Low Growth in the Mid-to-High 1% Range This Year... Additional Downside Risks

Strong Stimulus Intent and Policy Implementation Needed for a Low-High Trend

This year, South Korea's economic growth forecast is being revised downward one after another, with a 'low growth in the 1% range' anticipated. Experts unanimously agreed that there are significant downside risks to the economy this year, and that strong government stimulus intentions and policy implementations such as supplementary budgets (Chugyeong) are necessary.

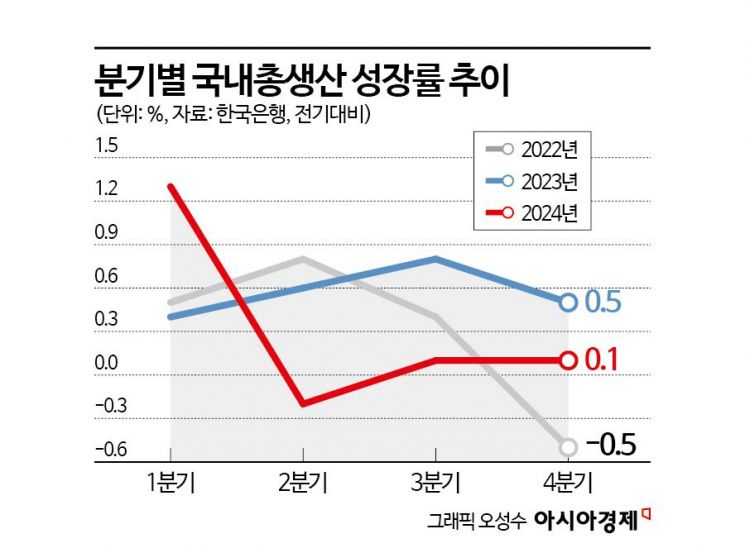

According to FnGuide on the 29th, following the announcement of the '0.5% shock in Q4 growth last year' this month, the real GDP forecasts for this year by major domestic securities firms have been gradually revised downward to the mid-to-high 1% range. The average economic growth forecast of eight major global investment banks (IBs) at the end of last year was also only 1.7%. According to the International Finance Center, global research firm Capital Economics lowered South Korea's economic growth forecast for this year to 1.1%.

Low Growth in the Mid-to-High 1% Range This Year... Additional Downside Risks

Experts forecast that this year's economic growth rate will remain in the mid-to-high 1% range, and the risk of growth slowdown in the first half is increasing, suggesting a 'low in the first half, high in the second half' trend. The analysis points to increased downward pressure due to delayed domestic demand rebound combined with export slowdown.

Hagunhyung, an economist at Shinhan Investment Corp., said, "Despite the base effect, the first half of this year is expected to see an average growth of 0.6% quarter-on-quarter due to sluggish domestic demand recovery," adding, "Although interest burden is eased by the base rate cut, domestic and external uncertainties have intensified, freezing sentiment. Until uncertainties are resolved, consumption and construction investment will be limited, restricting growth rebound."

Choi Kyuho, an economist at Hanwha Investment & Securities, also said, "Domestic economic recovery in the first half will be limited," and "The economy is likely to turn around gradually from the second quarter." He added, "Domestic demand recovery requires time. Political uncertainties have dampened household and corporate sentiment, negatively affecting consumption and investment for the time being, and the elevated unemployment rate (3.7%) will also burden demand recovery."

Park Sanghyun, an economist at iM Securities, pointed out, "Due to continued domestic political uncertainties, the facility investment growth rate in the first half of this year may significantly slow down. Especially, the fact that intangible asset investment (investment in intellectual property products), which is highly correlated with the global economic and industrial technology innovation cycle, is virtually stagnant, implies that domestic growth drivers may not be strong in the future."

He also viewed that exports are unlikely to rebound immediately. Jung Sungtae, an economist at Samsung Securities, said, "The Korean economy will recover gradually from the first quarter low point this year," but added, "Due to the Trump administration's tariff policies and China's sluggish domestic demand, external uncertainties persist, and exports excluding semiconductors are expected to stagnate." Jung Yeokyung, an economist at NH Investment & Securities, said, "The first quarter will fall below 1% due to the base effect and construction downturn," adding, "Trump's America First policy is a factor slowing Korean exports, but the won-dollar exchange rate in the 1400 won range in the first half (exchange rate effect) and localization strategies of production facilities will support sales of Korean export companies."

Strong Stimulus Intent and Policy Implementation Needed for a Low-High Trend

Experts agreed that for the economic growth trend to recover in the second half of next year, government economic responses must accompany it. To prevent further domestic demand slowdown, active interest rate cuts and early execution of supplementary budgets are necessary. The currently discussed 20 trillion won supplementary budget corresponds to about 3% of this year's annual government budget.

Choi Jemin, an economist at Hyundai Motor Securities, said, "In a situation where the economy is unstable and domestic and external uncertainties are high, it is urgent to implement a supplementary budget along with an accommodative monetary policy stance to fill the private consumption and investment gap and induce a virtuous cycle." He added, "In the first quarter, the government is executing the budget early and mobilizing various available stimulus measures, which will partially ease downward pressure on the economy, but since this is the period of highest domestic and external uncertainties, recovery may be constrained. From the second quarter, with interest rate cuts and supplementary budgets supporting the downside, economic momentum is expected to gradually revive toward the second half."

Kwon Heejin, an economist at KB Securities, also said, "The government's economic response is becoming important," adding, "Although domestic fiscal policy, political environment, and external uncertainties remain high, the first half of this year is expected to see more proactive early fiscal execution than last year, with additional discussions on supplementary budgets and industrial support measures after the Lunar New Year, leading to gradual growth recovery from the first quarter quarter-on-quarter and from the second quarter year-on-year." Lee Seunghoon, an economist at Meritz Securities, said, "Policy considerations are needed to ensure that the supplementary budget in the second half can take over after early budget execution in the first half," adding, "In this process, spending should be concentrated on areas with high economic revitalization and multiplier effects."

The supplementary budget, implemented for the first time in three years, is expected to contribute to recovering the sharply declined consumer sentiment. Jung Yeokyung, an economist at NH Investment & Securities, said, "Unlike the US, which has stimulated the economy with massive fiscal spending every year since COVID-19, South Korea reduced the growth rate of fiscal spending from 2023 and did not prepare supplementary budgets," interpreting that "Fiscal spending, which was below the trend line for the past two years, was insufficient to stimulate domestic demand." He added, "The government's early fiscal execution plan for the first half (40% in Q1, 70% in Q2) is positive for vulnerable group consumption, social overhead capital (SOC), and research and development (R&D) related projects," and "Discussions on supplementary budgets will begin in the second quarter, with expectations of supplementary budget execution of 20 to 30 trillion won in the second half." He noted, "Unlike in the past, as Korean households increasingly consume and invest overseas, the supplementary budget scale will not fully reflect the effect of stimulating domestic demand, but it is expected to contribute to recovering the sharply declined consumer sentiment."

Economist Park Sanghyun emphasized, "If stimulus policies are delayed or political uncertainty risks prolong, it may be difficult to confirm the economic bottom in the first half," adding, "More than ever, active policy measures are needed to revive the sentiment of economic agents."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)