Full Resumption of Short Selling Set for March 31

Mandatory Measures to Prevent Naked Short Selling and System Improvements

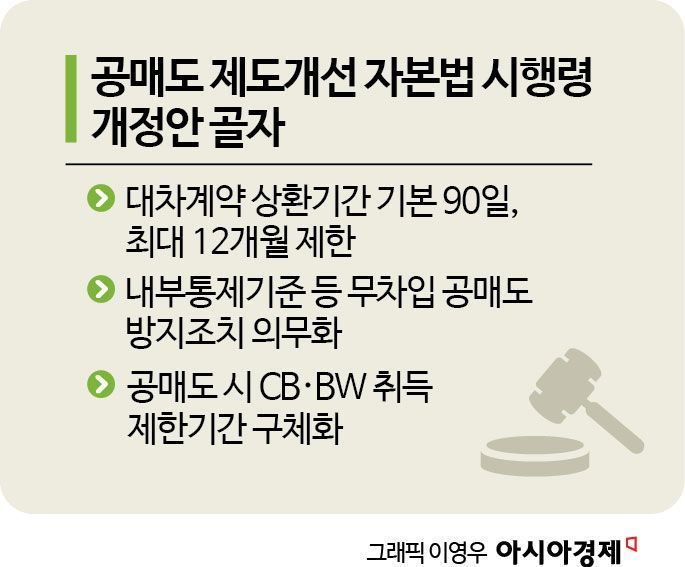

Amid ongoing concerns that selling pressure will emerge mainly on overvalued stocks following the full resumption of short selling at the end of next month, financial authorities have mandated all corporations to implement measures to prevent naked short selling. To ensure individual investors are not disadvantaged, institutions and foreigners who borrow stocks for short selling must repay them within 90 days, standardizing the repayment period, and violators face fines of up to 100 million KRW.

On the morning of the 18th, the Financial Services Commission announced at the Cabinet meeting that the amendment to the Enforcement Decree of the Capital Markets Act, which includes follow-up measures to improve the short selling system, was approved. The amendment will take effect from March 31, when short selling is fully resumed.

First, the amendment standardizes the repayment period condition, which had been criticized as a "tilted playing field" in short selling transactions. Not only individual investors but also institutional investors and foreigners are limited to a 90-day repayment period for lending services. The total period, including extensions, cannot exceed 12 months. However, in cases where repurchase is difficult due to delisting, trading suspension, or restrictions on account transfers, the repayment period must end within three business days from the end of the reason. Violations will incur fines of up to 100 million KRW.

Corporations intending to short sell listed stocks and securities firms entrusted with short selling orders are required to implement measures to prevent naked short selling. Corporations and institutional investors with a short selling balance (net holding balance) of 0.01% or 1 billion KRW or more in any single stock must establish a computerized system capable of blocking naked short selling. Additionally, they must prepare internal control standards regarding the roles and responsibilities of executives and employees, balance management, etc., and submit daily stock-specific balance information and securities lending transaction information to the Korea Exchange within two business days for post-inspection of short selling through the central inspection system (NSDS).

Furthermore, securities firms entrusted with short selling orders must verify in advance and annually whether the corporations have implemented these naked short selling prevention measures and report the results to the Financial Supervisory Service within one month. Corporations and securities firms that violate these rules may be fined up to 100 million KRW.

In addition, the days on which acquisition of convertible bonds (CB) and bonds with warrants (BW) is prohibited during short selling have been specified as from the day after the issuance disclosure to the day the conversion price or exercise price is disclosed. However, exceptions apply if the quantity purchased during this period exceeds the quantity short sold.

The amendment approved on this day is a follow-up regulation to the Capital Markets Act promulgated on October 22 last year. Related financial investment business regulations and exchange rules are also scheduled to be submitted to the Financial Services Commission in early March for amendment. A Financial Services Commission official stated, "Preparations for implementing the system improvements are proceeding smoothly, including system upgrades," and emphasized, "We will make every effort to prepare for the resumption of short selling by thoroughly implementing follow-up measures to improve the short selling system."

In the market, concerns are already emerging that selling pressure may appear on some stocks that have been overvalued until now after the resumption of short selling. LS Securities analyzed in a report titled 'Considering the Resumption of Short Selling in Advance' released the previous day that short selling will increase mainly on expensive leading stocks, and some of the stock index rebound will be partially reversed.

According to the report, in two of the three past cases of short selling bans (in 2009 and 2011), the KOSPI index declined one month after resumption. Researcher Jeong Da-woon assessed that although the stock index rose exceptionally after the short selling ban period from March 2020 to April 2021, it is unlikely to show a similar trend this time. Currently mentioned overvalued stocks include Samyang Foods, Doosan, Hanwha Aerospace, SKC, Douzone Bizon, and Korea Zinc.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)