Three-Stage Evaluation: Quantitative, Qualitative, and Comprehensive Assessments

Disqualification for Companies with Low Governance Ratings

The Korea Exchange has disclosed the selection criteria for Value-Up Excellent Companies. It has also established eight incentives for awarded companies, including preferential treatment for exemplary taxpayers and deferral of fines related to non-compliant disclosures.

On the 11th, the Korea Exchange announced that as part of the government's 'Corporate Value-Up Support Plan,' it plans to hold an annual Value-Up Excellent Company award ceremony every May. The selection criteria for this Value-Up Excellent Company were developed through research commissioned by the Korea Capital Market Institute and discussions with the Corporate Value-Up Advisory Group.

To be selected as a Value-Up Excellent Company, a firm must first be listed on the KOSPI or KOSDAQ markets and have disclosed a corporate value enhancement plan covering January to December of the previous year. However, considering that the disclosure of corporate value enhancement plans was implemented starting May of last year, companies that disclosed such plans by March of this year will also be eligible for this year's award. Newly listed stocks, SPACs, and companies deemed unsuitable for Value-Up evaluation or those that have received the Value-Up Excellent Company award within the past three years are excluded from evaluation.

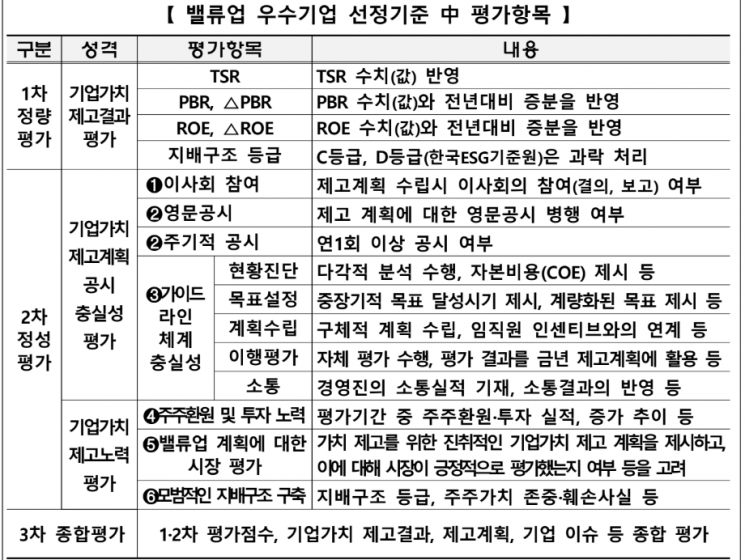

The evaluation is conducted in three stages: quantitative evaluation, qualitative evaluation, and comprehensive evaluation. In the first quantitative evaluation, TSR (Total Shareholder Return), PBR (Price-to-Book Ratio), and ROE (Return on Equity) serve as the assessment criteria. At this stage, companies rated C (weak) or D (very weak) in governance by the Korea ESG Standards Institute are disqualified.

In the second qualitative evaluation, the thoroughness of disclosure is assessed, including whether the board of directors actively participated in establishing the corporate value enhancement plan, along with shareholder returns and investment performance during the evaluation period. To ensure fairness, the evaluation is conducted primarily by numerous external financial investment industry experts, including securities firms, asset management companies, and foreign institutional investors. In the third comprehensive evaluation, the Corporate Value-Up Advisory Group considers social evaluations such as negative corporate issues comprehensively to recommend the final candidate companies. Based on these criteria, 10 Value-Up Excellent Companies will be selected for the first time this coming May.

Companies selected as Value-Up Excellent Companies will enjoy a total of eight incentives. These include preferential treatment when selected as exemplary taxpayers, pre-review of R&D tax credits, corporate tax reductions, and consulting for business succession. Additionally, they are exempt from the Exchange’s annual fees and additional or change listing fees, and can receive deferrals on Exchange actions related to non-compliant disclosures (such as fines and penalties). Furthermore, they are given priority opportunities to participate in joint IR activities hosted by the Exchange, and companies not included in the Korea Value-Up Index that are selected as Value-Up Excellent Companies may receive special inclusion benefits during the next regular index review.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)