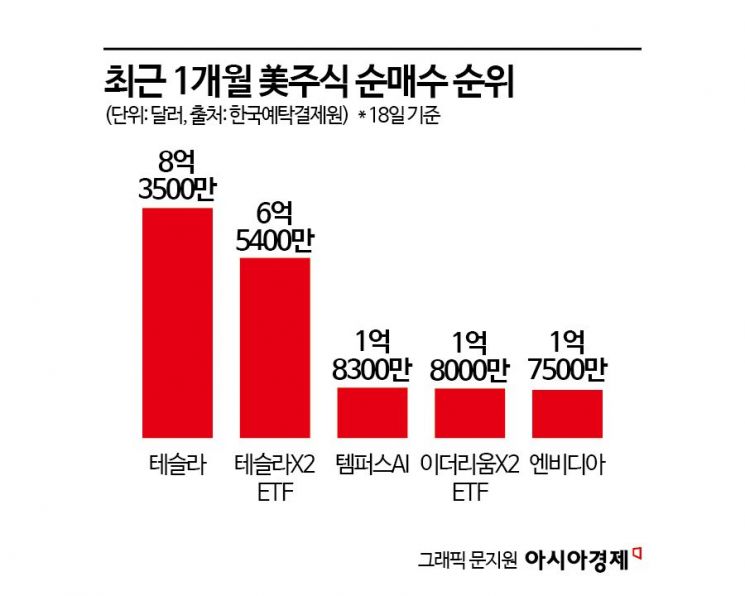

Ranks Second in Net Purchases After Tesla Over the Past Month

The cries of "Buy Nvidia" from foreign investors have been fading. While Nvidia's stock price struggles due to the 'DeepSeek Shock,' foreign investors are turning their attention to soft AI stocks aiming to become the next AI leaders.

According to the Securities Information Portal SaveRO of the Korea Securities Depository, domestic investors have net purchased about $183 million (approximately 262.1 billion KRW) worth of Tempus AI shares over the past month until the 18th. Excluding exchange-traded funds (ETFs), this ranks second after Tesla. During the same period, Nvidia shares were purchased for about $175 million. There is an assessment that Nvidia's position, which has held the second place in net purchases by foreign investors this year, is shaking after the DeepSeek Shock.

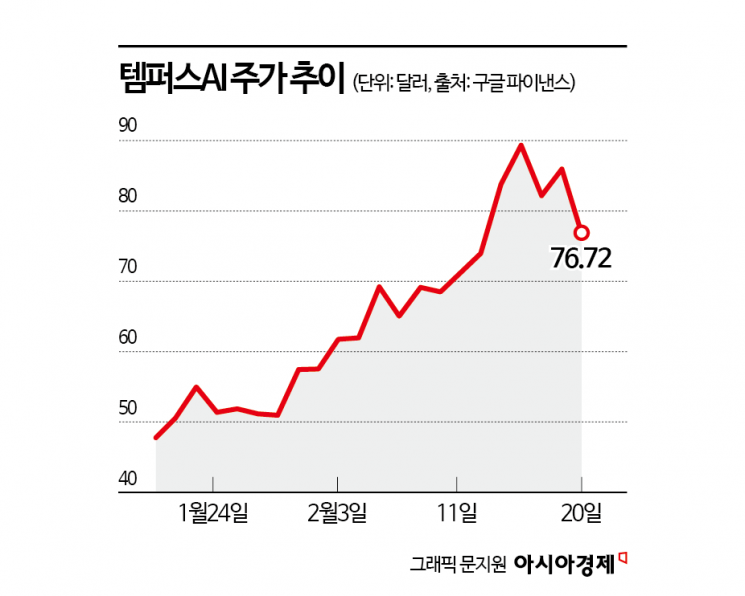

Tempus AI is a company that provides precision medicine solutions by analyzing medical data based on artificial intelligence (AI). It was founded in 2015 by billionaire entrepreneur Eric Lefkofsky, who wanted to develop technology to treat his wife diagnosed with breast cancer. Tempus AI, which was listed on Nasdaq in June last year, has seen its stock price rise 127% since the beginning of the year, overshadowing Nvidia's (4.33%) title as the AI leader. Last month, it attracted attention when it was revealed that Tempus AI call options were included in the portfolio of former U.S. House Speaker Nancy Pelosi, known as an 'investment expert.'

Seung-yeon Han, a researcher at NH Investment & Securities, said about Tempus AI, "It has secured differentiation points from competitors through data sales for AI drug development, clinical optimization, and AI analysis services," adding, "amid high interest in medical AI, compared to drug developers like Recursion Pharmaceuticals and Schr?dinger, who are still awaiting results, there is greater interest in Tempus AI, which supports the medical AI industry through data."

The shift in the AI industry's focus from AI chip manufacturers like Nvidia to soft AI companies due to the China-originated DeepSeek Shock is also a positive factor for Tempus AI. With the path opened to produce AI models at low cost and high efficiency, service-specialized companies utilizing AI have begun to attract market attention. It is also a positive factor that big tech leaders participating in the $500 billion AI infrastructure project 'Stargate,' announced by U.S. President Donald Trump, mentioned bio (cancer blood diagnostics, cancer vaccines) as an AI application area.

Su-wook Hwang, a researcher at Meritz Securities, said, "As AI inference costs decline and AI becomes commercialized, we can expect benefit expansion into AI application fields that utilize foundation models for specific areas," pointing out, "Notable fields include AI financial payment systems and bio-healthcare." According to the Korea Health Industry Development Institute, the AI drug development market is expected to grow at an average annual rate of 40% from 2023 to 2028, expanding from $900 million in 2023 to $5 billion in 2028.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)