The KOSPI rose for the second consecutive day due to net purchases by foreign and institutional investors. The KOSDAQ closed lower as foreign and institutional investors continued net selling.

On the 12th, the KOSPI closed at 2548.39, up 9.34 points (0.37%) compared to the previous day's closing price. The KOSDAQ ended the session at 745.18, down 4.41 points (-0.59%) from the previous day.

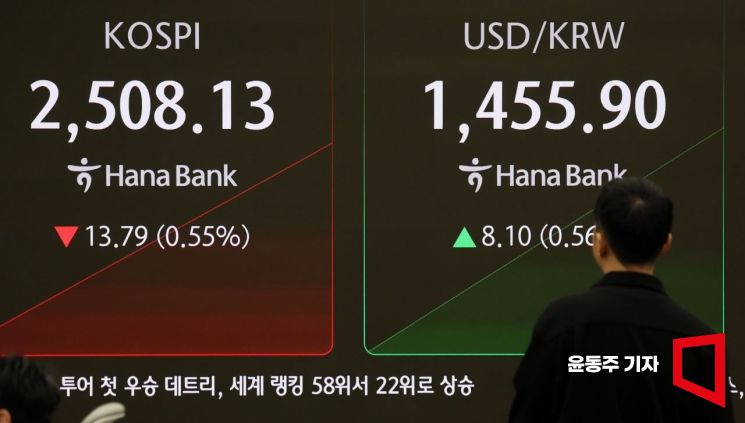

On the 10th, amid concerns over a US-triggered 'tariff war,' the KOSPI opened lower. The stock index and exchange rates are displayed on the status board in the Hana Bank dealing room in Jung-gu, Seoul. 2025.02.10 Photo by Yoon Dong-joo

On the 10th, amid concerns over a US-triggered 'tariff war,' the KOSPI opened lower. The stock index and exchange rates are displayed on the status board in the Hana Bank dealing room in Jung-gu, Seoul. 2025.02.10 Photo by Yoon Dong-joo

In the KOSPI, individual investors net sold 197.3 billion KRW, but foreign and institutional investors net bought 98.4 billion KRW and 51.9 billion KRW respectively, driving the index higher.

By sector, shipbuilding stocks showed strength following the introduction of a bill in the U.S. Senate allowing allied countries to build naval vessels.

HD Hyundai Heavy Industries surged 15.36% from the previous day, while STX Engine (11.96%) and HD Korea Shipbuilding & Offshore Engineering (5.64%) also closed higher together.

In particular, Hanwha Ocean (15.17%) and Hanwha Systems (29.64%) soared, hitting new 52-week highs during the session, amid expectations that the performance of the U.S. shipyard Filio Shipyard, acquired by Hanwha Group, will be fully reflected starting this year.

Na Jung-hwan, a researcher at NH Investment & Securities, said, "Industries that can benefit from aligning with the policy direction of U.S. President Donald Trump include shipbuilding, defense, and healthcare. Especially, since the Trump administration is regulating China's shipbuilding industry and aiming to utilize allied countries' shipbuilding industries, Korean shipbuilding companies can benefit."

In the KOSDAQ market, individual investors net bought 223 billion KRW, while foreign and institutional investors net sold 152.6 billion KRW and 55.7 billion KRW respectively.

Among the top 10 market capitalization stocks, except for Ecopro (0.00%), HLB (0.40%), Lino Industrial (1.10%), Classys (1.19%), and Hugel (1.36%) rose. Meanwhile, Alteogen (-0.13%), Rainbow Robotics (-6.52%), Ligand Chem Bio (-1.69%), and Samchundang Pharmaceutical (-1.37%) declined.

In the KOSDAQ market, venture capital firms rose significantly. News emerged that Meta Platforms, the parent company of Facebook in the U.S., is discussing the acquisition of Korea's AI chip design startup Puriosa AI, improving investment sentiment mainly among companies that participated in early-stage investments.

DSC Investment (29.97%) and TS Investment (29.95%), reported to be early investors, closed at their daily limit.

The won-dollar exchange rate stood at 1453.4 won, up 0.8 won from the previous session as of 3:30 p.m. in the Seoul foreign exchange market.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)