Google Recently Responds to FTC with Opinion Letter

Committee to Set Review Schedule After Examination

The competition authorities' decision on the suspicion of Google's YouTube Music 'tying sales' will be announced soon. The authorities believe that Google, which dominates the domestic video platform market, unfairly transferred its market dominance in its main market to the related market of music streaming, distorting fair competition and harming consumer welfare. Since Google denies all allegations, it is expected that the two sides will fiercely clash over the four key issues during the upcoming review process.

According to government sources on the 20th, Google's U.S. headquarters and Google Korea recently submitted their opinions on the Fair Trade Commission's (FTC) review report. This comes about seven months after the FTC sent Google a review report last July stating that it violated Article 5 (Prohibition of Abuse of Market Dominance) and Article 45 (Prohibition of Unfair Trade Practices) of the Monopoly Regulation and Fair Trade Act. The FTC plans to hold a plenary meeting to decide the final level of sanctions once the committee finishes reviewing the submitted opinions. A government official said, "The FTC plans to review the submitted legal and economic analyses and finalize the schedule for the plenary review soon."

FTC Judges All Four Conditions for Illegality of Tying Sales Met

The FTC's concern is the overall act of bundling music service products with video subscription products. Google offers 'YouTube Music Premium,' which normally costs 11,990 KRW per month, together with the 'YouTube Premium plan' (14,900 KRW per month) that allows ad-free YouTube viewing. The FTC views this as tying sales that block fair market competition with other competing music service providers such as Melon, Genie Music, and Flo. Even users who do not need music services are effectively forced to purchase YouTube Music if they want to avoid ads. A representative from a major domestic law firm pointed out, "Google does not operate a standalone product that excludes music services and only offers ad-blocking at a cheaper price. With no alternatives, consumers are forced to pay for unnecessary services, limiting their choices."

When Google first launched this controversial plan in September 2020, it was a challenger in the domestic music streaming market. As a latecomer, Google leveraged its dominant position in the video platform market to quickly capture the market. This strategy is similar to how Microsoft drove competitors like Netscape out of the market by offering Internet Explorer for free. The FTC believes Google's business practices have continued since September 2020.

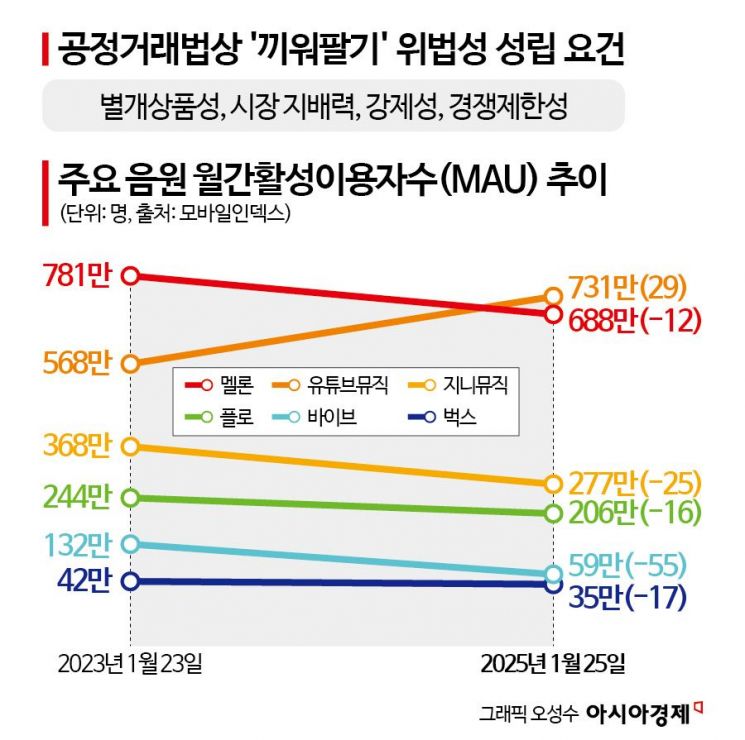

As a result, YouTube Music rapidly gained market share and secured the top position. According to Mobile Index, as of January 25, YouTube Music's monthly active users (MAU) reached 7.31 million, a 29% increase from 5.68 million two years ago. Meanwhile, the number of Melon users, ranked second, dropped 12% from 7.81 million to 6.88 million, and users of other competitors ranked third to sixth fell by up to 55%, losing their market presence. A source from the domestic music industry said, "Except for Melon (Kakao Entertainment), Genie Music, Flo (Dreamus Company), and NHN Bugs have all turned to losses or accumulated deficits, pushing them to the brink of closure."

Google is reportedly denying all allegations. Google denies all four conditions for illegality claimed by the FTC: that it forced the sale of the unpopular YouTube Music bundled with its main product YouTube based on market dominance, and that YouTube Music gained a competitive advantage through this bundling. A legal expert said, "The key issues are how broadly to define the relevant market to prove Google's market dominance (market definition) and to prove that Google's actions significantly reduced market competition (competition restriction). Both market definition and proving competition restriction are highly disputable, so the two sides are expected to strongly contest these points during the review process."

'Free Benefits' Are a Sales Tactic... "Price Increase Follows After Gaining Market Dominance"

Google is expected to argue that from the consumer's perspective who uses music services, subscribing to the YouTube Premium plan (14,900 KRW per month) provides YouTube Music Premium, which normally costs 11,990 KRW per month, for free as a benefit. Regarding this, a representative from a major domestic law firm pointed out, "When platform companies enter the market, they attract consumers with low prices to dominate the market, then later raise prices significantly in what is called 'predatory pricing,' which is a common business practice among platform companies." The idea is that they initially increase consumer welfare with low prices, then eliminate competitors and dominate the market before raising prices. In fact, Google raised the price of YouTube Premium by 43% in December 2023, from 10,450 KRW to 14,900 KRW per month. The price of YouTube Music also increased by 38%, from 8,690 KRW. Last year, Coupang also sparked monopoly controversy by significantly raising the price of its Wow Membership, which offers Coupang Play and Coupang Eats for free, from 4,990 KRW to 7,890 KRW.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.