Hana Securities, which successfully achieved an annual performance turnaround, has breathed a sigh of relief after avoiding the disciplinary crisis related to the so-called ‘bond rollover’ issue. Under the second term of CEO Kang Sung-mook, there is a flood of expectations that the company will gain momentum this year to leap forward as a ‘super-large investment bank (IB).’ Super-large IBs are generally evaluated as a benchmark to distinguish large firms.

According to the Financial Services Commission (FSC) and the industry, the FSC is scheduled to finalize the disciplinary review results related to illegal self-dealing in bond-type wrap accounts and specific money trusts (wraps and trusts) for nine securities firms, including Hana Securities, at its regular meeting on the afternoon of the 19th. This comes about 14 months after the Financial Supervisory Service (FSS) announced the inspection results in December 2023.

Hana Securities, which was initially subject to a partial business suspension in the original FSS proposal, is expected to see its disciplinary level lowered by two steps to an ‘institutional warning’ in the final review results. Last week, the FSC subcommittee resolved to issue institutional warnings to Hana, KB, Mirae Asset, Korea Investment, NH Investment, Eugene Investment, and Yuanta Securities, and an institutional caution to SK Securities among the nine firms. Kyobo Securities will have its business suspension period shortened but will maintain the disciplinary level. Typically, subcommittee decisions are confirmed as is at the regular meeting unless there are special reasons.

In particular, it is highly significant for Hana Securities to have avoided a business suspension penalty ahead of this year’s super-large IB licensing review, thereby eliminating uncertainty. Hana Securities’ entry into the super-large IB category is considered one of the key tasks for CEO Kang, who secured reappointment at the end of last year. Having proven his management leadership by improving the company’s structure and achieving a performance turnaround during his first term, CEO Kang is expected to further drive business diversification and profitability expansion through entry into the super-large IB sector. This will also strengthen his leadership.

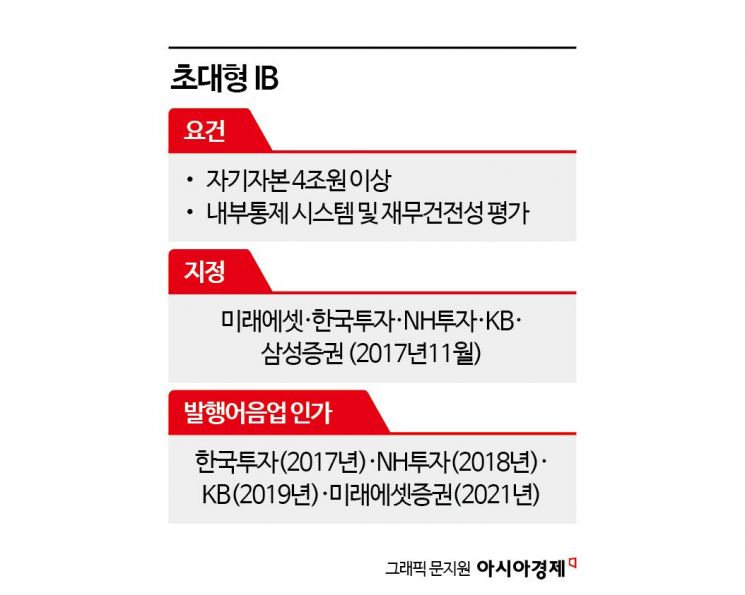

Becoming a super-large IB increases the credit extension limit to 200% of equity capital and enables entry into the newly available business of issuing commercial paper. Currently, five firms are licensed as super-large IBs in Korea: Mirae Asset, Korea Investment, Samsung, KB, and NH Investment Securities. Since 2017, no new licenses have been issued. Among these, four firms except Samsung Securities have received commercial paper issuance licenses.

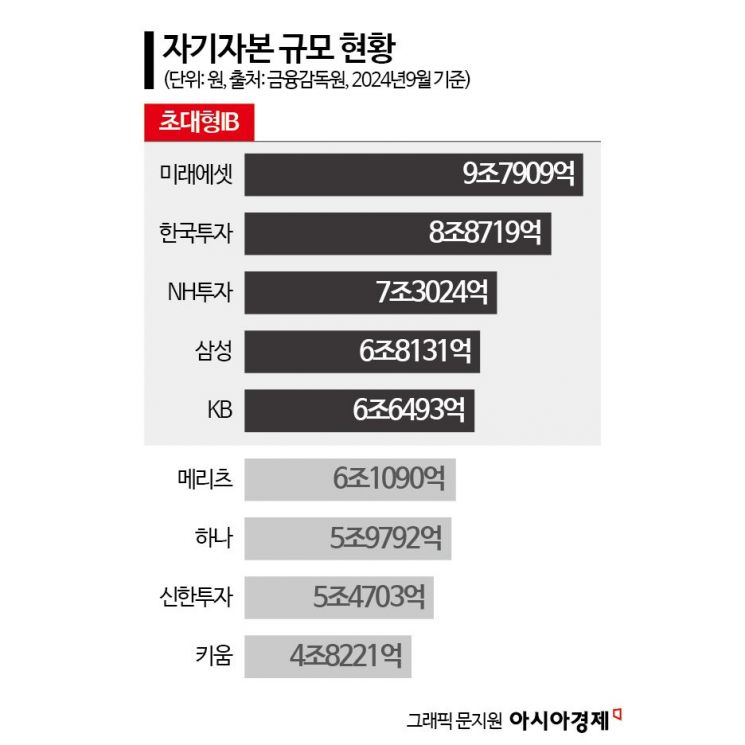

Hana Securities has already nearly completed preparations for entry into the super-large IB and commercial paper issuance businesses. It far exceeds the KRW 4 trillion equity capital requirement and is in the final stages of preparing the necessary systems, institutional frameworks, and personnel for operations. A Hana Securities official emphasized, “We are at a level where we can commence operations immediately upon licensing,” adding, “Upon receiving the commercial paper issuance license, we will proceed with business aiming for sustained growth as a super-large IB through stable funding channels and extensive sales know-how, expanded supply of venture capital, and synergy creation within the financial group.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)