More Proactive Efforts Needed in Trusts, Pensions, and Overseas Market Development

With the rapid progression of population aging, banks facing increasingly deteriorating profitability are being urged to take a more proactive approach in discovering new sources of revenue. There is a warning that if they do not attempt to shift their current revenue structure, which relies on loan interest, to new businesses such as trusts or overseas market expansion, they may become obsolete.

According to the report "Bank Responses to Population Changes" by the Korea Institute of Finance on the 13th, South Korea is expected to enter a super-aged society this year, with the population aged 65 and over exceeding 20% of the total population.

Population changes are highly likely to have a negative impact on the banking industry. Due to aging and population decline, economic agents are expected to reduce their demand for funds, leading to a decrease not only in bank loan demand but also in demand for stocks and corporate bonds. The younger the population proportion, the more likely debt exceeds assets, including mortgage loans, but as the elderly population increases, assets exceed debt, reducing loan demand. This decline in loan demand is analyzed to negatively affect banks' profitability.

Furthermore, in societies with a high proportion of elderly people, stagnation and slowdown in the domestic market occur, which act as factors suppressing new corporate investments. Consequently, incentives for corporate debt utilization also decrease. The report emphasizes that as aging progresses, with decreasing loan demand from both households and corporations, banks are likely to face a situation where assets shrink more than liabilities.

If the proportion of elderly people with low saving capacity continues to increase within the total population, new savings inflows into the financial sector will decrease, potentially increasing the volatility of banks' funding. As the proportion of groups without regular income rises and new fund supply decreases, competition among financial companies to attract funds will intensify, leading to higher volatility in banks' funding.

More Proactive Efforts Needed in Trusts, Pensions, and Overseas Market Development

The report argues that banks should take a more proactive approach in discovering new revenue sources such as trusts, pensions, and personal asset management to prepare for the decline in interest income caused by reduced loan demand. Among these, special attention should be given to trusts.

Seojeongho, Senior Research Fellow at the Korea Institute of Finance and author of the report, explained, "The existence of a reliable third party (trustee) like in trusts, around whom various financial designs can be centered, is a very useful tool in an era of low birth rates and aging." He added, "In Japan, which experienced aging earlier than us, the trust industry has shown high growth over the past decade, centered on testamentary trusts and education fund gift trusts."

Senior Research Fellow Seo suggested, "Currently, trusts are strongly perceived as customized services for high-net-worth individuals, but banks need to broaden their customer base. They can provide customized services for high-net-worth clients and offer standardized services to the middle class and general customers."

The report also emphasized the need for more active efforts in developing new markets such as overseas expansion. It mentioned that banks should increase their business share in countries with a low proportion of elderly populations, such as Indonesia and Vietnam, to diversify the aging risk of their overall portfolio. Seo noted, "The three major Japanese bank holding companies have expanded their presence in Southeast Asia, where the youth population is high, such as Indonesia and Vietnam, and by the end of 2023, the overseas segment accounted for nearly 40% of their total loans. In contrast, Korean financial companies have been relatively sluggish in developing new markets."

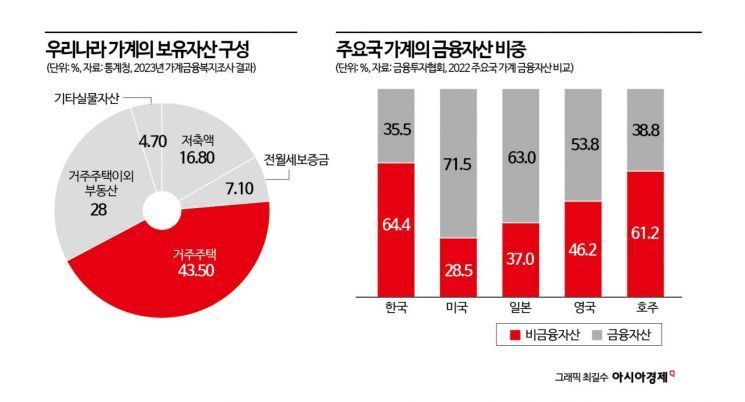

It also stressed the need to actively respond to market demand from the elderly to monetize real estate. Banks should prepare for demand to monetize real estate, which accounts for more than 70% of household assets, by enhancing competitiveness in reverse mortgage loans (home equity pension loans). In particular, it advised gradually reducing exposure to real estate risk, as real estate prices are likely to face downward pressure due to population changes.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)