Tax Investigation of 46 Businesses Including Wedding Preparation Services, Postpartum Care Centers, and English Kindergartens

Tax Evasion Through Sales Omission, Splitting Business Locations, and Inflating Expenses

The National Tax Service (NTS) will conduct tax investigations into studios, dress shops, and makeup (Seudeume) businesses, postpartum care centers, and English kindergartens that deceive consumers with opaque pricing structures such as 'blind contracts' and 'additional fee bombs.'

On the 11th, the NTS announced that it will carry out tax investigations targeting wedding, childbirth, and early childhood education businesses that evade taxes through various methods such as 'sales omission, splitting business locations, and inflating expenses,' while forcing excessive spending on consumers in their 20s and 30s.

The investigation targets a total of 46 businesses: 24 Seudeume (wedding preparation service) companies, 12 postpartum care centers, and 10 English kindergartens, among others.

An NTS official explained the purpose of the investigation, saying, "In the Seudeume market, price exploitation is so rampant that the phrase 'today is the cheapest day' is commonly used. Prospective couples are anxious because they do not know where additional fee estimates will come from even after signing contracts. Meanwhile, business operators in the related industries earn high incomes, acquire expensive assets, and enjoy luxurious lifestyles, yet neglect their tax obligations."

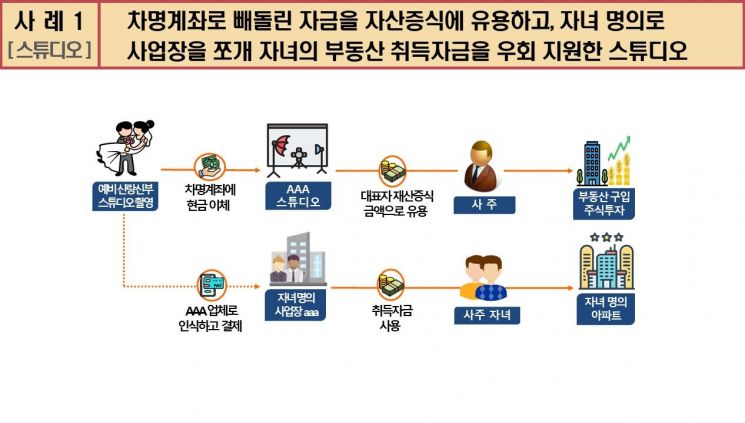

According to the NTS, Seudeume businesses induced customers to transfer additional fees beyond the basic contract details to multiple nominee accounts and omitted income reporting, using the funds to increase their assets. They also established additional businesses under the names of their children or spouses and split sales between the two businesses to evade taxes.

Postpartum care centers, which continuously raise childbirth costs, are also subject to this investigation. Despite being obligated to issue cash receipts, those under investigation offer cash discounts on the condition that consumers do not receive cash receipts. Some falsely report losses through sales omission and inflated expenses, yet acquire high-priced real estate or rent out postpartum care centers in their own buildings at above-market rates, using the proceeds for overseas travel and luxury goods purchases.

Additionally, some English kindergartens received cash payments for materials fees, after-school learning fees, and supplies fees beyond tuition but did not report these. Some of these operators used the embezzled income for their children's overseas education or created fictitious expenses by pretending to purchase materials from sham companies established under family members' names, such as non-existent textbook sales or consulting firms, thereby reducing their tax liabilities.

An NTS official stated, "The NTS plans to conduct thorough and rigorous investigations not only into the subjects themselves but also into the asset formation processes of their families and related parties. We will strictly impose additional taxes for failure to issue cash receipts (20% of the unissued amount) and take stern measures to ensure criminal penalties under the Tax Crime Punishment Act are enforced upon detection of tax fraud or other illegal acts."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)