Clarifying Compensation Standards for "Very Minor Accidents" in Auto Insurance

Developing Insurance Products for Low Birth Rates, Aging Population, and Climate Crisis

The non-life insurance industry is pushing to establish measures this year to prevent leakage of automobile insurance claims. The aim is to curb excessive medical treatment practices, such as repeatedly issuing medical certificates and prolonged treatment even for minor accidents.

On the 19th, at a New Year's press conference held at the Press Center in Jung-gu, Seoul, Lee Byung-rae, chairman of the Korea Non-Life Insurance Association, stated, "It is necessary to address the issue where unnecessary increases in insurance claims due to excessive medical treatment are passed on as a burden on premiums to honest insurance consumers."

Lee Byung-rae, Chairman of the General Insurance Association, is explaining the major tasks to be promoted this year at the New Year's press conference held on the 19th at the Press Center in Jung-gu, Seoul. Photo by the General Insurance Association

Lee Byung-rae, Chairman of the General Insurance Association, is explaining the major tasks to be promoted this year at the New Year's press conference held on the 19th at the Press Center in Jung-gu, Seoul. Photo by the General Insurance Association

Currently, the main diagnoses for minor injury patients classified as injury grades 12 to 14 under automobile insurance personal injury compensation are contusions and sprains. According to the Korean Medical Association’s guidelines for writing and issuing medical certificates, these patients require about 3 to 4 weeks of treatment. However, many cases involve long-term treatment, causing serious financial leakage in automobile insurance funds.

Accordingly, the Non-Life Insurance Association is considering introducing reasonable compensation standards for cases where, based on the Police Agency’s accident analysis results or injury risk analysis reports from specialized research institutions, the possibility of bodily injury is deemed unlikely in minor accidents. They also plan to prepare legal and institutional improvement measures to clarify compensation standards for very minor accidents through research projects and public hearings.

Standards for medical fees and review guidelines related to Korean traditional medicine treatment will also be specified. Currently, excessive treatment at some Korean traditional medical institutions leads to excessive insurance payouts and causes premium increases for many honest policyholders. Automobile insurance payments for Korean traditional medicine treatment surged by 451.8%, from 269.8 billion KRW in 2014 to 1.4888 trillion KRW in 2023. This is due to insufficient and unclear standards for medical fees and review guidelines related to Korean traditional medicine treatment. The Non-Life Insurance Association plans to analyze cases of excessive treatment for minor injury patients at Korean traditional medical institutions and guide the clarification of medical fee standards and review guidelines for Korean traditional medical treatment.

In addition to the automobile insurance improvement plan, the Non-Life Insurance Association announced 19 detailed tasks centered on three core strategies: ▲ expanding the role of social safety nets ▲ securing sustainability and enhancing consumer trust ▲ innovating insurance services.

The association is also focusing on strengthening coverage capabilities in response to demographic changes such as low birth rates and super-aging. Chairman Lee said, "We plan to conduct a comprehensive survey of insurance products currently sold that cover pregnancy and childbirth-related diseases to identify coverage gaps," adding, "We will introduce various new coverage products through research on pregnancy and childbirth-related products operated overseas."

They will also promote the activation of senior insurance, such as long-term care insurance to support old-age preparation. On the 23rd of last month, the government announced measures to strengthen the public care system for the elderly as part of its response to aging. This includes plans to build a comprehensive public and private old-age preparation system without coverage gaps by developing new insurance products linked to government policies in the private sector. The need to activate ‘in-kind benefit coverage,’ where insurance companies directly provide care-related services, was also mentioned. In-kind benefits provide subscribers with services such as nursing and dementia care instead of insurance payouts. Chairman Lee said, "We will prepare support measures to activate government policy-linked and in-kind benefit-type long-term care insurance through cooperation with relevant government ministries, research, and proposals for institutional benefits," and added, "We plan to propose measures such as establishing a tax credit limit (1 million KRW) for long-term care insurance premiums."

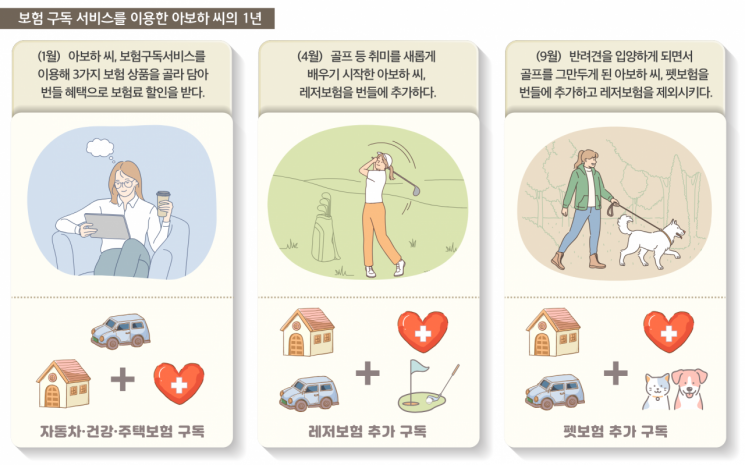

Diagram of the insurance subscription service promoted by the General Insurance Association. Provided by the General Insurance Association

Diagram of the insurance subscription service promoted by the General Insurance Association. Provided by the General Insurance Association

Plans to promote climate insurance as a response to the climate crisis will also be pursued. This is based on the judgment that traditional insurance products such as flood and earthquake disaster insurance have limitations in responding to new risks caused by climate change. Chairman Lee said, "To overcome the climate crisis and protect climate-vulnerable groups, we plan to propose a policy insurance model for climate insurance," adding, "We will also strengthen cooperation with local governments by supporting the development of region-specific customized climate insurance to enhance climate risk response capabilities."

The introduction of insurance subscription services will also be pursued. Currently, the consumption paradigm is shifting from a structure where consumers purchase and own products to subscription services where they pay to use and experience products across the economy. Chairman Lee said, "We will review types and operational plans for insurance subscription services by referring to subscription services in other industries such as online video services (OTT) and overseas insurance subscription cases," adding, "We will examine regulatory improvements through specialized research institutions such as the Korea Insurance Research Institute and propose them to financial authorities."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.