Baemin's Own Delivery Share Gradually Increasing

Stable Rider Recruitment Needed as Own Delivery Grows

CEO Kim Beomseok's Strategy Focuses on 'Customer Experience'

Baedal Minjok is focusing on securing riders this year. The use of 'store delivery,' where merchants use delivery agencies, is gradually decreasing, while the proportion of services where Baemin provides both order mediation and delivery is increasing. With the decision to discontinue the store delivery product 'Ultracall' this year, the role of Baemin's own delivery in its business model is expected to grow even larger. Securing riders who can reliably provide delivery services is essential. So far, Baemin lags behind Coupang Eats, which only operates its own delivery, in rider acquisition. Accordingly, Baemin plans to sequentially introduce various systems this year to increase rider earnings and provide benefits.

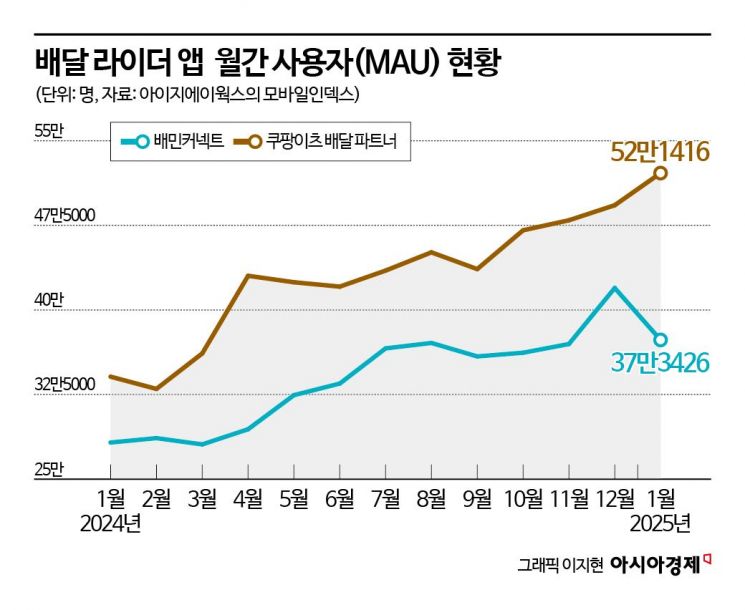

According to Mobile Index by data company IGAWorks on the 13th, the number of users (MAU) of Baemin and Coupang Eats rider applications, 'Baemin Connect' and 'Coupang Eats Delivery Partner,' recorded 373,000 and 521,000 respectively last month. The reason why Baemin, the market leader, has fewer riders performing deliveries is that about 60-70% of Baemin's orders are still store deliveries. However, as consumers increasingly prefer platform-owned delivery, this proportion is gradually decreasing. The 32.2% increase, about 90,000 users, in Baemin Connect users compared to a year ago is evidence of this growing demand for Baemin's own delivery.

Recently, Baemin's decision to discontinue the advertising product Ultracall, which was only for store delivery merchants, is expected to accelerate this trend. Going forward, Baemin's store delivery product will only include the 6.8% flat-rate 'Open List.' The win-win fee plan that Baemin will apply from the 26th allows merchants in the top 35% of sales to pay a 7.8% commission, while others pay 6.8% or less. This dilutes the merchants' incentive to maintain store delivery from a cost perspective.

The series of changes leading to the expansion of own delivery and the consequent need to secure riders is linked to the 'customer experience' emphasized by Kim Beom-seok, the newly appointed CEO of Woowa Brothers. An industry insider explained, "If the platform only mediates orders and leaves delivery to merchants, it cannot guarantee the delivery quality ultimately provided to customers," adding, "Recent management difficulties of some delivery agencies can also affect customer experience." The current market situation, where Coupang Eats is rapidly catching up by attracting 10 million users with its own delivery, is also analyzed to have influenced Baemin's service restructuring.

Baemin's recent announcement and upcoming implementation of the 'Delivery Fee System Integration Reform,' aimed at stable income expansion for riders, is an extension of this strategy. According to the reform plan, which will be applied sequentially from the 1st of next month, the minimum delivery fee will increase by 10% compared to before, and long-distance surcharges will be strengthened to increase earnings as travel distance grows. Settlement will also change from weekly to daily. In addition, Baemin plans to disclose various benefits for riders every month. A Baemin official said, "We will further strengthen rider partnership services consisting of about 20 categories including transportation, maintenance, fuel, finance, insurance, telecommunications, medical care, and travel, and make various efforts to improve the delivery environment through safety campaigns and support projects."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)