Only Korea Stands to Lose If Implementation Is Delayed

Most Major Countries Have Already Adopted the Global Minimum Tax

As President Donald Trump moves to undermine the global minimum tax, South Korean companies have decided to request a grace period from the government. Since the Trump administration has emphasized infringement on the U.S. taxing rights, there is an argument that the implementation should be delayed as much as possible to avoid trade pressure. However, since major countries have already adopted the global minimum tax, if only South Korea delays, the government is likely to lose taxing rights over global companies, making it difficult to accept such a request.

Korea Economic Association to Request Ministry of Economy and Finance for Grace Period on Income Inclusion Rule Reporting

According to the Korea Economic Association (KEA) on the 21st, KEA plans to soon request the Ministry of Economy and Finance to postpone the reporting period for the global minimum tax. KEA intends to propose a grace period specifically for the Income Inclusion Complementary Rule (UTPR, Undertaxed Payments Rule) among the global minimum tax principles.

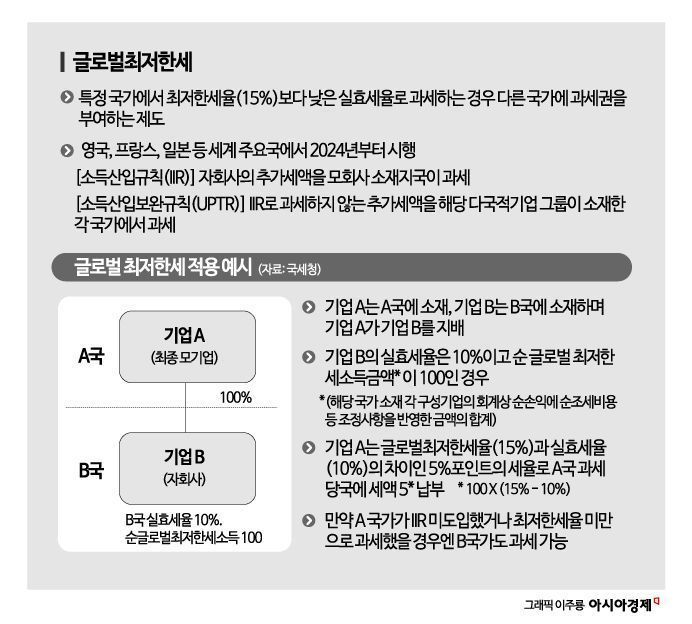

The global minimum tax is a system agreed upon by 143 countries participating in the Inclusive Framework led by the Organisation for Economic Co-operation and Development (OECD) and the Group of Twenty (G20) in October 2021. Although the implementation timing varies slightly by country, most countries except the United States have already decided to adopt it.

The global minimum tax requires multinational corporations with consolidated financial statement revenues of 750 million euros (approximately 1 trillion KRW) or more in at least two of the previous four fiscal years to pay a minimum corporate tax rate of 15% anywhere they operate. The core is to grant taxing rights to other countries if a company is taxed at an effective tax rate lower than the minimum rate (15%) in a specific country. For example, if Samsung Electronics' Vietnam branch pays only 10% corporate tax in Vietnam, Korea, where the headquarters is located, can impose an additional 5% tax. This is called the Income Inclusion Rule (IIR).

However, KEA explained that it is not requesting the government to delay IIR to prevent Korean large corporations from paying additional taxes. Since President Trump’s criticism of the global minimum tax focuses on the Income Inclusion Complementary Rule (UTPR), KEA believes South Korea should delay UTPR as well.

UTPR is a complementary tax principle to IIR. Its core is to allow countries where subsidiaries of multinational corporations are located to collect taxes if a specific country has not implemented IIR. For instance, even if Samsung Electronics' Vietnam branch pays only 10% corporate tax in Vietnam, if Korea does not adopt the global minimum tax and does not collect the additional 5%, the Vietnamese government can tax the 5%. Most countries that have adopted the global minimum tax implement both tax principles together.

KEA is concerned that if UTPR is implemented as is, trade conflicts may arise, causing difficulties for Korean companies in exports. With President Trump declaring that the U.S. will opt out of the global minimum tax, KEA emphasizes the need to prevent potential problems if South Korea maintains UTPR as is. If the Korean government taxes American companies such as Google Korea while the U.S. does not implement IIR, retaliatory measures could be taken.

Only Korea’s Taxing Rights Lost... Grace Period Has Limited Benefits

The Ministry of Economy and Finance plans to review KEA’s official request if it is submitted. However, since only the U.S. is opting out of the global minimum tax while most countries maintain the system, the ministry believes that the benefits of further delaying it only in Korea are limited. If Korea delays UTPR, it could result in Korea losing its taxing rights.

This is because taxes not collected by Korea due to UTPR delay will be collected by other countries where subsidiaries exist. From the perspective of multinational corporations like Google, the total amount of tax owed remains the same. In other words, as long as major countries such as those in Europe maintain UTPR, only the taxes Korea should collect will decrease. Since many companies have yet to quantify the tax impact of the global minimum tax, it is still difficult for the Ministry of Economy and Finance to grasp the scale of additional taxation resulting from its implementation.

South Korea began implementing the global minimum tax from 2024 but has not yet actually collected taxes. IIR applies from the 2024 fiscal year and reporting is scheduled to start in June 2026, while UTPR applies from the 2025 fiscal year with reporting starting in March 2027. To postpone reporting, the International Tax Adjustment Act must be amended. A Ministry of Economy and Finance official stated, “If KEA’s request is formally submitted, we will review it.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)