Lotte, Shinhan, and Woori Card Loan Ratio Exceeds New Sales

Promotional Expenses Rise to Boost New Sales... 'Self-Defeating' Competition

Card Loan Ratio Expected to Remain High as Companies Focus on Profitability

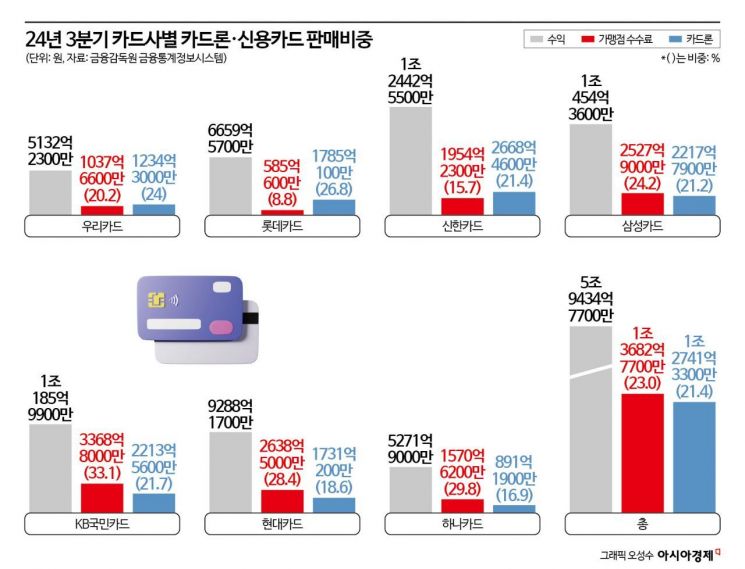

The long-term card loan (card loan) sales ratio of Lotte, Shinhan, and Woori Card has been found to be higher than the credit card sales (new sales) ratio for an extended period. Unlike Samsung, KB Kookmin, Hyundai, and Hana Card, the loan business performance ratio has been larger than the card sales performance ratio for as short as 9 months and as long as nearly 6 years, prompting calls to improve new sales business efficiency. Since card loans serve as a 'quick cash window' for ordinary people who find it difficult to obtain loans from primary financial institutions (such as banks) during economic downturns, the larger this business ratio becomes for card companies, the greater the risk of delinquency and deterioration of soundness.

On September 30 last year, advertisements related to card loans were posted on Myeongdong Street in Jung-gu, Seoul. Photo by Kang Jin-hyung

On September 30 last year, advertisements related to card loans were posted on Myeongdong Street in Jung-gu, Seoul. Photo by Kang Jin-hyung

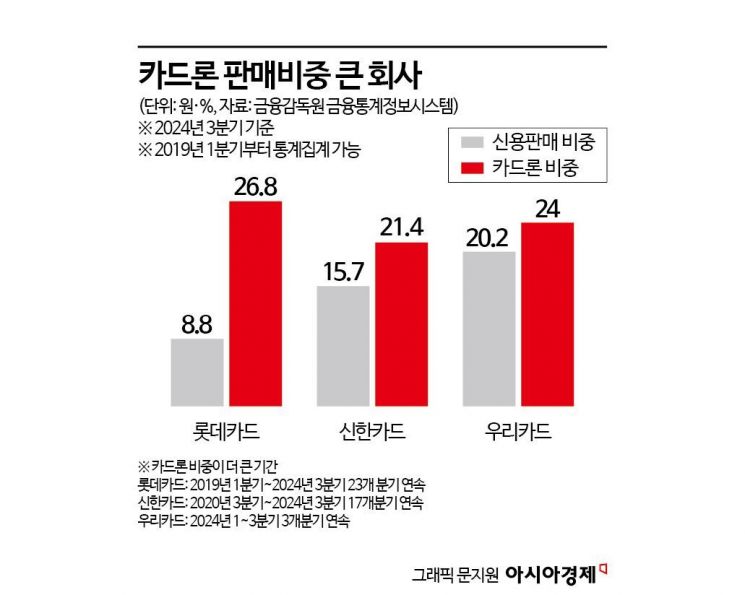

According to the Financial Supervisory Service's Financial Statistics Information System on the 19th, the proportion of card loan revenue (178.5 billion KRW) to total revenue (666 billion KRW) of Lotte Card in the third quarter of last year was 26.8%. This is three times larger than the merchant fee (new sales) revenue proportion of 8.8% (58.5 billion KRW). Shinhan Card's card loan revenue ratio was 21.4%, 5.7 percentage points higher than the new sales ratio of 15.7%. Woori Card's card loan revenue ratio was 24%, larger than the new sales ratio of 20.2%.

This is not a temporary phenomenon. A full survey of 23 quarters (5 years and 9 months) since the first quarter of 2019, after the Financial Supervisory Service's Financial Statistics Information System was revamped, shows that the 'card loan polarization' is even more pronounced. Lotte, Shinhan, and Woori Cards have relied on card loan performance in the mid to long term, while the other four companies had a higher new sales ratio than card loan ratio. Lotte Card's card loan ratio was higher than the new sales ratio in all 23 quarters after the statistics revision. Shinhan Card's card loan ratio was higher for 17 consecutive quarters (4 years and 3 months) from the third quarter of 2020 to the third quarter of last year. Woori Card's card loan ratio was higher than the new sales ratio for 9 months from the first to third quarter of last year. Since 2018, the Financial Supervisory Service has required credit card companies to disclose figures separately before and after the adoption of International Financial Reporting Standards (IFRS15) from the first quarter of 2019.

Analyzing the average card loan interest rates and the proportion of loans to vulnerable borrowers reveals that card companies are compensating their performance through loan business targeting relatively low-credit borrowers. First, as customer demand increased, a rise in card loan interest rates was detected. According to the Credit Finance Association, the average card loan interest rate (the rate applied by card companies to borrowers) of seven companies last month was 14.66%, up 0.1 percentage points from 14.56% in the same month last year. By company, the average card loan interest rate of Lotte, Shinhan, and Woori Card rose by 0.5 percentage points from 14.63% in January last year to 15.13% this January, while the average of Samsung, KB Kookmin, Hyundai, and Hana Card fell by 0.21 percentage points from 14.51% last January to 14.30% this January.

Looking at the distribution of card members by card loan interest rate brackets as of December 31 last year, among six interest rate brackets, the proportion of those receiving the highest 'annual 18-20% or less' interest rate was 23.58% for Lotte Card, 40.8% for Woori Card, and 23.99% for Shinhan Card. The average for these three companies was 29.46%, which is 12.52 percentage points higher than the average of the other four companies (Samsung, KB Kookmin, Hyundai, Hana) at 16.94%. Excluding Hana Card, which had an unusually low proportion in this bracket (1.77%), the average for the other three companies was 22%, 7.46 percentage points lower than the 29.46% of Lotte, Woori, and Shinhan Cards. Card companies set higher interest rates for borrowers with lower creditworthiness who are less likely to repay their debts reliably. This means that card companies with a larger proportion of customers subject to high interest rates face a higher risk of delinquency.

Card companies agree that while the increasing proportion of loan performance is a general trend, they need to strengthen new sales business further. However, they admitted that as latecomers try to increase market share in new sales, they inevitably face a 'self-defeating' competition by increasing card benefits and promotional expenses. Although strengthening new sales increases merchant fee revenue, costs also rise, so the card industry complains that they have no choice but to compensate profitability through the card loan business. Additionally, since the adoption of IFRS15 in 2019, the Financial Supervisory Service's disclosure system requires that new sales performance be reported as the total merchant fee revenue minus related costs such as promotional expenses, so the more promotional expenses are spent, the lower the reported figures become, which should not be overlooked.

An industry insider said, "Due to continuous reductions in merchant fees by the Financial Services Commission and increased use of card loans as a quick cash window for ordinary people, card loan revenue has increased, so its proportion inevitably grows," adding, "This trend is expected to continue for the time being." Another industry insider said, "There is a tendency for promotional expenses to keep increasing in the process of attracting premium card members," and "It will be difficult for the card loan ratio to fall below the new sales ratio in the short term."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)