14 Remaining Stores to Close in February and March

Rise in Single-Person Households and Prolonged Economic Downturn

Outback and Vips Survive... Thriving After Overcoming Crisis

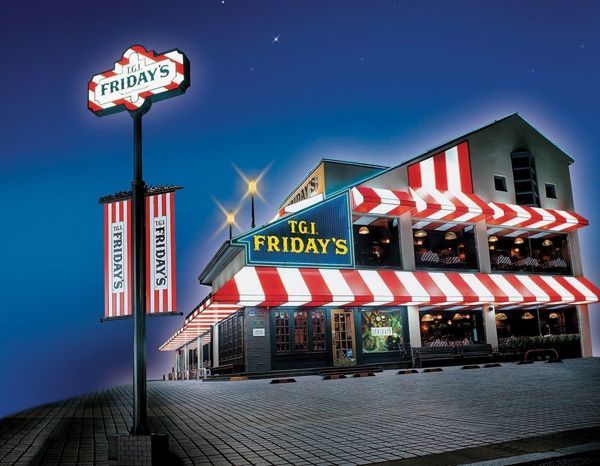

TGI Fridays, the first-generation family restaurant that enjoyed its heyday in the early 2000s, is disappearing into history after more than 30 years since its entry into the domestic market. Due to the increase in single-person households caused by low birth rates, changes in dining-out culture centered around popular restaurants, and prolonged economic recession, it ultimately failed to escape the slump.

Among the first-generation family restaurants, only Outback and Vips have survived. Although they also faced a crisis in the mid-2010s, they are now experiencing a second heyday by raising sales and operating profits through a strategy of selection and concentration.

TGI Fridays Disappears After Over 30 Years... MFG Korea Gives Up Operations

According to the food service industry on the 5th, MFG Korea has decided to soon end operations of the TGI Fridays brand. Stores will close sequentially according to lease contract periods. TGI Fridays currently operates in some branches of Lotte Department Store and Lotte Outlet. Out of 14 stores, 10 will close this month, and the remaining 4 will cease operations next month.

Started in the United States in 1965, TGI Fridays is a first-generation family restaurant brand that opened its first store in Yangjae-dong, Seocho-gu, Seoul in 1992. Along with Bennigan's (1995), Vips (1995), and Outback (1997), it was considered a representative family dining place for special occasions such as Christmas, graduations, and birthdays, enjoying its heyday until the early to mid-2000s. In 2000, the number of stores even surpassed 60.

However, in the mid to late 2000s, due to the impact of low birth rates shifting the population structure toward one- and two-person families and the prolonged economic recession caused by the global financial crisis, family restaurants centered on high-priced menus like TGI Fridays entered a decline. While popularity waned, burdens such as rent and labor costs increased, leading to a domino effect of store closures.

Although Lotte Group, which acquired TGI Fridays from Food Star in 2002, managed operations, MFG Korea purchased the domestic trademark and operating rights in 2021 to attempt a revival. However, the journey of over 33 years has come to an end. MFG Korea plans to focus the dispersed resources from TGI Fridays on rebranding Mad for Garlic. Mad for Garlic has been undergoing a brand revamp since November last year.

Outback and Vips: Premiumization and 'Selection and Concentration'... Second Heyday

With the closure of TGI Fridays, only Outback and Vips remain among the first-generation family restaurants. Restaurants that once thrived, such as Cocos, Sizzler, Marche, and Tony Roma's, closed their businesses long ago in the mid-2000s and disappeared into history. Another pillar of the first-generation family restaurants, Bennigan's, also ended operations in 2016.

Outback and Vips did not continue their success without challenges. They overcame the crisis in the mid-2010s when many family restaurants rapidly declined. In Outback's case, due to worsening management, it decided to focus on qualitative growth rather than expansion, closing 34 stores nationwide sequentially from November 2014 to January 2015. The number of stores closed during those two and a half months accounted for 31.2% of the total (109 stores) as of November.

Outback's bold strategy of selection and concentration paid off. After being acquired by the domestic private equity fund Skylake in 2016 and increasing its corporate value, it succeeded in increasing sales and operating profits even amid the COVID-19 pandemic. In 2021, it was sold to bhc Group (now Dining Brands Group), which operates bhc Chicken, for around 250 billion KRW. Since then, it has continued its premiumization strategy, such as replacing frozen meat with more expensive and harder-to-manage refrigerated meat. As a result, Outback's sales increased from 411 billion KRW in 2022 to 457.6 billion KRW in 2023, and it is estimated to have surpassed 500 billion KRW last year.

Vips, operated by CJ Foodville, also aggressively closed low-profit stores. The number of stores, which was 61 at the end of 2018, was halved during the COVID-19 pandemic, but after closing underperforming stores and upgrading to a premium concept, sales and profits increased. Sales per store rose by 24.2% in 2021 compared to the previous year, 66% in 2022, and 13% in 2023. Differentiating space concepts by area, such as kids zones or private rooms, also proved effective, allowing Vips to continue growing despite the dining-out industry downturn amid high inflation.

Last year, Vips opened seven new stores, including Eunpyeong Lotte Branch, Daejeon Hyundai Outlet Branch, Dongtan Lotte Department Store Branch, and Lotte Department Store Changwon Branch.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)