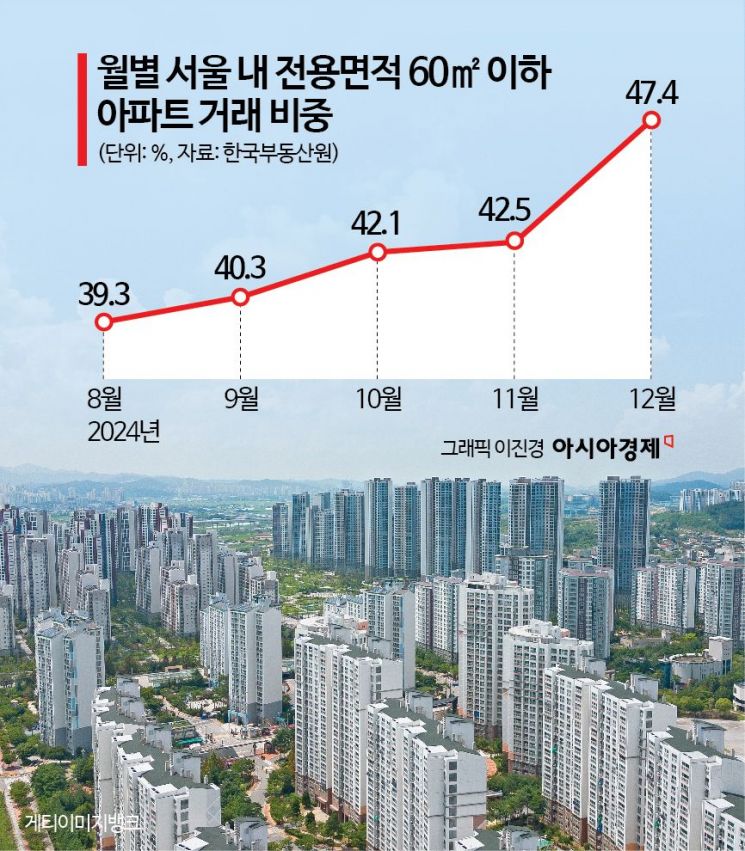

In December Last Year, Small Apartment Sales in Seoul Accounted for 47%

A 5 Percentage Point Surge Due to Loan Regulations

After the government's loan regulations, the proportion of small apartment sales in Seoul increased. It is analyzed that as the money flow was blocked due to the collateral damage of loan regulations, actual demanders turned their attention to reducing the size of their housing.

According to an analysis of data from the Korea Real Estate Board on the 19th, as of December last year, the proportion of small apartments with an exclusive area of 60㎡ or less in Seoul accounted for 47.4% of total transactions. Until August last year, the proportion of small apartment transactions was 39.3%, not reaching 40%. After recording 46.1% in March of the same year, the proportion continuously decreased. However, it began to rebound again starting in September last year. In October last year, it recorded 42.1%, and the following month increased to 42.5%, gradually increasing its share.

In fact, the proportion of small apartment transactions was on a decreasing trend. By year, the proportion of small apartment transactions in Seoul decreased every year. After recording the highest figure of 55.5% in 2022, it dropped to 47.1% in 2023. Last year, the annual figure was 43%. This was the result of a phenomenon where the prolonged COVID-19 situation increased the time spent indoors, leading to a preference for medium and large apartments.

Then December last year became a turning point. The proportion of small apartment transactions suddenly soared by 5 percentage points compared to the previous month. Since the second-stage Stress Debt Service Ratio (DSR) regulation started in September last year, the proportion of small apartment transactions increased. To reduce household debt, the government implemented the second-stage Stress DSR, applying an additional interest rate of 0.75 percentage points to bank mortgage loans, credit loans, and second-tier financial sector mortgage loan interest rates.

Despite the strengthened loan regulations, as apartment prices in Seoul rose, actual demanders are analyzed to have lowered their standards and purchased small apartments. The Seoul Apartment Sales Price Index showed a continuous upward trend; in September last year, when the second-stage Stress DSR was implemented, the index rose from 97.88 to 98.64 in December last year. Considering that the number of apartment sales in Seoul decreased to 3,803 and 3,369 in October and November last year respectively, and further dropped to 3,136 in December, it is interpreted that buyers first paused transactions and then switched their choices to small apartments.

The proportion of small apartment transactions was highest in Nowon-gu, a school district area, recording 67.2%. Gangdong-gu (65.3%) and Seodaemun-gu (64.6%) followed. On the other hand, Seocho-gu was only 26.1%, followed by Songpa-gu (26.3%) and Yangcheon-gu (29.1%) with small proportions. Gangnam-gu also showed a low level at 30.5%. In the case of the Gangnam 3 districts, there are relatively many large apartments, and the apartment transaction market is led by cash-rich buyers who avoid loan regulations, which seems to cause such disparities.

Yoon Ji-hae, senior researcher at Real Estate 114, said, "When loan regulations become stronger, the first reaction is to give up purchasing, and balloon effects appear such as turning to monthly rent or looking for small and medium-sized apartments." She added, "Since loans relative to income are limited and it is not possible to borrow excessively, reducing living space seems to be a rational choice at present."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.