Guidelines for Online Insurance Product Advertisements

"Avoid Rushing to Subscribe Due to Discontinued Marketing"

The Financial Supervisory Service urged consumers to carefully review online insurance product advertisements that use marketing phrases such as 'unlimited' and 'discontinued.'

On the 17th, the Financial Supervisory Service provided guidance on consumer precautions for insurance products. After inspecting 1,320 online insurance products over four months from August to November last year, they found many false and exaggerated insurance products and took measures to protect consumers.

The inspection revealed that online insurance product advertisements included definitive and exaggerated expressions, emphasized low premiums, and featured discontinued marketing ads.

Expressions like 'annual compensation' and 'unlimited coverage' were common. Although insurance payout eligibility varies by product and coverage amounts differ by incident, advertisements were made in a way that misled consumers into believing they could receive insurance payouts without limits. There were also cases that highlighted only specific insurance incidents with large payouts.

There were phrases such as 'only 10,000 won.' Insurance premiums can vary depending on the subscriber's age, payment period, and other factors. For example, if the payment period is 10 years, the monthly premium might be 20,000 won. Advertisements like 'only 10,000 won' are likely to be false or exaggerated.

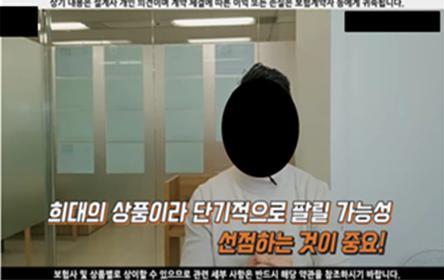

Discontinued marketing, which pressures consumers to hastily subscribe by claiming that sales will soon stop, was also rampant.

The Financial Supervisory Service, together with the Insurance Association, took corrective actions to modify or delete the inappropriate advertisements identified this time. On November 26 last year, they held a corporate insurance agency workshop and guided the strengthening of internal controls related to advertising.

The Financial Supervisory Service urged consumers to carefully check the insurance payout conditions in the explanatory documents and terms and conditions. They emphasized caution against advertisements that mislead consumers by suggesting large coverage amounts or that lack explanations about conditions that vary depending on age and other factors.

They advised consumers not to rush when subscribing to insurance. Many discontinued marketing products are not actually scheduled to stop sales. Even if sales are discontinued, similar products are often re-released.

A Financial Supervisory Service official said, "We will guide insurance companies and agencies to strengthen internal controls over online advertisements through meetings and will regularly inspect false and exaggerated online advertisements together with the association. We will also issue consumer alerts to inform consumers about precautions related to false and exaggerated advertisements."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)