Gold Bar Sales at Top 5 Banks Surge as Gold Prices Soar

Gold Prices Jump 44% in One Year

Global Demand Increase May Push Prices Even Higher This Year

As gold prices continue to rise, the sales of gold bars at commercial banks have surged sharply. Experts predict that interest in gold will persist as there is a possibility of further increases in gold prices.

Gold Bar Sales at Top 5 Banks Soar 4.3 Times

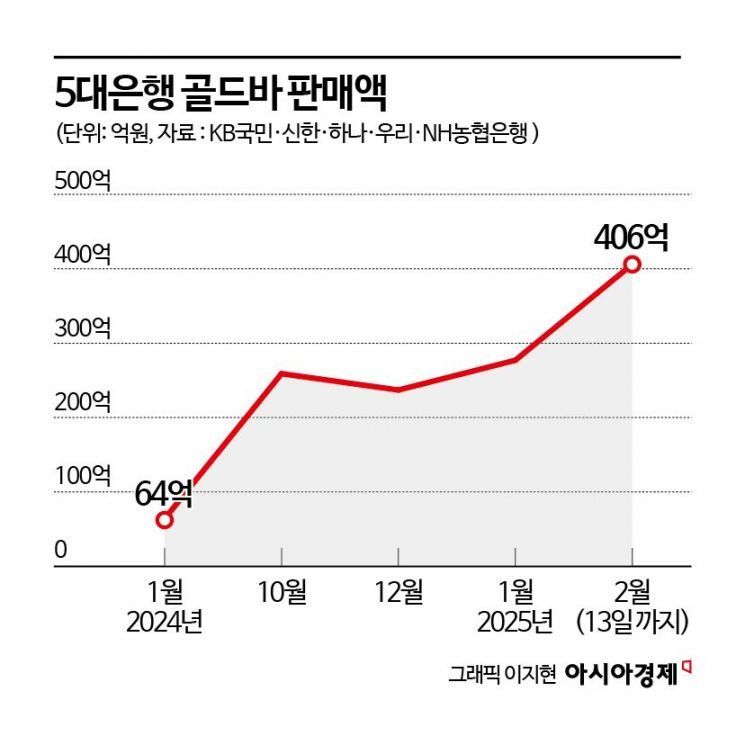

According to the financial sector on the 24th, the monthly sales amount of gold bars at the top five commercial banks reached 27.7 billion KRW last month, more than 4.3 times the 6.4 billion KRW recorded during the same period last year. Interest in gold bars has continued this month as well, with sales reaching 40.6 billion KRW by the 13th, setting new monthly records.

The increase in gold bar sales is due to the sharp rise in gold prices worldwide. As of the 21st, the gold futures price on the New York Commodity Exchange (COMEX) was $2,950 per ounce, a 44% increase compared to a year ago.

The recent surge in gold prices is mainly attributed to increased demand for the safe-haven asset amid concerns over a global trade war following the re-election of U.S. President Donald Trump in the second half of last year. The IBK Industrial Bank of Korea Economic Research Institute stated, "Trump's tariff policies have stimulated inflation, increasing the likelihood of inflation resurgence, which has enhanced the attractiveness of gold investment as an inflation hedge."

Another major factor driving price increases is the continued gold purchases by central banks of emerging countries such as China and T?rkiye for dollar hedging purposes. Since the Russia-Ukraine war, the world has witnessed Russia's overseas dollar funds being frozen by the West, leading more emerging countries to diversify their assets by converting dollars into gold.

In particular, China's significant increase in gold holdings after selling U.S. bonds has caused a surge in gold demand. Park Sang-hyun, a specialist at iM Securities, explained, "During Trump's first term, as U.S.-China tensions escalated, China sold U.S. Treasury bonds and has been continuously expanding its gold holdings with the proceeds."

Additionally, speculative capital inflows due to global interest rate declines and supply shortages caused by rising gold production costs are also factors fueling the rise in gold prices.

On the 18th, as gold prices soar, a gold bar shortage is occurring. A notice of gold bar sold out is displayed on the monitor at the Jongno main branch of Korea Gold Exchange in Jongno-gu, Seoul. 2025.2.18. Photo by Kang Jin-hyeong

On the 18th, as gold prices soar, a gold bar shortage is occurring. A notice of gold bar sold out is displayed on the monitor at the Jongno main branch of Korea Gold Exchange in Jongno-gu, Seoul. 2025.2.18. Photo by Kang Jin-hyeong

Gold Prices Soar 44% in One Year... "Will Rise Further"

Experts believe that although there may be short-term corrections, the upward trend in gold prices will continue in the medium to long term. Many forecasts suggest that surpassing $3,000 per ounce is only a matter of time. Global investment bank Goldman Sachs recently reported that increased gold purchases by central banks and inflows into gold-based exchange-traded funds (ETFs) could push year-end gold prices above $3,100 per ounce.

Rina Thomas, a Goldman Sachs analyst, said, "Central banks' gold purchases could reach an average of 50 tons per month, which is more than expected," adding, "If uncertainties regarding economic policies, including U.S. tariffs, persist, speculative demand may increase, potentially driving gold prices up to $3,300 per ounce."

With global demand rising and speculative capital inflows, domestic gold prices are also expected to continue rising. Jo Yuri, a researcher at IBK Industrial Bank of Korea Economic Research Institute, said, "Gold has no separate holding tax or capital gains tax when acquired physically, and it is excluded from comprehensive financial income taxation," adding, "Domestic gold prices are expected to maintain a high trajectory for the time being due to global supply and demand factors, exchange rate increases, and the asset growth effect from tax benefits."

Ha Geon-hyung, an economist at Shinhan Investment Corp., stated, "As long as central banks continue buying gold, the upward trend in gold prices is expected to continue," and added, "Although there is a possibility of short-term overshooting (overvaluation), there is room for an additional 10% increase by the end of this year."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)