S&P 500 Rises 1.5% Last Week, Nearing Record High

Tariff Uncertainty Remains... "Investor Anxiety Persists"

Despite increasing uncertainty surrounding the market due to U.S. President Donald Trump's ongoing 'tariff threats,' investors continue to buy stocks in the U.S. stock market, Bloomberg reported on the 16th (local time).

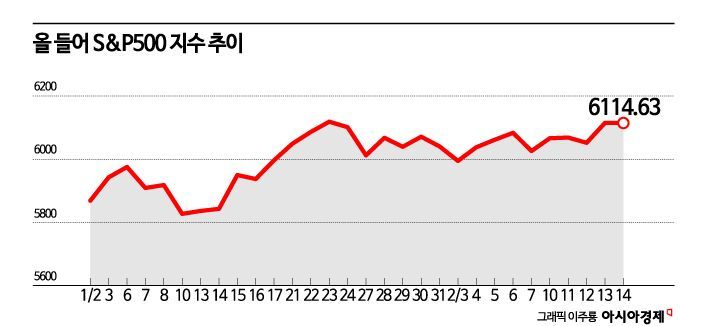

The S&P 500 index, which represents large-cap stocks in the U.S. market, rose 1.5% over the past week and is once again approaching an all-time high. Even though President Trump formalized a 25% tariff on imported steel and aluminum starting in March and announced plans to impose 'reciprocal tariffs' on various countries from April, considering both tariff and non-tariff barriers, the New York Stock Exchange has maintained a steady trend.

Andrew Sleiman, a Morgan Stanley portfolio manager, said, "Investors believe the tariffs will not be as punitive as initially expected," adding, "This is good news for the stock market compared to initial expectations." However, he noted that market sentiment, as reflected in investor surveys, remains weak, indicating lingering concerns about President Trump's tariff plans, which causes the market to react sensitively to news.

Bill Sterling, a global strategist at GW&K Investment Management, stated, "The tariff issue is one of the biggest risk factors in the current financial market," and assessed that "due to the uncertainty regarding the final size, scope, and timing, it is closer to a 'known unknown.'"

Major Wall Street financial firms share similar views. Goldman Sachs identified the tariff issue as the main downside risk factor for the economy in its annual outlook this year, and large investment advisory firm Evercore ISI pointed out that the uncertainty of U.S. government policies is pressuring market sentiment. Bank of America also diagnosed that the stock price vulnerability index, calculated based on the daily price fluctuations of the top 50 companies in the S&P 500, is approaching its highest level in over 30 years.

Concerns about the earnings of U.S. companies related to trade tensions continue. Jim Farley, CEO of Ford, expressed worries during the earnings announcement on the 11th that if the 25% tariff on imports from Mexico and Canada, postponed to take effect on the 4th of next month, is implemented, it would cause unprecedented damage to the U.S. automobile industry.

Lori Calvasina, a strategist at RBC Capital Markets, pointed out, "The lesson we learned from the brief plunge in the S&P 500 before the delay of tariffs on Mexico and Canada is that the U.S. stock market does not have much capacity to absorb bad news."

Some analysts argue that while the market has not fully priced in President Trump's entire tariff policy, it has already factored in some of it. Eric Lassels, chief researcher at RBC Global Asset Management, said, "It is reasonable to believe that without the tariff threats, the U.S. stock market would be at a higher level than it is now," adding, "Even if investors have not fully priced in the 25% universal tariff, the risk that tariffs could increase (beyond the current level) is somewhat reflected."

Alongside tariff threats, there is also growing interest in whether Big Tech (large information technology companies) can maintain their high valuations. Wall Street experts analyzed that while Big Tech has provided the momentum for bargain hunting whenever stock prices fell, these companies' stock prices could collapse. This is because the Chinese AI startup DeepSeek is shaking the high valuations of U.S. tech companies. Scott Rubner, a strategist at Goldman Sachs, warned, "Right now, the pool is full of water," explaining, "Big Tech has played a key role in 'dip buying' during market downturns. However, if trust that Big Tech will rebound after a decline is broken, the entire market will be at risk," suggesting that the influx of bargain hunters may decrease.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)