Hana Tour Achieves Record Operating Profit of 50.9 Billion KRW Last Year

Norangpungseon Posts Deficit Due to Pre-purchased Airline Ticket Costs

Travel Industry Conditions Expected to Continue Improving This Year Thanks to China's Visa-Free Policy and More

Last year, the domestic travel industry continued to improve its business conditions, expanding its sales scale to pre-COVID-19 pandemic levels. However, profitability showed mixed results. Hana Tour recorded its highest performance thanks to strong sales of high-priced package products in Europe and other regions, while other companies saw profitability decline one after another. In particular, Norangpungseon turned to a deficit due to a failure in forecasting travel demand.

Despite the ongoing domestic consumption slump caused by the economic recession, the travel industry's business conditions are expected to continue improving this year due to the implementation of China's visa-free policy and two golden holidays.

Hana Tour Achieves Record Operating Profit Driven by Growth in Mid-to-High Priced Packages

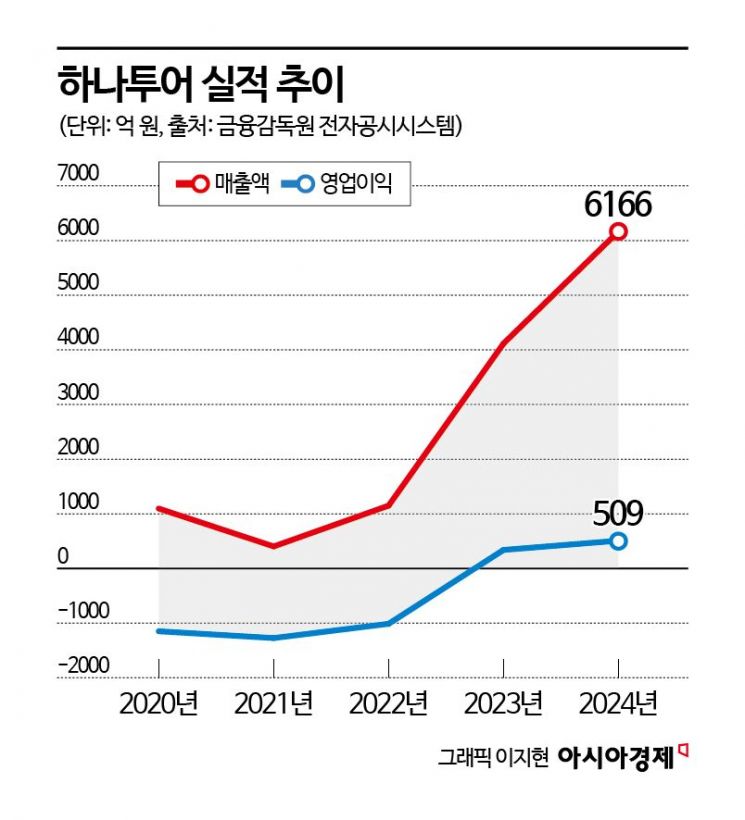

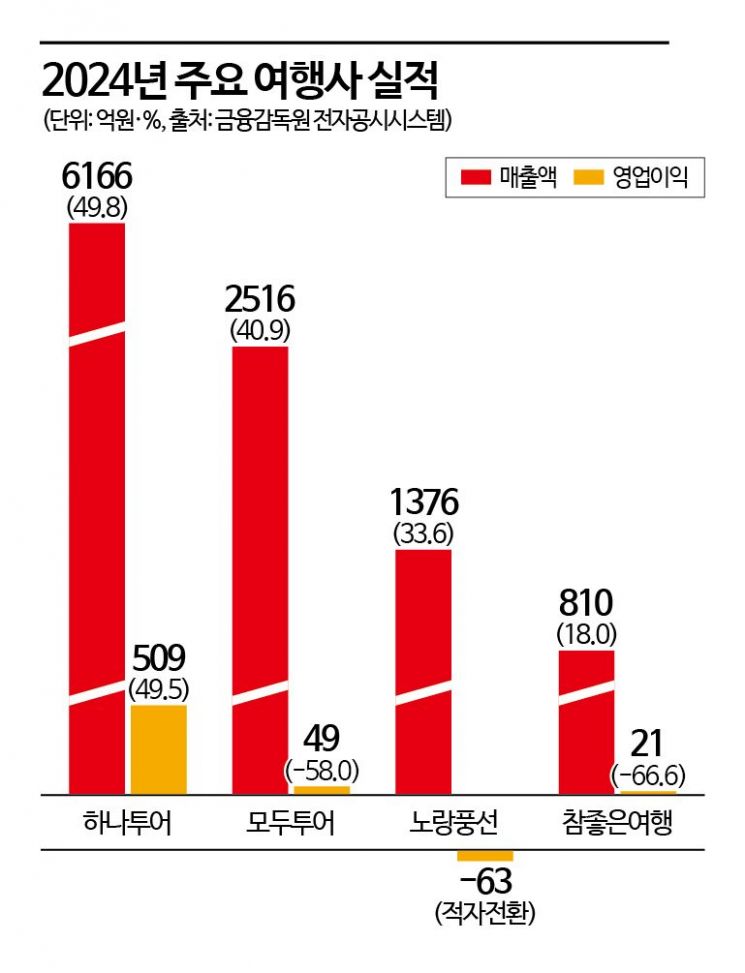

According to the Financial Supervisory Service's electronic disclosure system on the 14th, Hana Tour's consolidated sales last year were 616.6 billion KRW, a 49.8% increase from 411.6 billion KRW the previous year. Operating profit rose 49.5% to 50.9 billion KRW from 34 billion KRW, and net profit also increased by 69.1% to 99.9 billion KRW.

Despite generally unfavorable economic conditions last year, the travel industry's atmosphere showed signs of improvement. As the business environment recovered, Hana Tour saw an increase in the total number of outbound customers, regaining sales above 600 billion KRW for the first time since the COVID-19 pandemic. The company explained that the expansion of the sales proportion of the mid-to-high priced package 'Hana Tour 2.0' led to an increase in the average selling price. The customer share of mid-to-high priced packages, which was around 8% in 2019, rose to 41% by the fourth quarter of last year, confirming stable market demand for these packages. During the same period, the share of mid-to-high priced packages in entrusted funds (GMV) also increased from 14% to 46%.

Mid-to-high priced packages were mainly sold for medium- to long-distance destinations such as Europe and the Americas, where the average selling price is higher, rather than short-distance destinations like Southeast Asia, Japan, or China. This is attributed to the increasing demand for properly enjoying trips that require more time, even if it means paying somewhat higher costs. In fact, last year, the proportion of mid-to-high priced packages for short-distance destinations was 28% based on the number of customers, while it was 39% for medium- to long-distance destinations, more than 10 percentage points higher.

Along with increased sales, operating profit exceeded 50 billion KRW, setting a new record, largely due to a decrease in commission fees resulting from a higher proportion of online sales. Hana Tour's online sales proportion has significantly increased since the pandemic. In 2019, before COVID-19, 19% of all customers purchased packages online, but this proportion rose to 43% last year. The steady growth in users of Hana Tour's mobile application and total online membership also contributed to the expansion of online sales. As of the end of last year, Hana Tour's online membership reached 8.35 million, a 15% increase compared to the previous year.

Additionally, improvements in productivity through internal IT system enhancements and cost efficiency in subsidiaries also helped increase operating profit. Net profit also set a new record by increasing nearly 70%, influenced by a reduced corporate tax rate due to accumulated losses during the pandemic and the conclusion of litigation related to SM Duty Free, which reflected gains and losses from discontinued operations.

Profitability Declines Across the Board... Norangpungseon Turns to Deficit

However, other companies did not share the same success. Although the travel industry's business conditions improved and sales expanded, profitability was not secured. Norangpungseon's sales last year increased by 33.6% to 131.8 billion KRW, but it recorded an operating loss of 6.3 billion KRW, turning to a deficit. The increase in direct sales of charter flights and other airline tickets last year led to a rise in recognized airline ticket sales revenue, which had the greatest impact on poor performance. Additionally, one-time costs such as bad debt write-offs increased, causing selling and administrative expenses to rise compared to the previous year.

Norangpungseon anticipated the travel market to recover to pre-pandemic levels last year and secured charter flights and hard-block airline tickets (bulk-purchased tickets in advance) targeting the peak season. However, following adverse events such as the Tmon and Wemakeprice (WMP) incidents, along with economic recession and political uncertainties, product sales did not meet expectations. As a result, the company strengthened marketing to use up the pre-purchased airline tickets, boosting sales but making it difficult to maintain profitability.

Modetour also continued its sales recovery amid overall business improvement but saw a decline in operating profit. Modetour's sales last year were 251.6 billion KRW, a 40.9% increase from the previous year, but operating profit fell 47.0% to 6.1 billion KRW. Chamjoeun Travel recorded sales of 81 billion KRW, an 18.0% increase from the previous year, but operating profit dropped 66.6% to 2.1 billion KRW. Although sales increased due to a rise in overseas travelers and product sales, one-time costs such as selling and administrative expenses related to the Tmon and Wemakeprice (TMEP) refund incidents caused a significant decrease in operating profit.

Boom Amid Recession... Rising Expectations Due to China's Visa-Free Policy and More

Last year, the travel industry faced several negative events such as the TMEP refund incident, emergency martial law, and aircraft accidents. However, since most of these issues were external rather than internal company problems, the majority of the industry is expected to achieve improved results compared to last year. Above all, despite worsening consumer sentiment, demand and consumption for travel have remained exceptionally strong.

According to Incheon International Airport Corporation, during the special transportation period for the Lunar New Year holiday (January 24 to February 2), a total of 2,189,778 passengers used Incheon International Airport. This averages 218,978 passengers per day, the highest number recorded during the Lunar New Year holiday since the airport's opening. This figure is 8-15% higher than the daily averages of about 202,000 in the 2019 Lunar New Year holiday before COVID-19 and about 189,000 last year.

Starting in March, when the weather warms up, the visa exemption effect for Koreans visiting China is expected to take full effect. The industry plans to maximize the visa-free effect by expanding golf packages and launching new city routes. Additionally, there are two golden holidays this year in May and October, with the fourth quarter, which includes a 10-day holiday, expected to achieve record quarterly profits. Furthermore, the completion of the fourth phase expansion of Incheon International Airport at the end of last year and the increase in Korean routes by global low-cost carriers (LCCs) are also encouraging factors.

Na Seung-du, a researcher at SK Securities, said, "Despite somewhat negative economic conditions last year, the travel sector showed slight growth. The consumption propensity of consumers in the third income quintile and above is expanding again, and growth in online consumption, especially in service sectors like travel, is noticeable." He added, "Retail sales and consumer sentiment indices, which influence travel-related consumption, are expected to rebound starting last year, making the environment surrounding the travel industry positive this year."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.