Final preparations underway ahead of NextTrade ATS launch

Securities firms request extension of testing period

Changes after ATS launch: extended trading hours, reduced investment costs, and more

The era of multiple exchanges is just one month away. With the launch of NextTrade, Korea's first Alternative Trading System (ATS), on the 4th of next month, the nearly 70-year monopoly of the Korea Exchange (KRX) will shift to a competitive system. The securities industry is accelerating its final preparations to welcome the era of multiple exchanges.

Final preparations ahead of ATS launch

According to the financial investment industry on the 3rd, the Securities and Futures Commission under the Financial Services Commission approved the final authorization of NextTrade at its 2nd regular meeting last month on the 22nd. Previously, NextTrade obtained a preliminary license for ATS investment brokerage business related to listed stocks and securities depositary receipts from the Financial Services Commission in July 2023, and subsequently applied for final authorization on November 29 last year. Now, only the final approval from the Financial Services Commission remains. The regular meeting of the Financial Services Commission is scheduled for the 5th of next month.

NextTrade will launch on the 4th of next month after receiving approval from the Financial Services Commission. Not only NextTrade but also KRX and securities firms are in the midst of final preparations. However, it is expected that not all 30 securities firms that expressed their intention to participate in NextTrade at its March launch will be able to trade immediately.

Some securities firms are inquiring whether they can participate after conducting further testing. A securities firm official explained, "Some securities firms are not joining immediately with the ATS launch but are asking the relevant authorities whether they can participate after completing thorough testing. They want to ensure there are no order mistakes or errors, so they plan to complete testing and join around April or May."

Previously, NextTrade conducted its first mock test from November 5 to December 13 last year, and the second test from December 16 to January 10 this year, completing preparations for launch. However, some securities firms are still requesting additional tests.

Approximately 15 firms are expected to be fully ready to start trading at the launch of NextTrade. The remaining 13 to 15 securities firms plan to enter the pre-market and after-market first, then join the main market in September. Another securities firm official said, "Participation is delayed due to server construction costs and inspections to prevent order accidents."

Negotiations between KRX and NextTrade are in the final stages. Even after the ATS launch, market surveillance and clearing operations will be handled by the Korea Exchange. A KRX official said, "Negotiations with NextTrade are almost complete, and we are making final adjustments on points of disagreement."

What changes with the ATS launch?

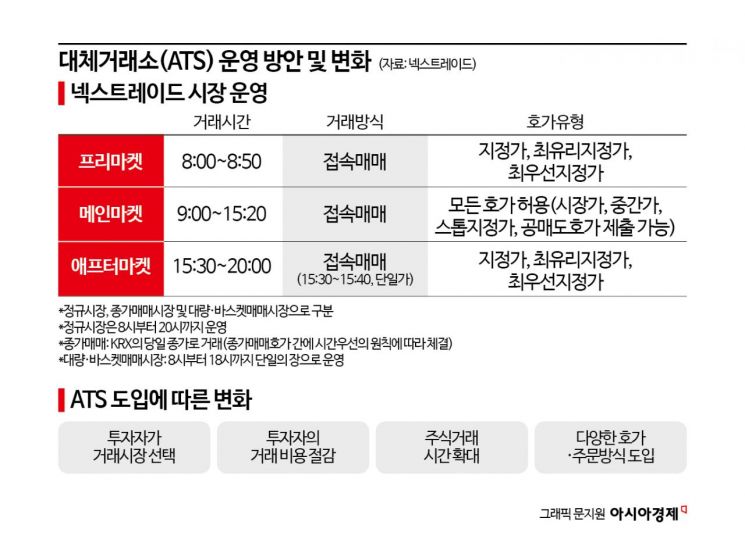

The launch of the ATS is expected to bring significant changes to investors' stock trading. First, investors will be able to choose their trading market, and stock trading hours will be extended. Trading costs will also decrease. Additionally, various new quote and order types will be introduced.

With the introduction of ATS, domestic stock trading will take place in multiple trading markets: KRX and NextTrade. Investors can compare services such as trading fees and speed at each exchange to select their trading market. If investors do not choose between the two markets, orders will be executed through an automatic order routing system (SOR) prepared according to the securities firm's best execution policy, directing orders to the market offering the most favorable conditions. SOR is a system designed to automatically fulfill the best execution obligation. The best execution obligation, under the Capital Markets Act, requires securities firms to execute customer orders under the best possible conditions, considering price, fees, execution speed, and trading methods to process orders most advantageously for customers.

Kim Young-don, head of NextTrade, said, "With the ATS launch, investors will have three options: buy the same stock on the Korea Exchange, buy on NextTrade, or use the best execution service."

Investors' trading costs can also be reduced. NextTrade plans to lower transaction fees by 20-40% compared to KRX. NextTrade expects that fee competition between trading markets will lead to reduced trading costs for investors.

The most significant change with the ATS launch is the substantial extension of trading hours. The existing KRX regular trading hours are from 9:00 AM to 3:30 PM, but ATS trading hours will be from 8:00 AM to 8:00 PM. This will allow investors to trade stocks after work and is expected to enable linked trading with global markets.

Additionally, various new quote and order types will be introduced. Currently, the stock market offers market price and four types of limit prices: general, best priority, most favorable, and conditional. With the ATS launch, midpoint quotes and stop-limit quotes will be newly introduced. Midpoint quotes adjust prices to the midpoint between the best bid and best ask prices. In other words, the midpoint value is displayed based on the prices at which sellers want to sell and buyers want to buy. Stop-limit quotes allow investors to place limit orders when the current stock price reaches a specific price. For example, if the current stock price is 10,000 KRW and the market price reaches 11,000 KRW, an investor can place a buy order at a limit price of 11,500 KRW. These new quote types will be applied not only to ATS but also to KRX.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)