A Steeper Decline Than Total Seoul Apartment Sales

Demand Drops First in Areas Concentrated with Mid-to-Low Price Units Like Nodogang

The cold wave in the Seoul real estate market has been particularly severe in the mid-to-low price segment. While prices of ultra-high-end homes are soaring, prices of mid-to-low price apartments are falling, deepening the polarization of housing prices. Analysts suggest that government loan regulations have blocked opportunities for ordinary citizens to buy homes, but have had little impact on wealthy asset holders.

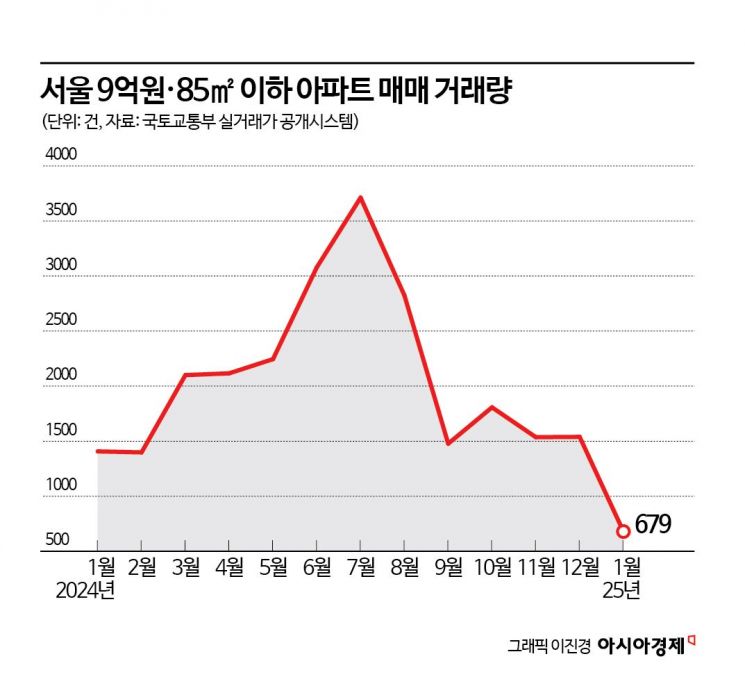

According to the Ministry of Land, Infrastructure and Transport's actual transaction price disclosure system on the 4th, the number of actual transactions for mid-to-low price apartments in Seoul priced under 900 million KRW and with exclusive area under 85㎡ totaled 679 last month. This represents a decrease of 51.7% and 55.9% compared to 1,407 transactions in the same month last year and 1,539 transactions in the previous month, respectively.

Compared to the total number of apartment sales in Seoul, the decline in mid-to-low price apartment transactions is even more pronounced. Last month, the total number of apartment sales in Seoul was 1,461, down 45.6% year-on-year. The decrease in mid-to-low price apartment transactions is 6.1 percentage points greater than the overall decline. Compared to the previous month, mid-to-low price apartments decreased by 3.1 percentage points more.

This is analyzed as a result of ordinary citizens unable to secure funds to purchase mid-to-low price apartments due to loan regulations. Since the implementation of the second phase of the stress total debt service ratio (DSR) in September last year, the number of mid-to-low price apartment transactions has sharply declined. Until August last year, there were 2,824 mid-to-low price apartment transactions, but from September, the number dropped to 1,477. The second phase stress DSR applies an additional interest rate of 0.75 percentage points to bank mortgage loans, credit loans, and second-tier financial institution mortgage loan interest rates. The government implemented this to reduce household debt.

By region, areas with clusters of mid-to-low price apartments such as Nodobang (Nowon, Dobong, Gangbuk districts) saw a higher supply dominance ratio and a sharper decline in sales prices. According to the Korea Real Estate Board, as of the fourth week of last month, the apartment sales supply-demand index in Seoul was 96.4, with the northeastern area including Nodobang at 91.2, the lowest among Seoul regions. The sales supply-demand index is based on 100; a value below 100 means there are more sellers than buyers. In Nowon and other areas, transactions mainly involve urgent sales at prices lower than actual market value, leading to a decline in actual transaction prices in individual complexes.

As mid-to-low price apartment sales prices fall, analyses indicate that housing price polarization in Seoul is intensifying. While the highest apartment prices are reaching record highs due to large apartments over 135㎡ and newly built apartments in Gangnam, mid-to-low price apartment prices are falling, widening the price gap. Last month, a 235㎡ unit in Hannam The Hill, Yongsan-gu, Seoul, was traded at a record high of 10.9 billion KRW. A 208㎡ unit in Hanyang 4th Complex, Apgujeong-dong, Gangnam-gu, also changed hands for 7.7 billion KRW.

Jang Jaehyun, head of research at Real Today, said, "With the start of mortgage loan regulations, it appears that actual buyers of mid-to-low price apartments, such as 2-3 person families, are postponing purchases. We are also observing that prices are first falling in areas with many small-to-medium sized apartments, such as Nodobang or Geumcheon-gu."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.