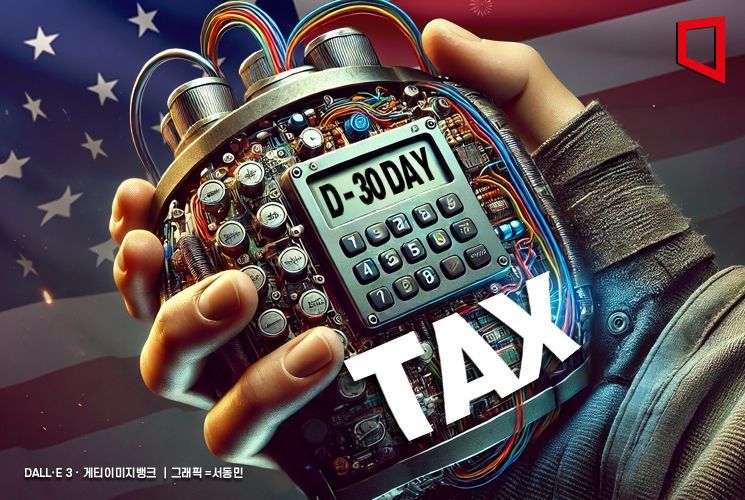

10% Tariff on China, 25% on Canada and Mexico Have Minimal Impact

Turning Point for Export Decline Begins with Universal Tariffs

"Public and Private Sectors Must Jointly Launch Outreach to the US"

Analysis suggests that the potential introduction of a 'universal tariff' in the future will be a turning point for our companies' exports, more so than when the US imposed tariffs on China or Canada and Mexico.

The Korea International Trade Association's International Trade and Commerce Research Institute released a report on the 9th titled "Impact Analysis of Tariff Measures under the Second Trump Administration," which analyzed the effects of various US tariff scenarios on our exports. The scenarios consisted of three stages: ▲10% tariff on China ▲10% tariff on China + 25% tariffs on Canada and Mexico ▲tariffs on China, Canada, and Mexico + 10% universal tariff.

According to the report, under the first-stage scenario of imposing an additional 10% tariff only on China, the impact on Korea's total exports was estimated at $410 million, equivalent to 0.1% of the previous year's total exports. Even when moving to the second stage, where the currently deferred tariffs on Canada and Mexico are imposed, the export decline was smaller than the previous scenario, at 0.03%, approximately $220 million.

Although demand for intermediate goods from the tariff-imposed countries decreases, reducing our exports, the increase in exports to the US market due to the reflected benefits is expected to offset this decline.

However, the report anticipated that under the third-stage scenario, where the US imposes universal tariffs on all countries, the decline in our exports would significantly expand. In this case, exports to the US would decrease by $10.03 billion, exports to Mexico by $1.57 billion, and total exports would fall by 1.9%, or $13.2 billion.

This interpretation suggests that the direct negative impact of universal tariffs will outweigh the export reflected benefits gained from tariffs targeting specific countries.

Nonetheless, even in this case, the decline in Korea's exports to the US is expected to be relatively small compared to other countries. Korea (-7.85%) is projected to have the fourth smallest decrease among the top 30 US import countries over the recent three years (2022?2024), following Chile (-2.26%), Australia (-7.04%), and Japan (-7.32%).

Yang Ji-won, senior researcher at the Korea International Trade Association, assessed that "the impact of the specific-country tariff measures mentioned so far under the second Trump administration on our exports is generally limited." He added, "Since the introduction of universal tariffs could be a turning point for export declines, both the public and private sectors should pool wisdom to proactively expand outreach activities to the US and prepare for the possibility of a prolonged tariff war."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)