Down 9.85% from IPO Price on First Day of Trading

Largest IPO in Three Years Falls Short of Expectations

Low Lock-up Ratio and Secondary Share Sales Weigh on Stock

Early Inclusion in KOSPI 200 and MSCI Indexes Unlikely

LG CNS, regarded as this year's biggest IPO and a source of market optimism, experienced a sharp decline on its first day of trading, marking a 'harsh initiation.' Analysts attribute the drop to factors such as a low proportion of mandatory lock-up agreements weighing on the stock price. Securities firms also predict that early inclusion in major indices like the KOSPI 200 will be challenging.

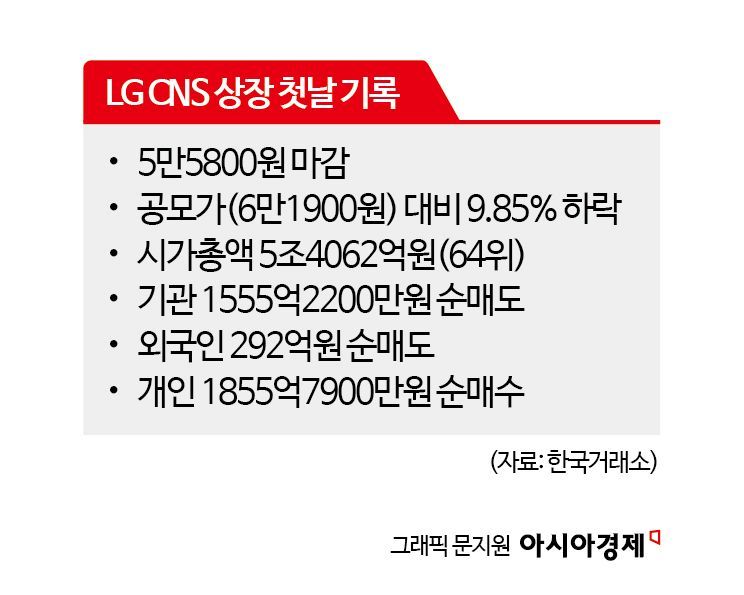

According to the Korea Exchange on the 6th, LG CNS, which was listed on the KOSPI the previous day, closed at 55,800 KRW, down 6,100 KRW (9.85%) from its IPO price of 61,900 KRW. Despite expectations of a 'double'?a twofold increase from the IPO price?the stock's performance on its debut was underwhelming.

LG CNS's IPO size was 1.1994 trillion KRW, the largest since LG Energy Solution's 12 trillion KRW IPO in January 2022. Riding on the anticipation of a major listing, the demand forecast for institutional investors conducted from the 9th to the 15th of last month saw a competition rate of 114 to 1, setting the IPO price at the upper end of the expected range. The subsequent general subscription attracted deposits totaling 21 trillion KRW, marking a successful public offering.

However, the stock price fell by over 10% on the first day, failing to meet expectations. Market participants point to the low proportion of mandatory lock-up agreements as a key factor behind the weak stock performance. Among the 2,059 institutional investors who participated in the demand forecast from the 9th to the 15th of last month, 1,741 institutions, or 85%, did not commit to a lock-up. On the first day of trading, institutions net sold LG CNS shares worth 155.522 billion KRW, making them the largest sellers. Foreign investors also net sold 29.2 billion KRW.

The high volume of secondary share sales also appears to have pressured the stock price. Of the LG CNS IPO shares, 9,688,595 shares?nearly half?were secondary shares held by Crystal Korea Limited, the company's second-largest shareholder. Crystal Korea is an investment vehicle managed by Macquarie PE, a financial investor (FI) in LG CNS. Generally, secondary share sales are viewed negatively in the IPO market because the proceeds do not flow into the company but go to existing shareholders.

Securities analysts also foresee difficulties for LG CNS in gaining early inclusion in major indices. NH Investment & Securities researcher Bae Cheol-gyo explained, "Recently, the Korea Exchange has tightened the requirements for early inclusion of large-cap stocks in the KOSPI 200 index. Previously, if the average market capitalization over 15 trading days after listing ranked within the top 50 in the KOSPI, early inclusion was decided. However, under the revised methodology, the free-float market capitalization must also exceed 50% of the market cap of the 50th-ranked stock." He added, "According to the prospectus, LG CNS's free-float ratio is estimated at 28.5%. Considering that as of the 3rd, Korean Air, ranked 50th in KOSPI market cap, stands at 8.6 trillion KRW, LG CNS's free-float market cap must exceed 4.3 trillion KRW for early inclusion. This corresponds to a total market cap of 15.2 trillion KRW based on common shares, requiring a stock price increase of over 253% from the IPO price to achieve."

Furthermore, with the Korea Exchange revising the KOSPI 200 index's regular rebalancing rules to apply large-cap special inclusion only to stocks that have been listed for more than six months, if LG CNS fails to gain early inclusion, it will be considered for review not in the June regular rebalancing but in the December one.

Early inclusion in the Morgan Stanley Capital International (MSCI) index is also challenging. Researcher Bae stated, "As of the 3rd of this month, to be included early in the MSCI Standard Index, a market cap of about 8.3 trillion KRW and a free-float market cap of 4.2 trillion KRW are required," adding, "Similarly, a significant rise in stock price compared to the IPO price is necessary."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)