Targeting Niche Markets Amid Dominance of Large Corporations

Emphasizing Transparency of Information and Price Competitiveness

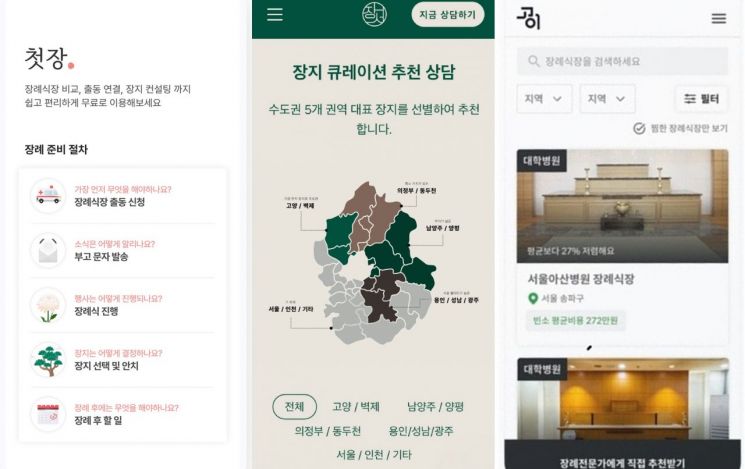

New Platforms Like Cheotjang and Jangseo Seek to Establish Themselves

A new wave is blowing through the 10 trillion won domestic funeral service market led by large companies, starting from online platforms. These online funeral platforms are challenging the 'giants' in the market with a strategy that broadens consumer choices by emphasizing transparency of information and price competitiveness.

According to the Fair Trade Commission's '2024 Disclosure of Key Information on Prepaid Installment Transaction Companies' on the 14th, the number of subscribers to prepaid installment transaction companies is 8.92 million, with advance payments totaling 9.4486 trillion won. Of the total advance payments, 86.9% are concentrated in 14 large funeral service companies such as FreedLife and Boram Sangjo, giving these companies dominance in the funeral service market.

Within this solid market structure, online funeral platforms are carving out niches. Consumers who have not subscribed to funeral service products have to physically visit to obtain information about funeral halls and other services. Targeting this, various online platforms focus on helping consumers compare information at a glance and make rational decisions.

'Cheotjang,' started as an in-house venture of Kyowon Group, officially launched its service in October 2023. This platform offers features to compare facilities, locations, and prices of over 1,000 funeral halls nationwide, more than 100 columbariums, and burial sites including tree burials. The company explained that it has enhanced the convenience of funeral procedures through various additional services such as 24-hour funeral hall dispatch requests, obituary text message sending, and online memorial halls.

'Jangseo,' launched last month, promotes itself as a 'one-stop funeral preparation solution.' It allows consumers to complete all procedures from funeral services to burial site services in one place. Jang Woo-n, CEO of Jangseo, said, "Our goal is to reduce the information gap in the funeral market and improve unnecessary cost structures."

There is also 'Goi' from Goi Funeral Research Institute. Goi introduced a funeral service product with a monthly payment of 100 won. Consumers pay only 100 won monthly, and the costs for vehicles, personnel, and supplies needed for the funeral are settled after the funeral is completed.

Regarding these changes, Jang Won-bong, CEO of Cheotjang Company, explained, "Korea's funeral culture is in a transitional phase from the first generation centered on family and relatives, through the second generation using funeral service companies, to the third generation centered on online platforms."

An industry insider said, "Online funeral platforms are increasing transparency of prices and services and the soundness of the market by disclosing previously hidden market information," adding, "These movements will also contribute to forming a new market."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)