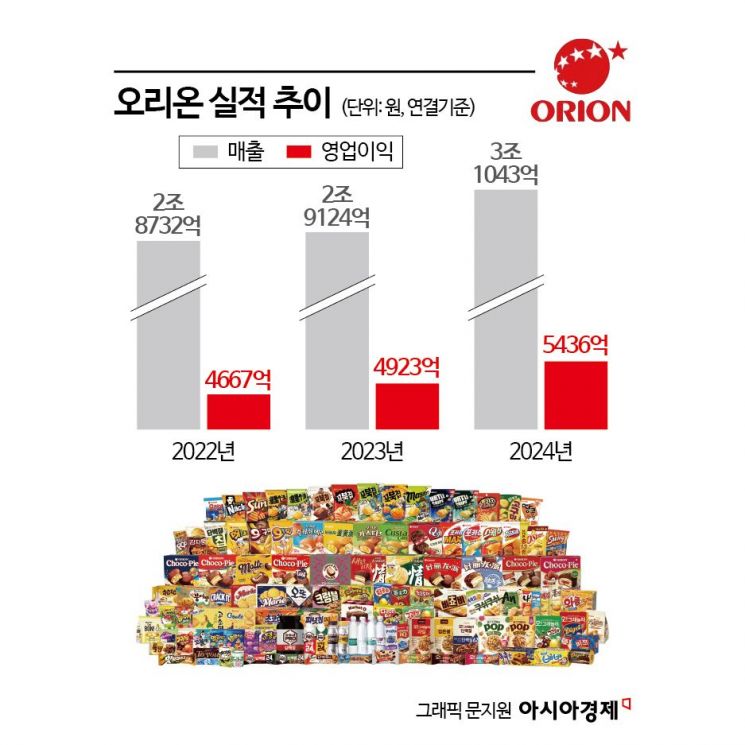

Last Year’s Sales Surpass 3 Trillion KRW and Operating Profit Exceeds 500 Billion KRW

Orion Cites “Strong Overseas Sales”... Operating Profit Margin at Industry High

Orion has achieved its highest-ever performance. Not only did it join the 3 trillion KRW sales club, but it also surpassed 500 billion KRW in operating profit for the first time since its founding in 1956. The operating profit margin reached an impressive 17.5%, maintaining the highest level in the food industry. Orion attributes this to strong overseas business and non-cacao products, but consumers are critical as the company raised product prices at the end of last year citing increased cacao costs and then posted record-breaking results.

On the 11th, Orion announced that its consolidated sales for 2024 reached 3.1043 trillion KRW, with an operating profit of 543.6 billion KRW. These figures represent increases of 6.6% and 10.4%, respectively, compared to the previous year. An Orion official explained, "Despite the prolonged global economic downturn and rising raw material costs such as cacao and sugar, we recorded strong results thanks to the robust performance of overseas subsidiaries in China, Vietnam, and Russia."

Orion also earned significant revenue from its Korean subsidiary. The Korean subsidiary's sales grew by 2.6% year-on-year to 1.0976 trillion KRW, and operating profit increased by 5.7% to 178.5 billion KRW during the same period.

However, some consumers view Orion's record performance with skepticism. This is because Orion decided to raise prices for the first time in two years at the end of last year, citing a sharp decline in profit margins due to soaring raw material costs such as cacao and sugar. From December 1, Orion increased prices on 13 products, including Choco Songyi (20%), Market O Brownie (10%), and Tokping (6.7%). The average price increase of 10.6% exceeded those of competitors Haitai Confectionery (8.59%) and Lotte Wellfood (9.5%).

At the time, Orion's decision reversed CEO Lee Seung-jun's plan to keep prices stable. In March last year, CEO Lee stated, "We will actively participate in the government's price stabilization policy and have no plans to raise prices in 2024." Therefore, the price hike was interpreted as a significant blow to Orion's business activities caused by rising cacao prices. However, criticism has emerged that the justification for the price increase has weakened as Orion achieved record-high performance.

An Orion official explained, "Due to the increase in cacao prices, products containing chocolate are currently operating at a loss," adding, "This strong performance was driven by sales of non-cacao products and improved management efficiency." The official further stated, "The previous price increase decision was made based on market forecasts that cacao and nut prices would continue to rise for several years."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)