Direct Hit to Korean Steel Industry Due to Sluggish Demand in China

Government's Decision on 'Anti-Dumping Measures' Expected to Be Influenced

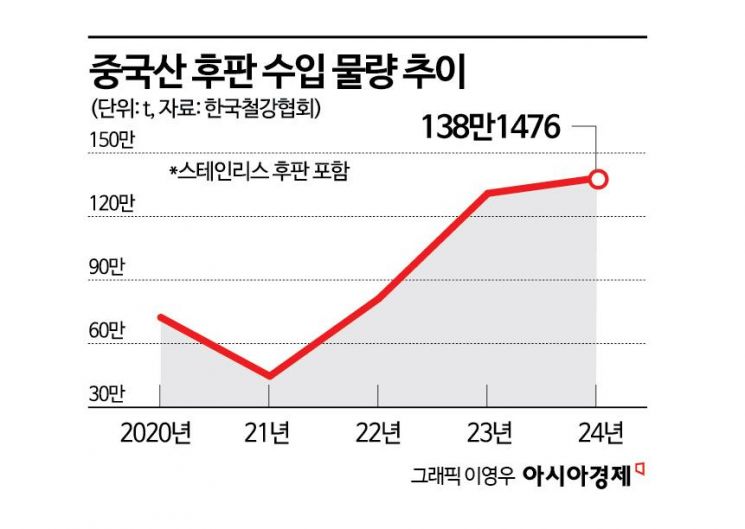

The volume of Chinese hot-rolled steel plates flooding into the domestic market at low prices reached a record high last year. As the Korean government is considering whether to impose anti-dumping duties on Chinese hot-rolled steel plates, the domestic steel industry's demand for 'industry protection' is expected to gain momentum.

According to the Korea Iron & Steel Association on the 13th, the volume of Chinese hot-rolled steel plates imported into Korea in 2024 was recorded at 1.38 million tons (including stainless steel plates). After a significant increase of 60.5% from 810,000 tons in 2022 to 1.3 million tons in 2023, it rose another 6.2% in 2024, reaching the highest volume ever. Hot-rolled steel plates are widely used in shipbuilding and construction industries. Especially in the booming domestic shipbuilding sector, the proportion of Chinese products has increased due to their lower cost. Hot-rolled steel plates account for 20% of the shipbuilding cost.

With last year's record-high imports of Chinese products, it is expected to influence the government's anti-dumping ruling. The Ministry of Trade, Industry and Energy will hold discussions on the 20th regarding whether to impose anti-dumping duties on Chinese hot-rolled steel plates. The domestic steel industry is urging to maintain the bargaining power of local companies for fair trade.

China, facing sluggish domestic construction demand, has been unable to absorb hot-rolled steel plates within its own market and is launching a low-price offensive toward Korea. The domestic steel industry, losing price competitiveness, has faced a crisis caused by oversupply head-on. Both POSCO and Hyundai Steel, the top two domestic steelmakers, saw their operating profits drop sharply by more than 30% compared to the previous year. Unable to withstand profitability deterioration amid the oversupply from China, the steel industry began adjusting production last year and has responded by shutting down factories or reducing operations.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)