Citi Report

"Base rate cuts of 0.25%p expected in February, May, August, and November"

Exchange rate projected between 1,344-1,348 won at the low end

and 1,451-1,457 won at the high end

"Cumulative impact of National Pension Service currency hedging"

The Bank of Korea's economic growth forecast for South Korea this year may be lowered to 1.5%, according to an analysis. The won-dollar exchange rate is expected to fall to 1,430 won within a year, and the National Pension Service's currency hedging is also anticipated to have a significant impact.

On the 14th, according to the financial sector, Jinwook Kim, a Citi economist, stated this in his report titled "Frequently Asked Questions about Won Weakness." He shared his views on the outlook for the won-dollar exchange rate, the impact of the Trump administration's America First policy on the won, and predictions for the Bank of Korea's base interest rate cuts.

Below is a Q&A summary of the contents revealed by Economist Kim in the report.

Q. How will the Bank of Korea's monetary policy respond amid the conflicting relationship between sluggish economic growth and foreign exchange volatility?

A. In the short term, unless the won-dollar exchange rate surges above 1,500 won, the Bank of Korea is likely to decide to cut the base interest rate by 0.25 percentage points to 2.75% at the Monetary Policy Committee meeting on the 25th. This year, the Bank of Korea is expected to lower interest rates by 0.25 percentage points in May, August, and November. However, if the won-dollar exchange rate fluctuates significantly, the timing of the Bank of Korea's policy rate cuts may be somewhat delayed. The Bank of Korea is predicted to prioritize stabilizing economic growth over external imbalance risks amid stable inflation. The economic growth rate for this year may be lowered to 1.5?1.6%, which is 0.1 percentage points lower than the 1.6?1.7% forecast announced last month. Despite South Korea's political uncertainties, the Bank of Korea's rate cuts, the National Pension Service's currency hedging, and the Ministry of Economy and Finance's supplementary budget (Chugyeong) are expected to support stable and effective economic policies.

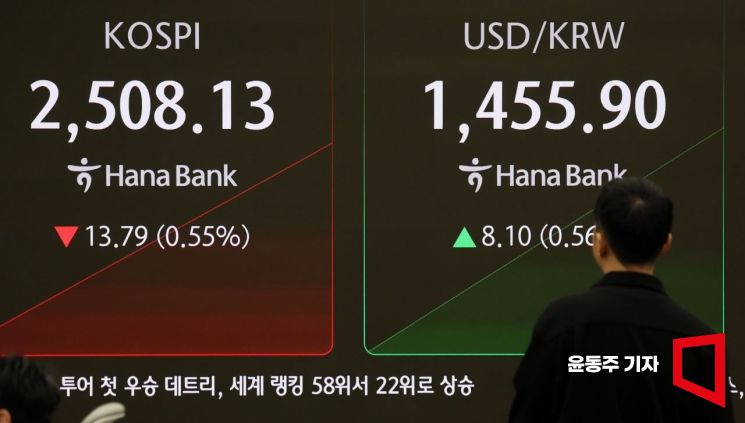

On the 10th, as the KOSPI started the session on a downward trend amid concerns over a US-triggered 'tariff war,' stock indices and exchange rates were displayed on the status board in the dealing room of Hana Bank in Jung-gu, Seoul. 2025.02.10 Photo by Yoon Dong-ju

On the 10th, as the KOSPI started the session on a downward trend amid concerns over a US-triggered 'tariff war,' stock indices and exchange rates were displayed on the status board in the dealing room of Hana Bank in Jung-gu, Seoul. 2025.02.10 Photo by Yoon Dong-ju

Q. What is your outlook for the won-dollar exchange rate going forward?

A. The won-dollar exchange rate is expected to remain in the 1,470 won range for three months and then likely fall to the 1,430 won range within 6 to 12 months. The exchange rate will be influenced by the strength of the dollar, the potential weakness of the Chinese yuan, the hawkish stance of the U.S. Federal Reserve (Fed), and U.S. tariffs and trade sanctions. As the Constitutional Court's impeachment trial proceeds, domestic political uncertainties are expected to gradually ease. In the medium term, the exchange rate is expected to form a range between 1,344?1,348 won on the downside and 1,451?1,457 won on the upside, aided by the cumulative impact of the National Pension Service's strategic currency hedging.

Q. How will the Trump administration's 'America First trade policy' affect the won?

A. It may put pressure on the won in the short term. The U.S. tariff policy is expected to weaken the won in three ways: short-term risk aversion will increase, export growth will decline in the medium term, and the demand for dollars by South Korean companies will rise as they build supply chains within the U.S.

Q. Despite U.S. tariff policies, will South Korea's current account surplus remain robust?

A. South Korea's current account surplus is expected to be about 5.5% of annual gross domestic product (GDP) this year. Last year, it was 5.3% of GDP, and the average from 2010 to 2023 was 3.9% of GDP. However, quarterly growth rates are expected to slow to 9% in the first half of last year, 7% in the second half, and -1.1% in the first half of this year. U.S. tariffs and semiconductor trade restrictions will have negative effects, as will the gradual adjustment of semiconductor export growth rates and Brent crude oil price stabilization.

Q. Will domestic investors' high demand for U.S. assets continue?

A. It is expected to continue despite the won's weakness. First, South Korean export companies are likely to convert a low proportion of their dollar earnings into won. These companies will continue to build supply chains in the U.S. and prefer to keep savings in dollars as natural hedging. Institutional investors such as the National Pension Service and individual investors also have strong incentives to invest in U.S. assets like stocks. U.S. stock investments have outperformed Korean stocks, so U.S. investments are preferred in overseas investments, and the interest rate differential between the U.S. and South Korea also provides incentives. Due to market concerns about U.S. tariff policies, foreign investors are also withdrawing from the Korean stock market.

Q. How can the National Pension Service's strategic currency hedging reduce dollar volatility in the medium term?

A. The daily hedging amount is expected to be about $200 million (2.896 billion won) to $300 million over the next 10 months. This hedging will accumulate over time and increasingly influence the exchange rate. However, in principle, from 2025 to 2029, the National Pension Service would not have needed to hedge because long-term risk reduction and return improvement are unlikely. Additionally, hedging is costly and can ultimately worsen the risk-return profile. In the past, the National Pension Service reduced its foreign investment hedging from 100% in 2007 to 0% in 2018.

Q. How will South Korea's foreign exchange authorities maintain the exchange rate around 1,450 won?

A. The authorities' smoothing operations (market interventions for fine adjustments) may be limited by two factors: the cumulative impact of the National Pension Service's strategic currency hedging over time and the risk of U.S. responses through trade negotiations. Last month, South Korea's fine adjustment operations were the largest since April last year but smaller than in October 2022. The Bank of Korea's temporary dollar lending to the National Pension Service through foreign exchange swaps may also be a major factor. South Korea's foreign exchange reserves stood at $411 billion last month, indicating sufficient foreign exchange management capability. The Korea-U.S. Free Trade Agreement (FTA) was revised during the first Trump administration, and future negotiations with the U.S. may continue to pose risks.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.