Hanwha Acquires Stakes from Koo Bon-sung and Koo Mi-hyun

Ourhome, Founded in 2000, Rises to Second Place in Catering Market

Legal Battle with Former Vice Chairman Koo Ji-eun Remains a Variable

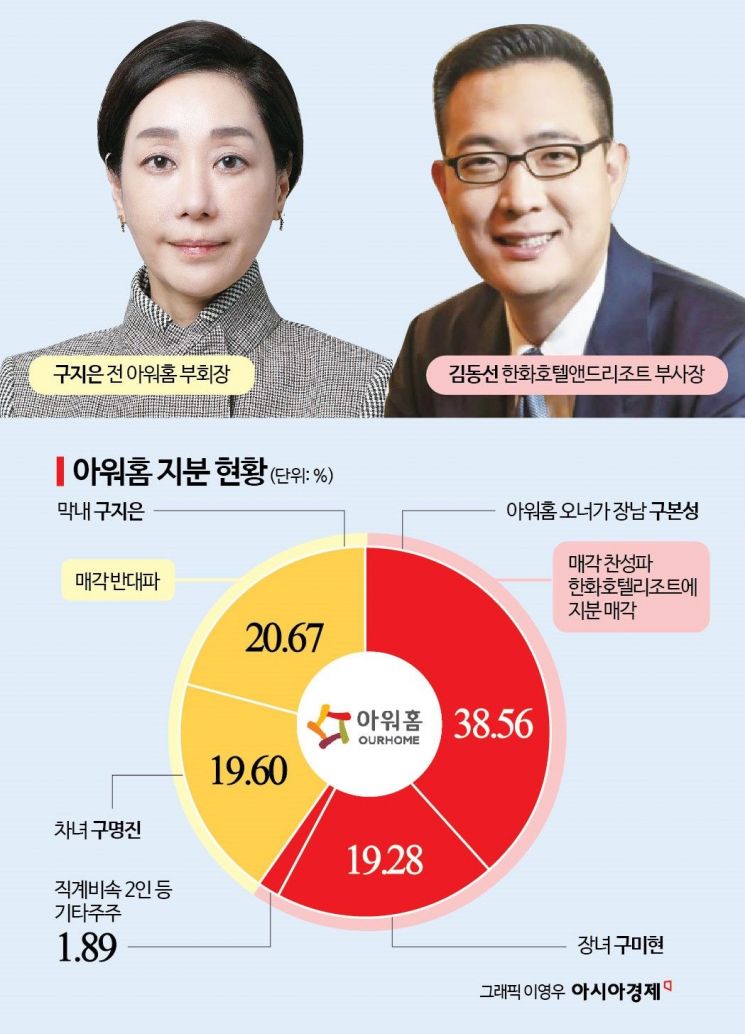

Hanwha Hotels & Resorts has passed the 'final hurdle' in its acquisition of Ourhome. Hanwha Hotels & Resorts signed a share purchase agreement (SPA) through the corporation ‘Woorijip F&B,’ established for acquiring management rights of Ourhome, with former Vice Chairman Koo Bon-sung (38.56%), Chairman Koo Mi-hyun (19.28%), and two direct descendants (1.8%). The stake Hanwha Hotels & Resorts is acquiring amounts to 58.62%, with the contract valued at a total of 869.5 billion KRW. They will acquire 13,376,512 shares at 65,000 KRW per share.

Will Ourhome Disappear into the Annals of History?

Ourhome, established in 2000 and having grown into the second-largest player in the catering market over 25 years, appears likely to disappear into history. The late Koo Ja-hak, the previous generation chairman who reached his 90s in 2000, founded Ourhome by spinning off the food division of LG Distribution (now GS Retail). In his memoir, “The First Is Not Afraid,” Chairman Koo recalled deciding on the spin-off and telling his family at home, “How familiar is the name Ourhome?” expressing his genuine fondness for the company name. At the time of the spin-off, Ourhome recorded sales of 200 billion KRW, which surpassed 1 trillion KRW within nine years. In 2023, Ourhome posted sales of 1.9835 trillion KRW and operating profit of 94.3 billion KRW. Honorary Chairman Koo reflected on Ourhome’s growth, saying, “My dream after retirement was to open a small restaurant in Yangpyeong, but it has grown this big.”

The management rights dispute has continued from 2016 to the present among former Vice Chairman Koo Bon-sung, Chairman Koo Mi-hyun, Koo Myung-jin (19.6%), and former Vice Chairman Koo Ji-eun (20.67%), who inherited shares of Ourhome. Koo Bon-sung and Koo Mi-hyun, who control the Ourhome board, sold their shares to Hanwha Hotels & Resorts. This was based on the rationale that the management dispute must end for Ourhome to continue growing. Lee Young-pyo, Ourhome’s CEO, wrote on the company’s internal bulletin board after Hanwha’s acquisition was formalized, “In the past, Ourhome was an object of envy, but the management dispute among shareholders destroyed the company’s growth momentum. Fortunately, we have found the optimal partner for Ourhome’s growth and development.” Ultimately, the Ourhome nurtured by Honorary Chairman Koo is increasingly likely to be incorporated into the Hanwha Group.

Legal Battle with Former Vice Chairman Koo Ji-eun Remains a Variable

There is a variable. Former Vice Chairman Koo Ji-eun is reportedly preparing legal action by asserting a preemptive purchase right under the articles of incorporation during the acquisition process. Ourhome’s articles specify that “if a shareholder sells shares, other shareholders have the right to purchase them first under the same conditions.” The preemptive purchase right grants shareholders the opportunity to exercise priority purchase rights when another shareholder sells company shares. If former Vice Chairman Koo Ji-eun or Koo Myung-jin exercises this right, they gain the right to purchase shares from former Vice Chairman Koo Bon-sung and Chairman Koo Mi-hyun before Hanwha. This would enable former Vice Chairman Koo Ji-eun, together with financial investors (FIs), to acquire their shares and block the company sale. Former Vice Chairman Koo Ji-eun already holds 40.27% of shares. Securing just an additional 9.74% would give her a majority stake. The key factor is her financial capacity to fund the acquisition.

However, Hanwha claims that the preemptive purchase right has expired. Hanwha previously sent a certified letter to former Vice Chairman Koo asking whether she intended to exercise the preemptive purchase right and her willingness to sell shares, but received no response. Hanwha argues that since no reply was received within a month, the right to exercise the preemptive purchase right has lapsed. On the other hand, former Vice Chairman Koo’s side contends that they were never formally offered the opportunity to exercise the right and that proper procedures have not begun. If the dispute prolongs, it could affect Hanwha’s acquisition schedule, making the court’s future ruling a critical factor.

Will the Domestic Group Catering Market Landscape Change?

The domestic group catering market is approximately 6 trillion KRW in size, with the top five companies occupying more than 70% of the market. Samsung Welstory, Ourhome, Hyundai Green Food, CJ Freshway, and Shinsegae Food lead the industry, and attention is focused on how Hanwha’s acquisition of Ourhome will impact the market landscape. According to the Fair Trade Commission, as of 2021, Samsung Welstory held the largest market share at 28.5%, followed by Ourhome (17.9%), Hyundai Green Food (14.7%), CJ Freshway (10.9%), and Shinsegae Food (7%).

Hanwha views the successful acquisition of Ourhome as an opportunity to expand into food tech and the broader food distribution industry. A Hanwha official explained, “By targeting the growing food industry sectors such as group catering and food material distribution, we aim to establish new growth engines while providing higher-quality food and beverage services.” As of June last year, Ourhome operates in over 800 business sites nationwide and has expanded overseas to five countries: the United States, China, Poland, Vietnam, and Mexico. Additionally, it is engaged in various food businesses such as home meal replacements (HMR) and premium kimchi.

However, if Hanwha acquires Ourhome, there is a possibility that the volume of catering and food material supply to LG, GS, LS, and other affiliates of the broader LG group?Ourhome’s main clients?may decrease. An industry insider noted, “Unlike competitors, Ourhome has a high proportion of orders from LG Group affiliates. If Ourhome is incorporated under Hanwha Group, it could negatively impact catering contracts with LG-related companies.” Currently, about 40% of Ourhome’s sales are generated from LG affiliates. Ourhome’s captive volume includes approximately 110 sites: around 80 LG sites, 5 LX sites, about 20 LS sites, and around 10 GS sites. Although there are differences in individual site sizes and meal counts, these collectively account for about 40%. In fact, last month, CJ Freshway won the bid for the LG Science Park DP2 outsourced catering site. At the end of last year, Pulmuone and CJ Freshway were selected as outsourced catering operators for LG Display’s Paju and Gumi sites, respectively, where Ourhome had previously operated the cafeterias.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.