Decoupling Income Transition Point at $30,000 Per Capita GDP

Higher Than the $23,000 Average Among 59 Countries

Need to Foster Low-Carbon, High Value-Added Service Industries

Introduction of 'Transition Finance' Needed to Support Decarbonization of High-Carbon Industries

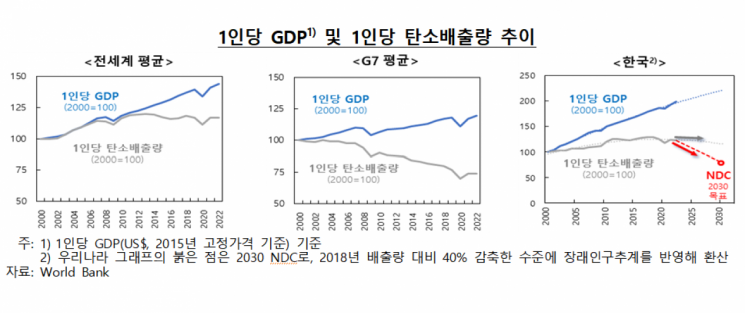

South Korea has been analyzed to begin 'decoupling,' where economic growth continues while carbon emissions decrease, starting at a per capita gross domestic product (GDP) level of around $30,000. This is higher than the average income transition point of $23,000 per capita GDP among 59 countries. It is diagnosed that to achieve stable decoupling, South Korea must actively introduce a Korean-style transition finance system that supports the gradual decarbonization of high-carbon industries.

According to the BOK Issue Note titled "Analysis and Implications of Decoupling Economic Growth and Carbon Emissions Using Country Panel Data," released by the Bank of Korea on the 19th, panel analysis of 59 countries classified as high- and middle-income shows that the income transition point where decoupling begins is around $23,000 per capita GDP. High-income countries are generally already in a state of decoupling. However, the income transition point varied due to various factors that either accelerated or constrained decoupling. Jeongin Yeon, head of the Climate Risk Analysis Team at the Bank of Korea’s Sustainability Growth Office, said, "Decoupling was promoted through changes in industrial structure (expansion of the service sector), and technological progress and financial development either accelerated or delayed decoupling depending on each country's economic structure."

South Korea is currently at a crossroads, having passed the income transition point and moving toward 'absolute decoupling.' The delay in South Korea’s decoupling compared to the average is attributed to industrial characteristics and the energy supply structure. Yeon pointed out, "The effect of industrial structural change was limited due to the expansion of labor-intensive, low value-added service sectors, and the high proportion of high-carbon manufacturing and fossil fuel-based energy supply structure tended to amplify the scale effect of carbon emissions despite technological progress and financial development."

While high-income countries can promote decoupling through financial development, in middle-income countries where the real economy lacks sufficient carbon reduction capacity in terms of industrial structure and technological level, financial development has contributed to increased carbon emissions. This is because even if the financial market’s funding capacity is large, if resources are concentrated on carbon-intensive economic activities, decoupling can be constrained. This suggests the need to shift financial flows toward low-carbon sectors to promote decoupling.

To proceed with stable decoupling in the future, South Korea needs to focus on ▲ fostering low-carbon, high value-added service industries ▲ promoting the adoption of clean energy and eco-friendly technologies ▲ and concretizing policies to revitalize green finance. Especially considering South Korea’s industrial characteristics centered on high-carbon manufacturing, Yeon emphasized the need to introduce a transition finance system that supports the gradual decarbonization of high-carbon industries to reduce financing blind spots that may arise during the transition to a low-carbon economy. Transition finance is a means of supplying funds for low-carbon transition activities in high-carbon and hard-to-abate industries. Although it does not meet the strict activity and recognition criteria under the current green taxonomy, it supports transitional activities that can partially contribute to carbon reduction.

Yeon explained, "Currently, South Korea’s green finance system has limitations in covering the funding demand necessary for restructuring the industrial structure of high-carbon manufacturing and for gradual low-carbon technology development," adding, "Recently, countries like Japan and China have actively introduced transition finance, and Singapore and the European Union (EU) are also preparing transition finance systems linked to existing green finance frameworks." Notably, Japan, which operates the world’s largest transition finance market, supplies large-scale funds to companies aligned with industry-specific carbon reduction roadmaps through loans and bond issuance, resulting in an accelerated decoupling trend in Japan from 2019 to 2022 compared to the past.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)