Insurance Costs Double Compared to Mortgage Expenses

Frequent Disasters Lead Private Insurers to Withdraw Coverage

Concerns Grow Over Falling Property Values in Some Regions

Due to catastrophic climate risks such as heatwaves, droughts, and floods, the proportion of insurance costs in subprime mortgage expenses in the United States has more than doubled in about nine years.

In the report titled "Property Prices in Peril," published on the 3rd (local time) by the nonprofit organization First Street Foundation, it was revealed that "the ratio of insurance costs to mortgage expenses rose from 7-8% in 2013 to over 20% in 2022."

First Street noted in the report that "climate change is disrupting existing migration patterns" and "chronic climate change nationwide is reshaping regional preferences."

For example, coastal areas are threatened by rising sea levels, while inland regions have seen increased damage from wildfires, droughts, floods, and hurricanes caused by heatwaves. As the frequency and intensity of natural disasters increase, unprecedented levels of property damage have occurred, leading insurers to raise premiums or withdraw insurance products in high-risk areas.

The rise in homeowners insurance premiums across the United States has been pointed out in several other reports as well. According to a report published by the Brookings Institution in January, the average homeowners insurance premium nationwide increased by more than 30% from 2020 to 2023. Even after accounting for inflation, this amounts to a 13% increase.

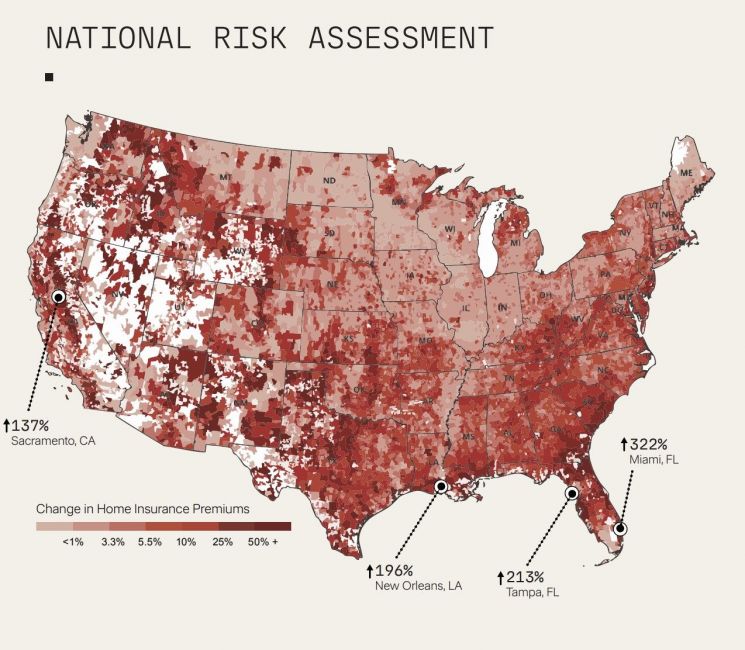

First Street projected that housing insurance costs will increase by 29.4% compared to the current level by 2055. In particular, Miami is expected to see a surge of up to four times. Florida is predicted to triple, and Sacramento, the capital of California, is also expected to more than double. Data from First Street Foundation report.

First Street projected that housing insurance costs will increase by 29.4% compared to the current level by 2055. In particular, Miami is expected to see a surge of up to four times. Florida is predicted to triple, and Sacramento, the capital of California, is also expected to more than double. Data from First Street Foundation report.

First Street forecasts that housing insurance costs will increase by 29.4% by 2055 compared to current levels. In particular, Miami is expected to see a fourfold increase. Florida is projected to triple, and Sacramento, the capital of California, is also expected to more than double.

The report stated, "Chronic climate change increases financial burdens from public service fees to maintenance costs," adding, "Ultimately, the rise in housing ownership costs related to environmental stress factors is also changing housing values."

It also predicted that migration among Americans facing the climate crisis will become more active. According to First Street's climate migration prediction model, more than 55 million Americans are expected to voluntarily move to areas with stronger climate resilience by 2055. It is projected that 5.2 million people will migrate this year (2025) alone.

Some regions, including the "Sun Belt" (Texas, Florida, California), are also expected to suffer declines in real estate values due to the climate crisis. First Street projected that by 2055, 70,026 towns will be negatively affected in terms of real estate values due to climate risks. This accounts for 84% of all census tracts. Furthermore, the net loss in real estate value due to insurance pressure and buyer withdrawal is expected to reach $1.47 trillion.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.