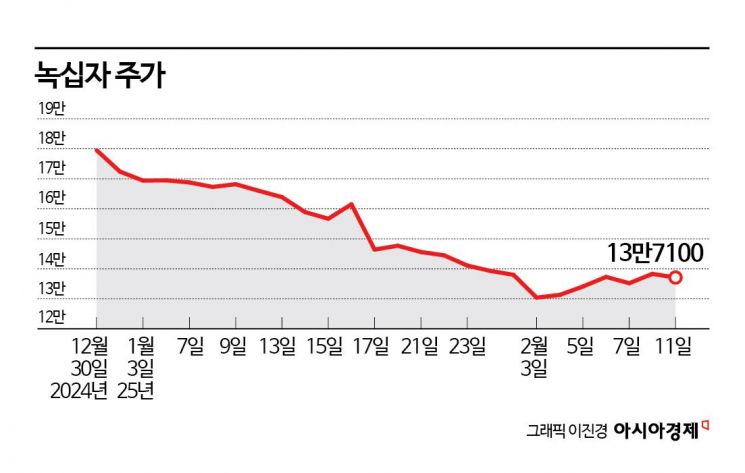

Stock Price Down 24% This Year

Failed to Return to Profit in Q4 Last Year

Investor Sentiment Weakens on Concerns Over U.S. Tariffs on Essential Pharmaceuticals

This year, the stock price of Green Cross Corporation has been rapidly declining. The drop in stock price followed the fourth-quarter earnings last year falling short of market expectations. Additionally, concerns that U.S. President Donald Trump is considering imposing tariffs on pharmaceuticals negatively affected investor sentiment.

According to the financial investment industry on the 12th, Green Cross's stock price has fallen 23.6% so far this year until the previous day. Considering that the KOSPI rose 5.8% during the same period, the relative market return is a poor -29.4 percentage points (P). During this period, domestic institutional investors recorded a cumulative net sale of 39.4 billion KRW.

Green Cross posted consolidated sales of 440.9 billion KRW and an operating loss of 10.1 billion KRW in the fourth quarter of last year. These figures fell short of market expectations of 455.3 billion KRW in sales and 2.3 billion KRW in operating profit. Although abnormal weather conditions led to an increase in flu patients starting from December last year, sales of flu vaccines and treatments were weaker than expected.

Sales of the blood product Aliglo also failed to meet targets. Earlier, Green Cross received FDA approval for Aliglo in December 2023. Aliglo officially entered the U.S. market, the world's largest immunoglobulin market, in August last year. It was expected to achieve sales of 60 billion KRW in the fourth quarter, but due to competitor promotions, sales reached only 48 billion KRW.

Increased selling and administrative expenses at subsidiary GC Cell also negatively impacted Green Cross's consolidated earnings. The loss scale of GC Cell in the fourth quarter of last year increased compared to the previous quarter, failing to achieve the anticipated turnaround to profitability.

As earnings fell short of expectations and stock prices declined, concerns grew over the possibility of the U.S. government imposing tariffs on pharmaceuticals. After signing a proclamation imposing a 25% tariff on imported steel and aluminum products, President Trump stated that tariffs on automobiles, semiconductors, and pharmaceuticals are also under consideration.

Despite the ongoing negative factors making a stock price decline inevitable, there are voices expecting a rebound. Market experts predict that Green Cross's earnings will improve this year. Mi-hwa Seo, a researcher at Mirae Asset Securities, explained, "Green Cross's operating profit estimate for this year is 72.9 billion KRW, a 127% increase compared to last year," adding, "Sales of Aliglo are expected to increase, and subsidiary earnings are also likely to improve."

Hae-soon Kwon, a researcher at Eugene Investment & Securities, also expressed optimism, saying, "With Aliglo's U.S. sales becoming full-scale, the overseas segment will enter a growth phase," and "We expect stock price momentum to arise when the visibility of reaching Aliglo's target sales improves and cost control at subsidiaries is confirmed."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)