Turnover Rate of Demand Deposits Hits Five-Year High in Q4 Last Year

Funds Flow from Banks to U.S. Stocks, Cryptocurrency, Dollars, and Gold

In the fourth quarter of last year, the turnover rate of demand deposits at domestic banks reached its highest level in five years. This is interpreted as an increase in funds seeking higher returns as deposit interest rates declined.

According to the Bank of Korea's Economic Statistics System on the 21st, the turnover rate of demand deposits at domestic deposit banks in the fourth quarter of last year was 18.8 times, the highest in five years since 19.2 times in the fourth quarter of 2019. It increased by 0.8 times compared to 18 times in the previous quarter.

Demand deposits, which include ordinary deposits and checking accounts, refer to short-term funds that can be withdrawn at any time, unlike savings deposits. The deposit turnover rate is the ratio of the amount withdrawn to the average deposit balance at financial institutions. A high deposit turnover rate means that withdrawals for investment or consumption were active.

The increase in the turnover rate of demand deposits is interpreted as being influenced by the base interest rate cut. In October last year, the Bank of Korea lowered the base interest rate and made a pivot (monetary policy shift) to ease monetary policy for the first time in three years and two months. The base interest rate was lowered again in November, and it is highly likely to be lowered further this month.

As the Bank of Korea began to actively cut the base interest rate, commercial banks also lowered their rates one after another, and funds moved in search of higher returns. According to the Korea Securities Depository, the trading volume of U.S. stocks by domestic investors in December last year reached about 95 trillion won, setting a record high. The trading volume of virtual assets such as Bitcoin in the fourth quarter of last year also more than doubled compared to the previous quarter, and investor deposits, which are standby funds for the stock market, have been steadily increasing.

An official from a commercial bank said, "Not only in Korea but also globally in the U.S. and Europe, as the trend of interest rate cuts continues, funds are moving in search of higher returns."

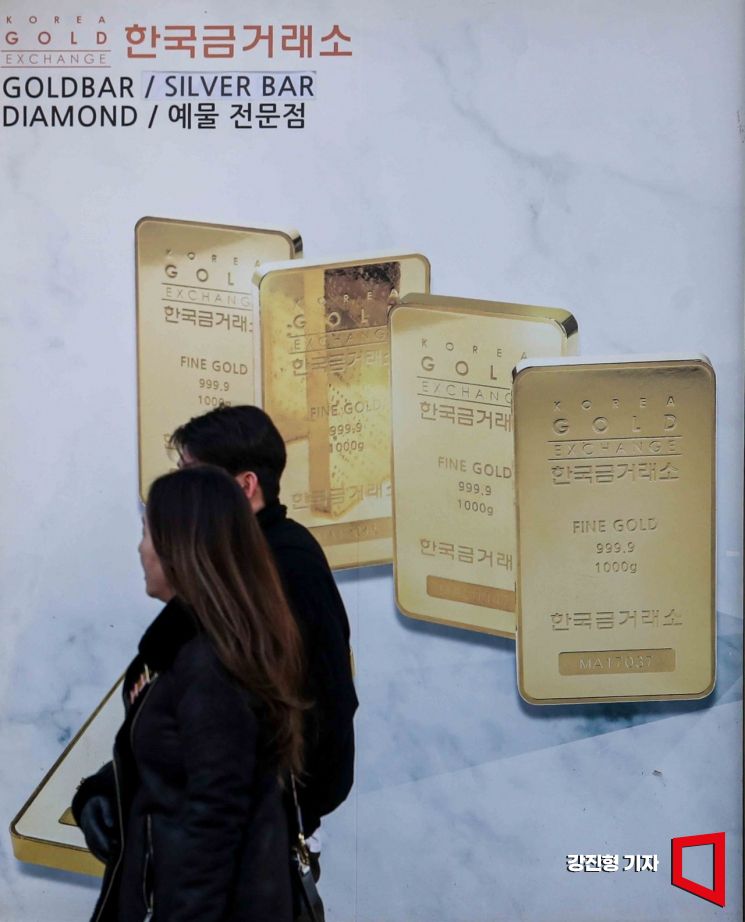

On the 18th, when gold prices soared and a gold bar shortage occurred, a photo of a gold bar was posted on the exterior wall of the Korea Gold Exchange Jongno Main Branch in Jongno-gu, Seoul. 2025.2.18. Photo by Kang Jin-hyung

On the 18th, when gold prices soared and a gold bar shortage occurred, a photo of a gold bar was posted on the exterior wall of the Korea Gold Exchange Jongno Main Branch in Jongno-gu, Seoul. 2025.2.18. Photo by Kang Jin-hyung

Not only short-term funds such as demand deposits but also long-term funds such as time deposits and installment savings, which are savings deposits, are showing an increasing turnover rate trend. The turnover rate of savings deposits in December last year was 1.5 times, the highest in five months since July last year (1.5 times). As interest rates decline, money that was kept for the long term is also moving out to find other investment destinations.

This trend is expected to continue this year as well. Since the beginning of this year, both demand deposits and savings deposits at major banks have been decreasing. Time deposits at the five major domestic banks decreased by nearly 26 trillion won from 948 trillion won in November last year to 922 trillion won in January this year, and demand deposits have also shown a clear decreasing trend this year.

Funds withdrawn from banks are moving toward safe assets such as dollars and gold. As of the 14th, the dollar deposit balance at the five major banks was a total of 67.65207 billion dollars, the highest in two years since the end of January 2023. This year, sales of gold bars and gold banking at banks have also been rapidly increasing. Another official from a commercial bank explained, "As the interest rates on bank time deposits continue to fall, investment funds are moving," adding, "This trend applies not only to households but also to corporate funds."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.