Acquisition of KEPCO Site and Governance Restructuring Failure as Turning Points

Hyundai Motor Group Strengthens Market Communication

Actively Recruiting Capital Market Experts

Most Positive Governance Evaluation Among Major Corporations

Challenges Remain Including Further Governance Restructuring

In 2014, Hyundai Motor Group was selected as the final successful bidder for the Korea Electric Power Corporation (KEPCO) headquarters site in Samseong-dong, Seoul. The winning bid was a staggering 10.55 trillion KRW, which was literally a 'bold investment' at three times the appraised land value. Hyundai Motor Group presented a blueprint to build an integrated group headquarters, a long-cherished project of Honorary Chairman Chung Mong-koo. At the same time, they expressed their ambition to develop the Samseong-dong area into a landmark of South Korea and transform it into an innovation hub promoting a smart city.

However, the market reaction was cold. Hyundai Motor Group's bid far exceeded the appraised land value and was more than twice the bid price submitted by its competitor Samsung (in the low 5 trillion KRW range). At that time, foreign investors called IR officers and domestic analysts asking, "Is Hyundai Motor buying KEPCO to enter the power business?" When they were told, "No, it's just the land price of 10 trillion KRW," they raised doubts about the company's decision-making structure and voiced criticism. Subsequently, a wave of institutional sell-offs began in anger. Hyundai Motor Group spent 10.55 trillion KRW in cash to acquire the KEPCO site but had to pay an even greater cost in lost market trust. The market capitalization of major affiliates such as Hyundai Motor, Kia, and Hyundai Mobis evaporated by more than 11 trillion KRW within a week after the bid decision.

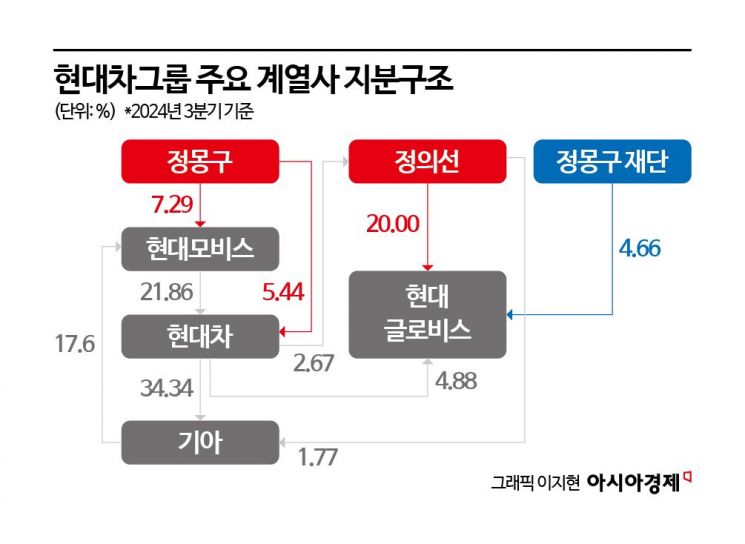

Four years later, in 2018, Hyundai Motor Group pushed forward with a governance restructuring to break the long-criticized circular shareholding chain pointed out by the government and the market. After much deliberation, they proposed splitting Hyundai Mobis into an investment and core parts business and a module and after-sales (AS) business, merging the cash cow module and AS business with Hyundai Glovis. The government gave the green light to this plan, but the market opposed it. The market criticized the merger ratio between the split Hyundai Mobis and Hyundai Glovis as unfair. The proposed merger ratio was 0.61 to 1. Institutional investors argued that this ratio favored Hyundai Glovis shareholders, who had a higher stake from the founding family, and was disadvantageous to Hyundai Mobis shareholders. Chairman Chung Eui-sun even traveled to the U.S. to personally persuade overseas investors, but the market opposition remained firm. Ultimately, Hyundai Motor Group withdrew the restructuring plan after two months.

These two incidents brought significant changes to Hyundai Motor Group's communication with the market. Whereas in the past decisions were made unilaterally and then communicated to the market, now they always monitor market reactions and engage in dialogue. Since 2018, Hyundai Motor has appointed current analysts as IR officers and actively recruited outside directors with capital market backgrounds. They have brought shareholder-friendly figures onto the board of directors, the highest decision-making body, to increase points of contact with the market.

As of 2025 (post-March shareholders' meeting), Hyundai Motor's board consists of five inside directors and seven outside directors. One-third of them are women (four members), with two foreigners and two experts from the financial market. Notably, the new board includes two former pension fund executives from major global financial investment firms. Former Kim Soo-yi, ex-Global PE Head at the Canada Pension Plan Investment Board (CPPIB), is a senior managing director from one of the world's top 10 pension funds and is regarded as the most influential Korean in the global PE industry. Another outside director candidate, Benjamin Tan, a manager at the Government of Singapore Investment Corporation (GIC), has managed Asian portfolios at this world-renowned pension fund. They are expected to leverage their extensive global capital market experience and networks to strengthen communication with global market investors.

Hyundai Motor's outside directors protecting shareholder rights regularly hold governance roadshows (NDRs) and meet with domestic and international investors. In August 2024, they announced a value-up policy aiming to achieve a total shareholder return (TSR) of 35%. The Korea Corporate Governance Forum awarded this value-up policy an 'A-' grade. The Governance Forum is a non-profit organization pursuing capital market advancement through corporate governance improvement. It includes institutional investors, academia, lawyers, accountants, and financial experts who score corporate governance. Although the forum requested Hyundai Motor to sell idle assets such as the Samseong-dong site and KT shares, the 'A-' grade Hyundai Motor received is higher than the average for large corporations, such as SK Corporation's D grade, LG Electronics' D grade, and SK Hynix's C grade.

What is the overall market assessment of Hyundai Motor Group's governance? We interviewed four capital market insiders familiar with Hyundai Motor Group (▲ Ko Taebong, Head of Research at iM Securities (hereafter Ko), ▲ Lim Eun-young, Research Fellow at Samsung Securities (Lim), ▲ a value investment fund manager (Ga), and ▲ an activist fund manager (Haeng)). The discussion was reconstructed in a roundtable format.

Q. What is Hyundai Motor's image in the market?

▲ Haeng: From the perspective of enhancing shareholder value, I think Hyundai Motor is the best among domestic conglomerates. Usually, the market holds a negative view of most large corporations regarding shareholder value enhancement, but Hyundai Motor is relatively positive. There is at least a belief that they will not blatantly harm shareholder value through physical spin-offs or simultaneous listings. The atmosphere has changed significantly since Elliott's challenge in 2018. Although there have been some controversies, such as Hyundai Motor Securities' large rights offering and the sale of old shares by Hyundai Motor India, no company is 100% perfect.

▲ Ko: Compared to the past, Hyundai Motor's image and status have definitely changed a lot. Hyundai Motor is practically the last global automaker to internalize its own engine technology. It has the passion and drive as a 'fast follower' who can grasp trends and move quickly. However, with the market changing rapidly, there is a slight bottleneck in autonomous driving. While the mechanical engineering foundation for engine development was somewhat established at the time, we worry that we lack a sufficient software foundation to prepare for the AI era.

Q. How do you evaluate the corporate head (executive)?

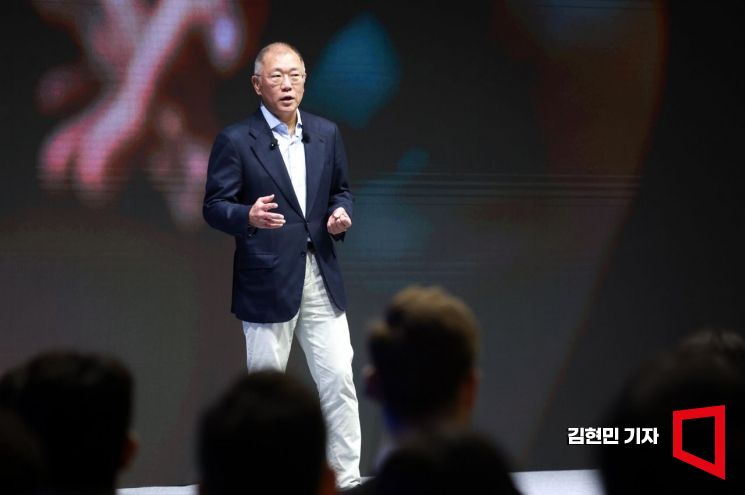

▲ Haeng: The core of evaluating a businessperson is growth and distribution. How well they present the company's vision and how fairly they distribute achievements. From this perspective, Chairman Chung Eui-sun is still the best among chaebol heads. He takes risks and appears as a proactive manager who communicates by receiving market feedback. Among domestic family businesses, he is the best example. If the market's perception of large corporations is 90% negative and 10% positive, Hyundai Motor is about 50-50. As a de facto monopoly operator in Korea, reaching global third place with the sacrifice and support of the public and shareholders means they have done their part at the national level.

▲ Ga: In Yeouido, the evaluation of Chairman Chung is positive. Even if it is past performance, Hyundai Motor has been the best among traditional automakers over the past three years. It is highly regarded for making the best and fastest decisions among global automakers like GM and Volkswagen. However, there is criticism that Hyundai Motor is falling behind as Chinese automakers rise rapidly. The industry's rapid changes somewhat undervalue Chairman Chung's management capabilities.

Hyundai Motor Group Chairman Chung Euisun is speaking at the '2025 Hyundai Motor Group New Year's Meeting' held on the 6th at Hyundai Motorstudio in Goyang-si, Gyeonggi Province. Photo by Kim Hyunmin

Hyundai Motor Group Chairman Chung Euisun is speaking at the '2025 Hyundai Motor Group New Year's Meeting' held on the 6th at Hyundai Motorstudio in Goyang-si, Gyeonggi Province. Photo by Kim Hyunmin

Q. There has been much controversy over Hyundai Motor Group's investments, such as acquiring the KEPCO site, Boston Dynamics, Motional, and 42dot. What do you think about the investment direction?

▲ Haeng: At the time of acquiring the KEPCO site in 2014, many said, "Buy Aston Martin with that money" or "Invest in R&D." The perception was very negative then, but looking back now, the land value has increased three to four times. Personally, I think Hyundai Motor Group bought Korea's Central Park. Regarding Boston Dynamics, there was controversy at acquisition, but now the unlisted stock value has risen nearly tenfold, and they are considering an IPO.

▲ Ko: I think they have made significant investments in new technologies like Boston Dynamics and Motional. What is most needed now is investment in data centers to prepare for the AI era. Although the group already has data centers, large-scale trillion-won investments are required to fully utilize AI technology. A data center capable of processing and utilizing real data collected across Korean territory is urgently needed.

Hyundai Motor and Kia sell about 1.2 million new cars annually in the domestic market, which is about one-twentieth of the total registered vehicles in Korea. Suppose they collect data by equipping new autonomous driving systems. This is not a small number. Hyundai Motor and Kia are the only automakers with over 70% domestic market share worldwide. Korea is a truce country with a small, densely populated land. The data collected throughout Korea should be managed and developed domestically.

Q. Any other questions about Hyundai Motor Group's governance?

▲ Haeng: The resource allocation between Hyundai Motor and Kia is a question. Both operate the same finished car business under one roof, so I wonder how decisions are made regarding talent acquisition, patents, and asset allocation. Especially for R&D, costs are likely shared and amortized together. I would like to know the ratio and decision-making process at the group level. It would be good to clarify how the two companies differentiate themselves.

Q. It seems Hyundai Motor Group began seriously focusing on shareholder value enhancement after the failed 2018 governance restructuring. How do you foresee future governance restructuring?

▲ Ga: Since the 2018 restructuring failure, there have been no signs, only uncertainty. In fact, the current structure is optimal for the current generation (third generation). Unless Chairman Chung plans to pass management to the fourth generation, there is no need to spend huge funds to create a holding company system. They could restructure to secure next-generation management rights, but if they decide not to hand over management to the fourth generation like Samsung, maintaining the current system might be better. They might give their children the choice regarding succession.

▲ Ko: At this point, rather than pushing for governance restructuring recklessly, considering the honorary chairman's advanced age, inheritance is likely. Even if the shareholding ratio in major affiliates decreases through inheritance, there are various ways to use resources, such as selling shares in affiliates outside the circular shareholding chain.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.