Construction Market Slowdown in Q4 Last Year

Hyundai Livart Yields Top Spot to Hanssem

Accelerating Expansion in the B2C Sector

The furniture industry's 'Big 2,' Hanssem and Hyundai Livart, are expected to compete fiercely in the B2C (business-to-consumer) sector this year.

Last year, Hyundai Livart briefly surpassed Hanssem due to strong B2B (business-to-business) performance in built-in furniture, but its results sharply declined in the fourth quarter due to a slowdown in the construction market, allowing Hanssem to catch up on an annual basis. This industry environment is expected to continue this year as well.

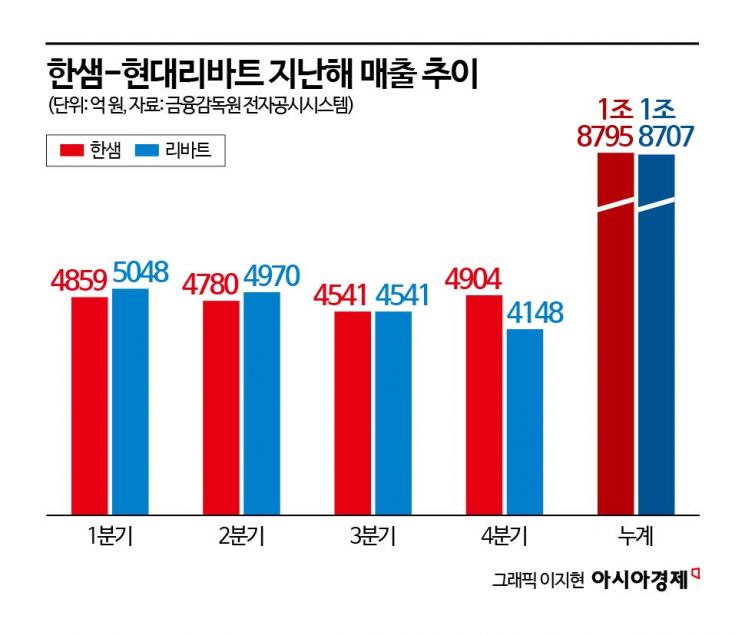

According to the Financial Supervisory Service's electronic disclosure system on the 12th, last year's annual sales for Hanssem and Hyundai Livart were recorded at 1.8795 trillion KRW and 1.8707 trillion KRW, respectively. Hyundai Livart surpassed Hanssem based on cumulative sales through the third quarter, but in the fourth quarter, sales reversed with Hanssem at 490.4 billion KRW and Hyundai Livart at 414.8 billion KRW, ultimately allowing Hanssem to maintain the top position.

Hyundai Livart's built-in furniture sales surged 86% year-on-year last year, supported by a temporary rebound in housing transactions. With 75.6% of the company's sales coming from B2B, it held a favorable position until the third quarter when special sales demand from construction companies was strong. However, in the fourth quarter, disruptions in built-in supply led to a decrease in sales.

A Hyundai Livart representative explained, "Sales slightly decreased due to delays in the built-in supply schedule caused by delays in preceding processes."

On the other hand, Hanssem, which focuses on B2C, recovered profitability as sales of key product lines such as kitchens, storage, and hotel beds turned upward. Since more than half of Hanssem's sales come from B2C, it is analyzed to have been relatively less affected by the construction market.

This trend is expected to continue for the time being. Lowering dependence on B2B will be a key factor. According to the Ministry of Land, Infrastructure and Transport, the nationwide housing completion volume last year was 450,000 units. This year, it is expected to decrease by about 20% to 360,000 units.

From Hyundai Livart's perspective, concerns over growth slowdown are inevitable. Accordingly, Hyundai Livart has decided to accelerate the expansion of its B2C sector, which has entered a sales growth phase. Examples include expanding the excellent dealership 'Jipterior' to increase customer touchpoints and expanding the premium line as part of a brand premiumization strategy.

Hanssem also plans to focus on its strength in the B2C sector to widen the gap with Hyundai Livart by enhancing products and services to boost brand competitiveness. The Rehouse division also plans to increase customer visits through marketing focused on core commercial areas with high demand.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.