Embrain Trend Monitor Survey on Quick Commerce Services

7 out of 10 Respondents Express Willingness to Use Quick Commerce

High Satisfaction with Fast Delivery and Convenience in Urgent Situations

Concerns Remain over High Service Fees and Preference for Offline Shopping

"Setting Appropriate Price Levels Is Key to Growth"

As Coupang Rocket Delivery ignites the 'logistics speed war' in the distribution industry, including e-commerce, consumer interest in 'quick commerce,' which compresses delivery times to the minute, has increased. Quick commerce is an instant delivery service that delivers products within about an hour when ordered near one's residence or workplace.

According to a 'Quick Commerce Service (Platform) Related U&A Survey' conducted on the 22nd by market research firm Embrain Trend Monitor targeting 1,000 adult men and women aged 19 to 69 living in the metropolitan area, 69.3% of respondents said they 'intend to use quick commerce in the future.' Additionally, 45.8% answered that 'their interest in quick commerce services has recently increased.'

Delivery service is the second most important factor consumers consider after price when using online platforms. In fact, more than 4 out of 10 respondents (41.4%) said they 'consider whether the delivery speed is fast,' ranking second after 'checking if the price is cheap (50.3%).'

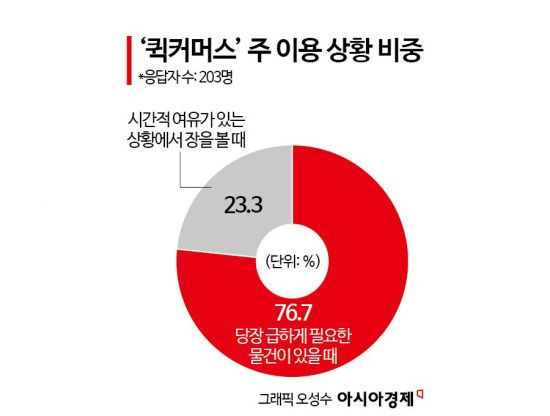

Survey respondents cited the advantages of quick commerce as 'fast delivery makes it convenient from the consumer's perspective (77.2%).' The response 'useful in situations where items are urgently needed (77.0%)' followed closely. Accordingly, a relatively high proportion (76.7%) said they 'use the service when they urgently need something immediately,' and the frequency of use was mainly '2 to 3 times a month (30.5%).'

The platforms mainly used for quick commerce were delivery applications (59.7%), large supermarkets (52.1%), and convenience stores (47.9%), in that order. Those who used quick commerce services through the apps of large supermarkets and convenience stores mainly ordered fresh food (41.4%), ready meals (37.9%), and processed foods (33.5%), indicating a relatively high proportion of food products.

As interest in quick commerce grows, many also view the future growth potential of the related market positively. More than 7 out of 10 respondents (71.7%) predicted that 'delivery speed will become an important issue in the distribution industry in the future,' and 69.2% said 'fast delivery service will become the core of grocery shopping.'

Also, more than half (58.3%) responded that 'in the future, they will frequently use distribution channels that provide the fastest delivery.' The platforms respondents intend to use for quick commerce were mainly large supermarkets (67.5%) and dawn delivery (64.1%).

However, it is noteworthy that negative perceptions were high regarding quick commerce products being 'more expensive because they are convenient (67.8%).' About half of the respondents also said, 'It might be better to shop in advance rather than using quick commerce services (53.7%)' or 'It might be better to visit a nearby mart (47.1%).' Especially among those in their 60s and older, there was a stronger preference for offline grocery shopping compared to other age groups.

An Embrain official pointed out, "Since price sensitivity to quick commerce is still high, forming price levels at an appropriate range that the general consumers can accept will be an important factor for the growth of the quick commerce market."

Meanwhile, the domestic quick commerce market size, estimated by related industries, is expected to grow more than 14 times from 350 billion KRW in 2020 to 5 trillion KRW this year. Delivery Hero, the parent company of the delivery service platform Baedal Minjok, predicted that the global quick commerce market size will increase to 448 billion euros (about 600 trillion KRW) by 2030.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.