Expansion of Value-Up Fund to 500 Billion KRW

Approval for Overseas Listing of Korean Index Derivatives

Reaffirmed Commitment to Removing Zombie Companies and Normalizing IPOs

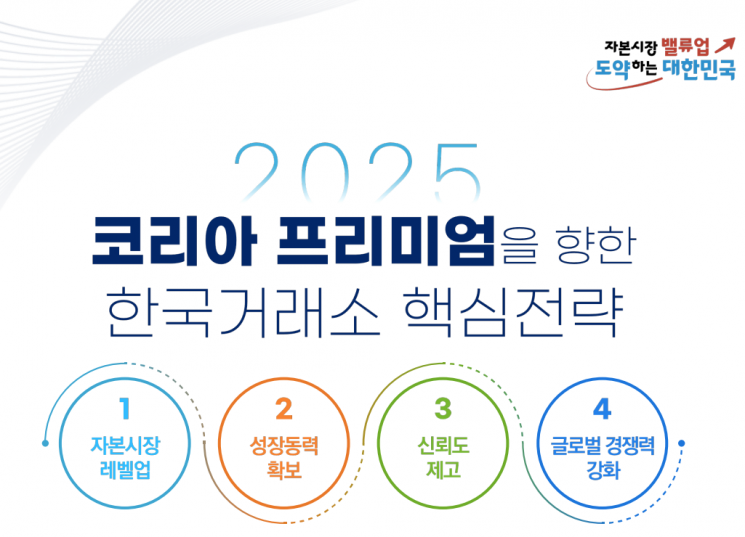

The Korea Exchange announced four core strategies to resolve the 'Korea Discount' and advance toward the 'Korea Premium.'

On the 11th, Jeong Eun-bo, Chairman of the Korea Exchange, held a New Year's press conference at the Korea Exchange in Yeouido, unveiling four core strategies and 12 implementation tasks for the 'Korea Premium': ▲achieving capital market value-up ▲securing future growth engines ▲enhancing investor trust ▲strengthening global competitiveness.

Chairman Jeong first stated that to firmly establish the value-up program, outstanding value-up companies will be selected and awarded every May, and corporate meetings and consulting will be expanded. The scope of value-up consulting will increase to cover a total of 120 listed companies with total assets under 500 billion KRW, and the value-up fund, established with a scale of 500 billion KRW, will also see phased increases in investment.

Measures for inclusion in global advanced indices were also disclosed. Chairman Jeong announced plans to open overseas offices in global financial hubs such as New York and London in the first half of this year to expand marketing efforts for inclusion in the Morgan Stanley Capital International (MSCI) index. In the second half, the index usage rights will be opened to allow Korean bond index derivatives to be listed overseas. The plan also includes introducing night trading (6 p.m. to 6 a.m. the next day) for 10 representative exchange derivatives, including KOSPI 200 futures, to enhance the convenience of derivatives investors.

Chairman Jeong identified the exchange's future growth engine in strengthening index and information business models. The plan is to build a data production, management, and distribution system suitable for the artificial intelligence (AI) era and to advance the index lineup with value-up linked indices, derivative/theme indices, income-type indices, and overseas partnership indices. Additionally, starting from October this year, KOFR-OIS clearing will commence, and the listing of KOSDAQ 150 weekly options and emission allowance futures will be pursued to broaden the range of financial products.

Chairman Jeong reaffirmed the commitment to swiftly remove insolvent and marginal companies and restore the soundness of the initial public offering (IPO) market. More stringent delisting criteria will be introduced regarding market capitalization and sales, and the delisting review stage and improvement period will be shortened to facilitate the rapid market exit of zombie companies. Regarding the IPO market, the scope of mandatory lock-up agreements for institutional investors will be expanded, and the roles and responsibilities of underwriters will be strengthened to eradicate 'short-term trading of public offering stocks.'

Regarding illegal short selling, which is considered a major cause of declining trust in the domestic stock market, Chairman Jeong pledged to establish a system that fundamentally blocks it through the introduction of the Short Selling Central Inspection System (NSDS). Concerning the introduction of Alternative Trading Systems (ATS) scheduled for next month, he promised to build an integrated market management system to create a stable and efficient trading environment.

The strategy to strengthen global competitiveness, inspired by new business ventures of leading overseas exchanges such as Nasdaq in the U.S. and Japan Exchange Group (JPX), was also mentioned. Future overseas offices will serve as bases to expand value-up promotion and institutional investor marketing, and a next-generation listing disclosure system applying international standards (XBRL 2.1) will be established. The plan includes enhancing English disclosure translation by introducing AI translators and MTPE (1st machine translation → 2nd translator proofreading) translation services.

Chairman Jeong expressed his ambition, stating, "In response to this year's challenging capital market environment amid rising domestic and international uncertainties, we will faithfully carry out strategic tasks so that the Korean market can leap forward as a 'premier capital market.'"

Meanwhile, on the occasion of the 20th anniversary of the Korea Exchange's headquarters relocation to Busan, measures to strengthen Busan's status as a financial hub were also revealed. The main points include promoting the establishment of a finance-specialized autonomous private high school to nurture financial talent, supporting the growth of unicorn companies in the Busan region, and continuously expanding Busan-tailored social contribution projects.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.