Ramen Exports Reach $107.49 Million in January, Up 25% Year-on-Year

Manufacturers' Performance Hinges on Overseas Markets... Accelerating Global Expansion

Nongshim and Samyang Establish Sales Subsidiaries in the Netherlands to Target Europe

Last year, ramen became a key export item by surpassing $1 billion in export value for the first time in history, and this year it is solidifying its position as the spearhead of 'K-food' exports by setting new records from the very first month. Since the success of domestic ramen companies depends on overseas markets, manufacturers are expected to accelerate their efforts to target foreign markets.

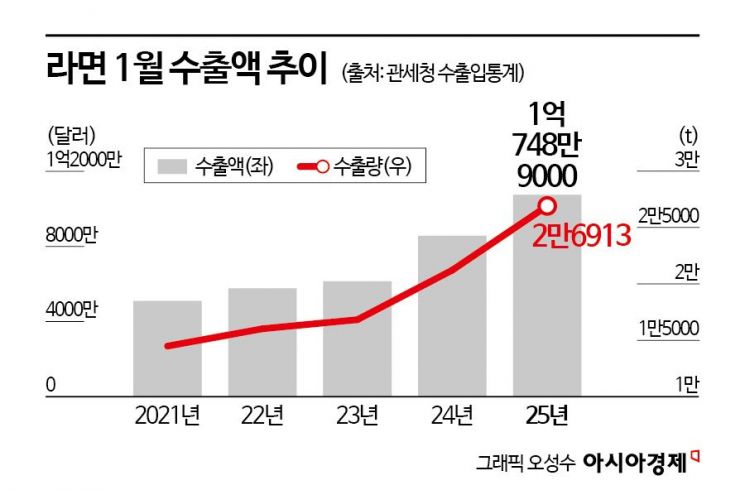

According to customs export-import trade statistics on the 18th, ramen exports in January this year amounted to $107.49 million (approximately 155 billion KRW), an increase of 25.4% ($22.15 million) compared to the same period last year ($85.75 million). This is the highest export value recorded for January, and ramen exports have exceeded $100 million for 10 consecutive months since April last year, when monthly exports first surpassed $100 million with $108.54 million.

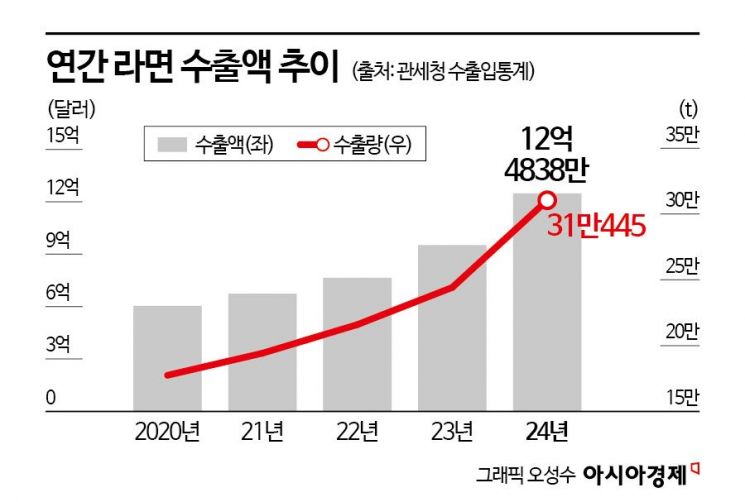

Overseas sales of Korean ramen have rapidly increased in recent years. Ramen export value was $467 million (approximately 670 billion KRW) in 2019, exceeded $600 million the following year, reached $765.41 million in 2022, and recorded $952.4 million in 2023. Last year, it surged past $1 billion for the first time, reaching $1.24838 billion (approximately 1.8 trillion KRW). Export volume also more than doubled over five years, from 137,285 tons in 2019 to 310,445 tons last year.

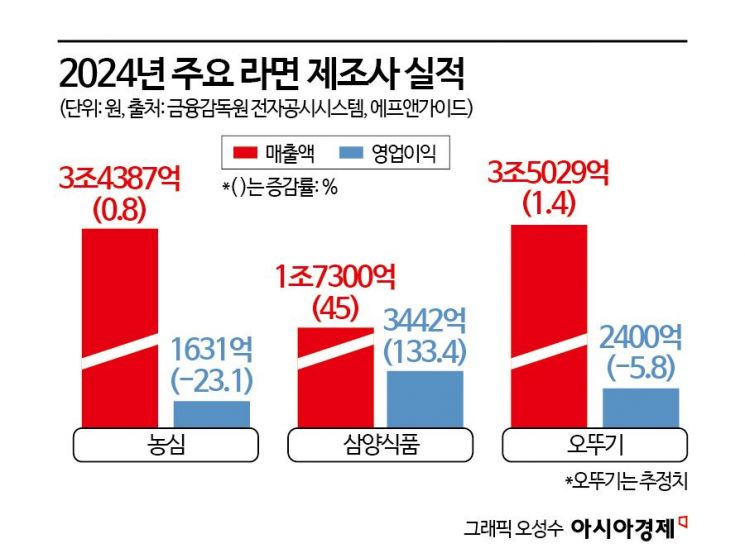

As ramen exports take off, the performance of manufacturers responsible for exports is also rapidly improving. Samyang Foods, leading the K-ramen craze overseas, posted sales of 1.73 trillion KRW last year, a 45.0% increase from the previous year. Samyang Foods' sales have steadily increased since the export of 'Buldak Bokkeum Myun' began in 2016. Sales exceeded 1 trillion KRW for the first time in 2023, and based on last year's strong performance, the company is aiming for 2 trillion KRW in two years. Operating profit growth was even more significant. Samyang Foods' operating profit last year was 344.2 billion KRW, a 133.4% increase from the previous year. This is the highest ever since the company's founding and the first time operating profit exceeded 300 billion KRW. The operating profit margin also rose sharply from 12.4% in 2023 to 19.9% last year.

Samyang Foods' strong performance last year was due to a significant increase in the proportion of highly profitable exports. The export ratio of Samyang Foods increased by about 10 percentage points in one year, from 68% in 2023 to 77% as of the third quarter last year. Popularity of the Buldak brand expanded rapidly overseas, not only in Asia but also in the Americas and Europe, leading to a surge in overseas demand and record performance. Notably, last year, the Danish food authorities requested a recall of Buldak Bokkeum Myun due to its intense spiciness, but this news spread worldwide and actually boosted brand awareness.

On the other hand, Nongshim, which leads the domestic ramen market with 'Shin Ramyun,' did not fare as well. Last year, Nongshim's sales increased by 0.8% from the previous year to 3.4387 trillion KRW, about twice that of Samyang Foods, but operating profit decreased by 23.1% to 163.1 billion KRW, about half of Samyang Foods' operating profit. Nongshim's operating profit dropped from 212 billion KRW in 2023 to the 100 billion KRW range last year, largely due to sluggish domestic demand. Although the Shin Ramyun Tomba launched last year gained popularity and attention, the burden of promotional expenses due to slowed domestic consumption held back performance. More importantly, although Nongshim is targeting the global market through exports and overseas direct production, its overseas sales ratio is around 40%, lower than Samyang Foods. Ultimately, overseas market performance determined the differing fortunes of the two companies.

Therefore, interest in overseas markets among ramen manufacturers is intensifying. Nongshim plans to increase its overseas sales ratio by globally launching Shin Ramyun Tomba this year, expanding brand awareness, pioneering new markets, and entering new distribution channels. To this end, next month Nongshim will establish its European subsidiary, 'Nongshim Europe B.V.,' in Amsterdam, the Netherlands. The European ramen market was approximately $2 billion (about 2.89 trillion KRW) in 2023 and has shown a steep growth rate of 12% annually over the past five years (2019?2023).

In particular, the Netherlands was chosen as the hub for European expansion by Samyang Foods when it established its sales subsidiary there in August last year. Following Samyang Foods, Nongshim also selected the Netherlands as the forward base for European exports due to logistics efficiency. The Netherlands hosts the Port of Rotterdam, one of the largest cargo volumes in Europe, and has excellent logistics infrastructure including rail and land transportation connected to the port, making it easy to expand business across Europe, including the UK, France, and Germany.

As Nongshim expands production facilities and strengthens overseas sales networks, competition among ramen manufacturers is expected to intensify further. Nongshim revealed its long-term ambitions for overseas market expansion by announcing the establishment of the 'Noksan Export-Only Factory' in Busan in the second half of last year. Once the Noksan Export-Only Factory begins full operation in the second half of 2026, Nongshim will have the largest global supply capacity in Korea, producing 2.7 billion units annually.

Samyang Foods also plans to maintain its leadership in the overseas ramen market. It has already started building its first overseas factory in China, aiming for completion in 2027, and its second factory in Miryang is set to begin operations this June. Additionally, Samyang Foods plans to expand market size by launching the global soup ramen brand 'Maep' to support its flagship brand Buldak Bokkeum Myun in the Japanese market this month, following its launch in Thailand at the end of last year.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)